How to account for fixed assets. What refers to fixed assets in accounting

Fixed assets are accounted for differently in accounting and tax accounting. It depends on the value of the fixed asset. What counts as fixed assets in 2019? We made detailed instructions on accounting for fixed assets in 2019 and looked at examples of depreciation methods.

OS in tax and accounting in 2019

Above, we have already outlined the difference in depreciation of fixed assets in 2019 in accounting and tax accounting. So, for property to be recognized in both places, it is necessary that all of the following conditions be met:

- the period of use of the object is more than 12 months;

- the object was purchased for its use in the company;

- the asset can bring benefits to the company;

- the initial cost exceeds 40,000 rubles. for accounting and 100,000 rubles. for tax purposes.

Fixed asset in tax and accounting in 2019, at different initial costs:

Fixed assets in 2019 worth up to RUB 100,000. in accounting and tax accounting

Property worth less than RUB 100,000. reflected differently in accounting and tax accounting:

- In accounting:

- if the value of the asset is less than 40,000 rubles, then the company can decide for itself how to take it into account in accounting. They can be taken into account as part of inventories or taken into account as fixed assets. The chosen method must be recorded in the accounting policy.

- if an object costs more than 40,000 rubles, its cost cannot be written off as expenses in one amount. Such property is accepted for accounting as fixed assets (clause 5 of PBU 6/01 “Accounting for fixed assets”),

- In tax accounting, a company has no choice. All objects are cheaper than RUB 100,000. are accounted for as low-value property, and assets more than 100,000 rubles. are included in depreciable fixed assets (Clause 1, Article 257 of the Tax Code of the Russian Federation).

We offer a brief reminder on how to take into account property worth less than 100,000 rubles in accounting and tax accounting:

|

Initial OS cost |

Accounting |

Tax accounting |

|---|---|---|

|

Less than 40,000 rub. |

Any of 2 options for the company to choose from:

|

|

|

From 40,000 rub. up to 100,000 rub. |

Write off to current expenses in one amount upon commissioning |

|

|

More than 100,000 rub. |

Take into account as part of fixed assets and calculate depreciation |

|

Example. Write-off of fixed assets in tax and accounting in 2019 worth up to 100,000 rubles

In January 2019, Gamma LLC bought a computer worth 90,000 rubles. (without VAT) and put it into operation. According to the Classification of Fixed Assets, computers should be classified as a group with a useful life of two to three years. The company has determined that it will be depreciated over 25 months using the straight-line method.

Then the monthly norm in accounting = 90,000 rubles / 25 months = 3,600 rubles. That is, starting from February, this exact amount will be accrued monthly.

For profit tax purposes, this property is not recognized as depreciable, but is written off as expenses in accordance with Art. 254 of the Tax Code of the Russian Federation, and it is written off as expenses in a linear manner. This means that the company’s monthly expenses will amount to 3,600 rubles. Or a lump sum of 90,000 rubles. But pay attention, both actions must be reflected in material costs. Not in depreciation.

Fixed assets worth over 100,000 rubles. in accounting and tax accounting

Property worth more than RUB 100,000. is taken into account in BU and NU equally. These items are accounted for as fixed assets and are depreciated over their useful lives.

Example. Write-off of fixed assets in tax and accounting in 2019 worth up to 100,000 rubles

In January 2019, Alpha LLC buys a passenger car worth 610,000 rubles. (without VAT) and put it into operation. According to the Classification of Fixed Assets, such property is classified as a group with a useful life of three to five years.

The company has determined that depreciation will be calculated over 60 months using the straight-line method.

Then the monthly rate = 610,000 rubles / 60 months = 10,167 rubles.

That is, from February, 10,167 rubles will be credited monthly throughout the year.

For tax purposes, this property is considered depreciable. This means that every month during 2019, the depreciation rate for tax purposes will be equal to 10,167 rubles.

Depreciation of fixed assets in 2019 in accounting and tax accounting

There are still four methods for calculating depreciation of fixed assets in 2019 in accounting:

- Linear;

- Declining balance;

- Write-off method based on the sum of the number of years;

- Write-off of cost in proportion to the volume of goods produced.

In tax accounting, accordingly, there are only two methods of calculation:

- Linear;

- Nonlinear.

Important: Always remember that write-off of fixed assets in 2019 must be stopped if management has decided to transfer the funds to conservation or in cases of reconstruction, major repairs or modernization of the facility for more than one year.

To put an object into operation, it is necessary to draw up documents in accordance with forms OS-1 “Act of acceptance and transfer of fixed assets” and OS-6 “Inventory card”.

All expenses that form the initial cost are accumulated on account 08 “Investments in non-current assets”, and then transferred to account 01.

Let's look at how to correctly put property on the balance sheet.

|

Wiring |

Wiring meaning |

|---|---|

|

The company bought the property |

|

|

Bought an object |

|

|

Put into operation |

|

|

The object was made as a contribution to the authorized capital |

|

|

Dt 75.1 Kt 80 |

Founder's debt allocated |

|

Dt 08 Kt 75.1 |

Accepted property as a contribution to capital |

|

Put on balance |

|

|

Property received free of charge |

|

|

Dt 08 Kt 98.2 |

The object was reflected according to the market value |

|

We allocated additional costs for delivery, installation, etc. |

|

|

Put on balance |

|

For taxation, fixed assets are taken into account differently. You can only depreciate those assets that are more than 100,000 rubles. and the company put the property on its balance sheet after December 31, 2015. And all objects cheaper than this amount can be written off at a time (Article 256 of the Tax Code of the Russian Federation).

The cost of fixed assets in 2019 is written off in accounting by gradually transferring it to finished products (works or services). However, for some fixed assets it is not necessary to calculate depreciation. For example, it is not charged to land plots, environmental management facilities and objects that are classified as museum objects and museum collections (clause 17 of PBU 6/01).

The procedure for calculating depreciation depends on the group to which the property belongs. The classification of fixed assets was approved by the Government of the Russian Federation by Resolution No. 1. This list was significantly changed in 2017, and now new objects must be taken into account according to the new edition.

The Tax Code of the Russian Federation, in turn, adheres strictly to the list of groups:

- the first group - all short-lived assets with a useful life from 1 to 2 years;

- the second - property with SPI from 2 to 3 years;

- third group - objects with a useful life from 3 to 5 years;

- fourth - property with a private life insurance period from 5 to 7 years inclusive;

- fifth group - assets with a useful life from 7 to 10 years inclusive;

- sixth - assets with SPI from 10 to 15 years inclusive;

- seventh group - property with a useful life from 15 to 20 years inclusive;

- eighth - assets with SPI from 20 to 25 years;

- ninth group - property with a useful life of 25 to 30 years;

- tenth - objects with a useful life of over 30 years.

A little more about the differences between the accounts. It is necessary to depreciate fixed assets in accounting starting from the 1st day of the month following the day after it was accepted for accounting (clause 21 of PBU 6/01). In tax law, depreciation is calculated from the month following the putting into operation of the operating system (Clause 4, Article 259 of the Tax Code of the Russian Federation).

So, let's look at the methods of calculating depreciation in 2019 using examples. We discussed the linear method above. There are three left in accounting and one (nonlinear) in tax.

Example. Reducing balance method

Alpha LLC purchased a computer, the initial cost of which was 200,000 rubles.

Commissioning date - 01/10/2019.

SPI = 5 years.

The company's accounting policy states that the multiplying factor is equal to two.

The depreciation rate will be: 1/5 = 0.2.

Then for the year the organization will write off: 200,000 * 0.2 * 2 = 80,000 rubles.

Since depreciation is calculated for the month following commissioning, in February 2019 the following amount will be = 80,000 * 1/12 = 6,666.7 rubles.

OS = 200,000 – 6,666.7 = 193,333.33 rub.

193,333.3 * 0.2 * 2 = 77,333.3 rub.

For February 2019 the following will be written off: 77,333.3 * 1/12 = 6,444.4 rubles.

Briefly, the sum of the numbers of years of useful use is calculated using the following formula:

Aos = PS (VS) * SPIO / SPIS,

where: SPIO is the remaining useful life, SPIS is the sum of the numbers of years of useful life.

Example. Method based on the sum of numbers of years of useful life

The initial conditions are from the example above.

First you need to determine the SPIS: 1 + 2 + 3 + 4 = 10.

SPIO in the first year of operation = 3.

Annual Aos = 200,000 * 3 / 10 = 60,000 rub.

Aos for February = 60,000 * 1/12 = 5,000 rub.

Let's calculate AOS for the 2nd year, knowing that SPIO = 2.

Annual Aos = 200,000 * 2 / 10 = 40,000 rub.

Aoc = 40,000 * 1/12 = 3,333.33 rub.

Thus, for the first year, the company will charge monthly depreciation in the amount of 5,000 rubles, and for the second year, 3,333.33 rubles.

Another way is to calculate based on production volume:

Aos = O * PS / Ospi,

where: O is the actual volume of production, Osp is the forecast volume of production for the entire useful life.

Example. Calculation of depreciation based on production volume

We use data from the example of Gamma LLC purchasing a computer for 200,000 rubles. At the same time, let's take into account that in February the computer performed calculations in 20 programs, and in March 10. And in total such a computer will test 600 programs.

Then depreciation for February will be:

20 * 200,000 / 600 = 6,666.7 rubles.

In March the amount will be written off = 10 * 200,000 / 600 = 3,333.3 rubles.

This concludes the examples of accounting for depreciation in accounting. It remains to illustrate the nonlinear method in tax accounting with an example.

So, let's start with the fact that depreciation rates in this method have already been approved (clause 5 of Article 259.2 of the Tax Code of the Russian Federation). Each of the ten groups that we cited above has its own meaning.

|

Group |

Meaning |

|---|---|

|

First group (SPI = 1-2 year) |

|

|

Second group (SPI = 2-3 years) |

|

|

Third group (SPI = 3-5 years) |

|

|

Fourth group (SPI = 5-7 years) |

|

|

Fifth group (SPI = 7-10 years) |

|

|

Sixth group (SPI = 10-15 years) |

|

|

Seventh group (SPI = 15-20 years) |

|

|

Eighth group (SPI = 20-25 years) |

|

|

Ninth group (SPI = 25-30 years) |

|

|

Tenth group (SPI = more than 30 years) |

Then the depreciation rate according to the non-linear tax method will be as follows:

NormaA = Sbg * K /100,

where: NormaA – deductions for the month according to the established depreciation group;

SBG - the total balance of such a depreciation group;

K – group depreciation rate (in the table).

Let's look at an example.

Example. Non-linear tax accounting method in 2019

So, in January 2019, Omega LLC purchased and already put into operation 3 computers, the cost of each is 100,000 rubles (excluding VAT). SPI according to OKOF from two to three years.

Depreciation amount for February, March = 3 pcs. * 100,000 rub. * 8.8% = 26,400 rub. monthly.

Let’s also assume that at the end of March the company purchased and put into operation another computer with an initial cost of 120,000 rubles.

For April, the amount will be = (3 pieces * 100,000 rubles + 120,000 rubles – 26,400 rubles – 26,400 rubles) * 8.8% = 32,313.6 rubles.

So, we have looked at examples of all depreciation methods, both in accounting and tax accounting. And we talked about innovations in 2019 in fixed assets.

Fixed assets in accountingrepresent an important and in some aspects complex area of accounting. After all, any movement of fixed assets (acquisition by a company or disposal from production) requires the organization’s accountants to have a clear understanding of the rules and regulations of accounting relating specifically to fixed assets. What specialists should know first of all will be discussed in this article.

Accounting for fixed assets at an enterprise in 2017-2018: what has changed

First of all, accounting specialists at an enterprise should clearly understand the differences and similarities in approaches to reflecting fixed assets and transactions with them in the accounting and tax accounting of fixed assets.

In both accounting and tax accounting, in order for a company to consider certain equipment as its fixed asset, the object must meet the following criteria:

- the estimated period of use of the object exceeds 12 months;

- the object was acquired for use in the business of the enterprise, and not for resale;

- the asset is capable of bringing economic benefits to the enterprise;

Until 01/01/2016, the criterion for the initial cost of fixed assets in accounting coincided with that in tax accounting: fixed assets were considered equipment worth more than 40,000 rubles. But from 01/01/2017 in paragraph 1 of Art. 256 and paragraph 1 of Art. 257 of the Tax Code of the Russian Federation, amendments were made, according to which OS began to be recognized for tax purposes only for property exceeding the value of 100,000 rubles. Moreover, this increase in the limit applies only to OS accepted from 01/01/2016. In accounting, the value of the limit has not yet changed: depreciable property is an asset worth more than 40,000 rubles. In this connection, taxable temporary differences are formed between tax and accounting.

Each fixed asset belongs to a specific depreciation group, and its cost is written off as expenses over a certain time period.

The main change in accounting for fixed assets that 2017 brought was a change in the codes of the All-Russian Classifier of Fixed Assets (OKOF), due to which the depreciation periods of some fixed assets changed, and some types of fixed assets were transferred to another depreciation group. The new standards apply to OS facilities put into operation after 01/01/2017.

IMPORTANT! If the object was put into operation before 01/01/2017 and after the entry into force of the new OKOF it ended up in a different depreciation group or its useful life changed, the depreciation rate does not need to be recalculated.

We talked about the nuances in the material.

The procedure for accounting for the receipt of fixed assets in a company

When a company acquires (or receives) fixed assets, the task of accounting specialists is to ensure a correct reflection of the fact that the fixed assets have been received by the company, as well as the subsequent accounting of the fixed assets in the financial statements.

The first thing to do in this context is to determine the initial cost of the fixed asset. Therefore, it is important to know what this cost consists of.

As follows from paragraph 8 of PBU 6/01, the initial cost is determined by adding up all the costs that the company actually made in order to acquire the object and bring it to a state where it can be used in production, namely:

- Purchase price or construction price. If the operating system for the company was built by a counterparty, the costs can be confirmed using a transfer and acceptance certificate, invoice, work completion certificate, etc.

IMPORTANT! The price should be included in the original price excluding VAT. VAT is taken into account in the cost of fixed assets only if the company will use such fixed assets for VAT-free activities.

- Amounts spent on delivery of an object from the manufacturer (previous owner) to the company. For accounting, confirmation of this part of the initial cost of the fixed assets will be a transport invoice or waybill (when the company independently brought the fixed assets).

- The costs a company had to incur to make a facility suitable for use in production. This group of costs includes costs for installation, debugging, etc.

- If a company imported an asset from abroad, then customs duties and fees specified in the declaration can also be taken into account as part of the initial cost. This, in particular, was indicated by the Federal Tax Service of the Russian Federation in a letter dated April 22, 2014 No. GD-4-3/7660@.

- State duty, if its payment is necessary so that the object can be used by the company in production. Confirmation of such costs can be a simple payment order for payment of the duty.

- Any other costs that the company was forced to incur in connection with the acquisition of the operating system.

NOTE! The fundamental difference between accounting and tax accounting is that it allows you to take into account in the initial cost of an investment asset interest on loans that the company had to take out in order to acquire such an asset (clause 7 of PBU 15/2008, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 107n). In tax accounting, interest is always a non-operating expense.

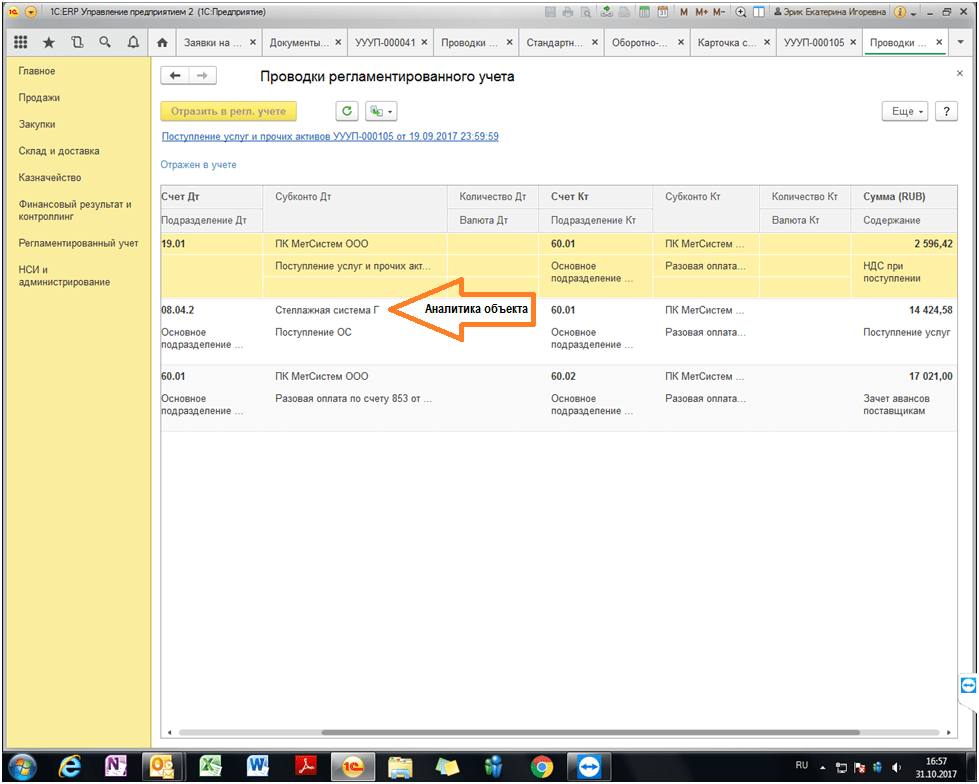

An example of the formation of the cost of fixed assets in accounting based on 1C ERP version 8.3 is presented below:

After a company specialist calculates the total initial cost of the fixed assets, such an object can be taken into account. To do this, the company should register and then open a special one for the object.

IMPORTANT! The company should be aware that even if the OS needs to be registered with government authorities, this procedure will not affect the moment of acceptance for accounting. In any case, such a moment occurs on the date when the initial cost of the fixed asset is determined.

Depreciation and revaluation of fixed assets in accounting

The company depreciates the OS over the course of its operation, i.e., gradually transfers its value to account 02.

NOTE! Depreciation in accounting for the operating system used should not be interrupted. An exception exists only for OS preserved for more than 3 months, as well as for OS, the restoration of which should last longer than 12 months (clauses 17, 23 of PBU 6/01).

However, accounting specialists should remember that some categories of fixed assets do not need to be depreciated. These include, for example, land plots.

The company also has the right to revaluate its fixed assets, that is, recalculate both the cost of fixed assets and the amounts of previously accrued depreciation. This follows from clause 15 of PBU 6/01. Such revaluation must be carried out at the end of each year. In this case, the results of revaluation (the value of revaluation or discount) can both influence the financial results of the company and increase/decrease the company’s additional capital.

For more information on OS revaluation, see the article .

Organization of accounting for the sale of OS

If a company decides to sell an operating system, then the accounting specialist has the task of correctly showing the fact of sale in the financial statements. What are the accounting consequences of selling an asset?

1. On the date of sale (transfer of ownership rights to the new owner), the selling company should record income. Such income is taken into account as part of other income and accumulated in account 91 (on the loan).

IMPORTANT! Income is only the net sales price, excluding VAT. However, all income is first credited to account 91, after which the amount of VAT on fixed assets is reflected by posting to the debit of account 91 in correspondence with account 68.

2. The sale of fixed assets entails the need to attribute the residual value of such fixed assets to other expenses of the company.

Find out about the features of accounting for the sale of fixed assets.

In terms of documenting the sale of OS to a company, it should be remembered that the fact of transfer of OS to the buyer is recorded in an acceptance certificate.

What is important to remember when selling unfinished properties

In practice, cases often arise when a company decides to sell an unfinished future OS, for example, a warehouse or building. Here you should also remember some accounting features.

In particular, income from the sale of such unfinished objects is also considered other income and is credited to account 91 in the amount that the buyer paid for the object.

However, since the unfinished object has not yet been recognized by the company as fixed assets, it does not have a formed initial value. The question arises as to what should be included in expenses.

IMPORTANT! As indicated by paragraphs. 11, 14.1, 16, 19 PBU 10/99, approved by order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n, in this situation, in other expenses (debit of account 91), the company should include those costs that it has already incurred in connection with the construction of the operating system ( the actual value of the object as of the date of sale), as well as, if relevant, costs associated with the sale (for example, intermediary fees, etc.).

As in the case of the sale of fixed assets, when selling an unfinished object, income arises (and is shown in the reporting) on the date when ownership rights transferred to the acquirer.

Nuances of accounting for the transfer of fixed assets to the authorized capital of an LLC

If a company decides to transfer its former OS to the authorized capital of another organization, it should be remembered that such a transfer must also be formalized by an appropriate act. It can be compiled either in free form or using a template in the OS-1 form. At the same time, it is important that such an act reflects the residual value of the fixed assets, as well as the amount of VAT that the company will have to recover in connection with the transfer of the fixed assets as a contribution to the capital of another company.

Further. The transferred OS is assessed by the participants of the receiving organization to determine the size of the contribution made by such OS. Therefore, it is important for the company to understand that if participants evaluate the fixed assets at a cost exceeding its book value, then the company will attribute the difference to its income (credit to account 91 in correspondence with the debit of account 76, intended to account for the company’s debt on a contribution to the capital of a third-party company). In the opposite case, if the shareholders valued the operating system at a smaller amount than what was indicated in the company’s accounting documents, it turns out that in fact the debt on the contribution to the capital company was not fully repaid. Therefore, the difference should be included in other expenses and written off as a debit to account 91.

Whether to charge depreciation on fixed assets received as a contribution to the capital company, read.

Liquidation of fixed assets in accounting

Liquidation of fixed assets has some peculiarities in terms of accounting.

Firstly, since the company did not receive income for the disposed fixed assets, the company will only have to show expenses in its accounting. In this case, expenses (recorded in the debit of account 91) will include the following:

- residual value of the liquidated asset;

- the amount of costs for work (both our own and those performed by third parties) that directly accompanied the liquidation of the OS;

- the amount of VAT that the company had to restore in connection with the liquidation of the operating system.

Which postings are compiled at disposal object OS cm . V material .

Secondly, specialists responsible for fixed assets accounting should not forget that as a result of liquidation, the company receives some new inventory. They must be taken into account on account 10 (debit) in correspondence with the increase in the company’s other income (credit 91).

Read about how to take into account costs when liquidating an operating system.

Results

Accounting for fixed assets in 2017-2018 should, for the most part, be carried out in the same order as before. Namely, to take into account the operating system on the date of bringing it to a state of readiness for operation. Subsequently, when selling the OS, the remuneration received is included in income, and the residual value of the OS is included in expenses. Similar rules apply to the sale of unfinished properties. At the same time, it is important for specialists to remember: despite the fact that in tax accounting the cost criterion for recognizing an asset has increased to 100,000 rubles, in accounting it has not changed and is still 40,000 rubles.

Fixed assets are accounted for differently in accounting and tax accounting in 2019. We have made detailed instructions on property accounting. This is a complete guide with all the changes included!

What is the difference between accounting for fixed assets in tax and accounting?

The introduction of Chapter 25 into the tax code at one time led to the emergence of differences between accounting standards and accounting for income and expenses for the purpose of profit taxation.

With regard to fixed assets, there are especially many differences in the tax code and accounting standards. These differences and simplifications apply. But if you approach the issue of drawing up accounting policies correctly, then some inconsistencies can be minimized.

Criteria and characteristics of a fixed asset

The differences in the norms of tax and accounting legislation are in three points:

- minimum cost per OS unit;

- costs that are included in the initial cost;

- method of calculating depreciation.

The remaining criteria for fixed assets that are used to register an object are the same. What is recognized by the OS can be judged by the fulfillment of the following conditions:

- the object is used in activities and cannot be classified as goods based on any of the characteristics;

- its useful life exceeds a calendar year;

- the object directly or indirectly affects the receipt of economic benefits or the achievement of the main mission of the enterprise.

Changes in fixed asset accounting in 2019

The main changes in the accounting of fixed assets affected enterprises that have the right to conduct simplified accounting. For them, clauses were introduced granting the following rights:

- The cost of purchased fixed assets can be calculated at the price paid to the supplier and installation organization (if installation was not included in the supply contract), and the cost of independently manufactured fixed assets – at the price paid to contractors and similar organizations. The remaining costs can be immediately attributed to expenses for ordinary activities.

- Accrue depreciation as a lump sum transaction dated December 31st.

- Accrue depreciation of production and household equipment immediately upon commissioning in the amount of the entire initial cost of the object.

These innovations will reduce the property tax of enterprises on OSNO. And simplifiers will be allowed in some cases to comply with the cost limit, allowing them to remain on the simplified tax system.

Small changes were also made regarding objects that were purchased for a currency other than the Russian ruble - for them, paragraph 16 and the last paragraph of paragraph 8 were excluded from the PBU.

As for tax accounting, in 2019 changes affected depreciation charges due to the introduction of the new OKOF classifier, in which some types of fixed assets fell into depreciation groups with maximum useful lives that differed from the old classifier.

What is considered the main means in 2019

A fixed asset is property that:

- used in an activity or rented out for a fee

- will bring income in the future

- not intended for resale

- has a useful life of over 12 months

- costs more than 100,000 rubles for tax accounting and more than 40,000 rubles for accounting

As you can see, the main difference between property for accounting and tax accounting is its initial cost.

If the property partially meets the criteria, then it cannot be classified as fixed assets. For example, a company resells goods whose useful life exceeds 12 months.

In accordance with clause 3 of PBU 6/01, the following cannot be classified as fixed assets:

- products of manufacturing companies

- cap. and Finnish attachments

- items being installed (to be installed) or in transit

List of fixed assets: equipment, buildings, household. inventory, tools, measuring instruments, working machines, cap. investments in leased fixed assets, land plots and more.

What documents should I use to document the receipt of fixed assets?

Fixed assets can be received by the organization on the following grounds:

- under a purchase and sale agreement;

- free of charge;

- as a contribution to the authorized capital;

- by barter (under an exchange agreement);

- as a result of construction (manufacturing) by contract and economic methods;

- in the form of surpluses identified during inventory.

Fixed assets entering the organization are accepted by a specially created commission. It defines:

- whether the fixed asset meets the technical specifications and whether it can be put into operation;

- whether it is necessary to bring (rework) the fixed asset to a state suitable for use.

If the organization has only a director on its staff, he alone performs the functions of the commission.

After examining the received property, the commission gives an opinion on the possibility of its use. This conclusion is reflected in the transfer and acceptance certificate, which is drawn up in the form:

The act confirms the inclusion of objects in fixed assets for accounting purposes. The act also reflects information about the commissioning of objects, which is important for tax accounting purposes.

The procedure for drawing up the transfer and acceptance certificate depends on how the received property was accounted for by the transferring party - as goods or as part of fixed assets.

If the received object was accounted for by the transferring party as a fixed asset, the act must be completed by both parties to the transaction, executed in two copies. One copy of the act remains with the transferring party and serves as the basis for reflecting the disposed property in accounting. In this case, the section “Information about the fixed asset as of the date of acceptance for accounting” is not filled out by the transferring party in its copy. The second completed copy is transferred to the recipient organization. Based on this document, it reflects the receipt of fixed assets. The section “Information about the object of fixed assets as of the date of acceptance for accounting” is filled out by her independently. Both the first and second copies of the act must be signed by both parties.

If the received item was accounted for by the transferring party as a product (for example, at a wholesale store), only the recipient should draw up the act. The basis for filling out the act in this case will be shipping documents and technical documentation attached to the fixed asset. In this case, the details of the donating organization, which are provided at the beginning of the act, as well as the sections “Information on the condition of the fixed asset object on the date of transfer” and “Passed” are not filled in.

The same procedure applies when the fixed asset is manufactured (built) by contract or on its own. In this case, the report is drawn up on the basis of primary accounting documents confirming the expenses incurred, as well as technical documentation. The act is drawn up in one copy and in relation to surplus fixed assets taken into account based on the results of the inventory.

For any of the above options, the transfer and acceptance certificate must indicate:

- full name of the fixed asset according to the technical documentation;

- name of the manufacturer;

- place of acceptance of the fixed asset;

- factory and assigned inventory numbers of the fixed asset;

- depreciation group number and useful life of the fixed asset;

- information about the content of precious metals and stones;

- other characteristics of the fixed asset.

In addition, the act must contain the conclusion of the acceptance committee (for example, the entry “Can be used”). The executed act is approved by the head of the organization.

Simultaneously with drawing up the acceptance and transfer act for each fixed asset, fill out the inventory card in form No. OS-6.

If an organization uses not only its own, but also leased fixed assets, then it is recommended to open inventory cards for such property.

If an organization receives equipment that requires installation, an act in form No. OS-1 (OS-1b) is not drawn up immediately. After examining the received property, the commission's conclusion is reflected in the act. It is drawn up on the basis of shipping documents. When filling out the act, indicate:

- details of the organization and equipment supplier;

- number and date of drawing up the act;

- name of the manufacturer and carrier of the equipment;

- information about the place and time of equipment acceptance;

- full name of the equipment according to the technical documentation;

- equipment serial number;

- other equipment characteristics.

In addition, the act must contain the conclusion of the acceptance committee (for example, the entry “Can be transferred to installation”). The executed act is approved by the head of the organization.

When transferring equipment for installation, a certificate is drawn up according to form No. OS-15 download. It is drawn up in one copy based on the act according to form No. OS-14 download and shipping documents. The act of handing over equipment for installation specifies:

- organization details;

- number and date of compilation;

- who will do the installation and where;

- information about the installed equipment.

If the equipment is installed by a contractor, he must sign a document stating that he received the equipment for installation. A copy of the act is given to the contractor.

After the equipment has been installed and all work to bring the facility to a state suitable for use has been completed, a report is drawn up according to form No. OS-1. It is filled out on the basis of the act according to form No. OS-15 and other documents confirming the costs of installation and bringing the object to a condition suitable for use. For example, if the installation of equipment was carried out by a contractor, the basis for completion will be an act in form No. KS-2 and a certificate in form No. KS-3, submitted by the contractor.

The details of the donating organization, which are provided at the beginning of the act, as well as the sections “Information on the condition of the fixed asset as of the date of transfer” and “Passed” are not filled in.

Limit on fixed assets in 2019

The most common question is from what amount property is considered fixed assets. It depends on the accounting where you use the property.

The limit on fixed assets is:

- 100,000 rubles in tax accounting (minimum cost)

- 40,000 rubles in accounting (minimum cost)

This follows from the Federal Law of 06/08/2015% 150-FZ.

Accountingfixed assets in 2019 in tax accounting

In the tax code, in order to include property as depreciable, its value must be more than 100,000 rubles.

The initial cost, unlike accounting, includes a limited list of expenses, namely:

- the amount of expenses for acquisition, construction or production;

- the amount of delivery costs;

- the amount of expenses to bring the OS object to working condition.

This means, for example, that if a fixed asset was purchased using borrowed funds, then in accounting it is possible (not necessarily, but possible) to include the amount of interest accrued before putting it into operation in the initial cost. And in tax accounting, such expenses will be written off at a time.

It makes sense to avoid discrepancies in the formation of the initial cost, since the increased initial cost of fixed assets in accounting does not bring any economic benefits. The only justification for additional inconvenience for an accountant due to differences in accounting is the need to increase assets in order to make the financial statements more attractive to credit institutions or investors, for example.

As for the different minimum costs in accounting and tax accounting, this accounting difference can also be eliminated by using the method of writing off material expenses from sub-clause. 3 p. 1 art. 254 Tax Code of the Russian Federation. The provisions of this paragraph allow taxpayers to write off the cost of property not included in depreciable property over several reporting periods. Unfortunately, in this way expenses can only be written off for income tax purposes. In the simplified version, material expenses are written off at a time.

A feature of fixed asset accounting when simplified is the absence of depreciation charges. The initial cost is written off in the tax period in which payment was made for the commissioned object (or in the period in which the previously paid object was put into operation).

In this case, the cost may be included in expenses under the simplified tax system for several reporting periods. Clause 3 of Art. 346.16 provides for the attribution of the cost of fixed assets to expenses in equal shares in each reporting period until the end of the tax period.

Tax accounting of fixed assets under the simplified tax system

If an organization operates on the simplified tax system with an income object, the cost of acquired (created) fixed assets is not written off as expenses (clause 1 of article 346.18 of the Tax Code of the Russian Federation). If the object of taxation is income minus expenses, the value of such property reduces the tax base. But this requires the simultaneous fulfillment of a number of conditions. You can find out what these conditions are in our article.

1. The fixed asset must be put into operation (subclause 1, clause 3, article 346.16 of the Tax Code of the Russian Federation).

2. The costs of the fixed asset must be paid (subclause 4, clause 2, article 346.17 of the Tax Code of the Russian Federation).

3. If rights to property are subject to state registration (this applies to real estate (Article 130 of the Civil Code of the Russian Federation), it is necessary to document the fact of submitting documents for registration (paragraph 12, paragraph 3, Article 346.16 of the Tax Code of the Russian Federation). Such confirmation will be a receipt from the territorial body Federal Service for State Registration, Cadastre and Cartography (Rosreestr). The receipt certifies the receipt of documents for registration indicating the date of their submission (Clause 6, Article 16 of the Federal Law of July 21, 1997 No. 122-FZ “On state registration of rights to real estate and transactions with him").

4. Expenses must comply with the requirements of paragraph 1 of Article 252 of the Tax Code of the Russian Federation (clause 2 of Article 346.16 of the Tax Code of the Russian Federation). That is, to be documented. And the property must actually be used in economic activities aimed at generating income (clause 1 of Article 256, clause 4 of Article 346.16, subclause 4 of clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

The procedure for writing off costs depends on when the object was purchased - during the period of application of the simplified tax system or before the transition to the simplified tax system (clause 3 of article 346.16 of the Tax Code of the Russian Federation).

Costs for fixed assets acquired during the period of application of the simplified tax system are taken into account from the moment these fixed assets are put into operation. In this case, the cost of the object is written off as expenses during the year in equal shares for the reporting periods in the amount of paid amounts. The useful life of an object does not affect the accounting procedure. Including if a used fixed asset was purchased. The cost of the operating system must be divided into as many equal parts as there are quarters left until the end of the year from the quarter of commissioning. The quarter when the OS is put into operation is taken into account.

An example of writing off as expenses fixed assets acquired during the period of application of the simplified tax system

In January 2019, the organization acquired a fixed asset worth RUB 150,000. The property was registered in February and paid for in May of the same year. This means the amount is 150,000 rubles. need to be divided by 3: after all, there are three quarters left until the end of the year, taking into account the quarter when the OS is put into operation.

In 2019, the organization completely wrote off the cost of fixed assets. When calculating the tax base, the organization took this amount into account in equal shares of 50,000 rubles. (RUB 150,000: 3) on June 30, September 30 and December 31.

The procedure for writing off fixed assets under the simplified tax system (table)

|

Useful life of fixed assets |

The period during which the residual value of objects will be included in expenses under the simplified tax system (subclause 3, clause 3, article 346.16 of the Tax Code of the Russian Federation) |

The procedure for attributing the cost of objects to expenses during the tax period (subclause 4, clause 2, article 346.17 of the Tax Code of the Russian Federation) |

|---|---|---|

|

Up to three years (inclusive) |

During the first calendar year of application of the simplified tax system |

On the last day of each reporting period, in equal shares in the amount of amounts paid (paid value) |

|

During the first calendar year - 50% of the cost of the object |

||

|

From three to fifteen years (inclusive) |

During the second calendar year – 30% of the cost of the object |

|

|

During the third calendar year – 20% of the cost of the object |

||

|

From fifteen years and above |

During the first ten years of application of the simplified tax system |

OS when switching to simplified tax system

The cost of fixed assets acquired before the transition to the simplified tax system is included in expenses in the following order:

- in relation to fixed assets with a useful life of up to 3 years inclusive - during the first calendar year of application of the simplified tax system;

- in relation to fixed assets with a useful life from 3 to 15 years inclusive: during the first calendar year of application of the simplified tax system - 50% of the cost, the second calendar year - 30% of the cost and the third calendar year - 20% of the cost;

- in relation to fixed assets with a useful life of over 15 years - during the first 10 years of application of the simplified tax system in equal shares of the cost of fixed assets.

In all cases, the annual cost is expensed on the last day of each reporting period in equal shares in the amount of amounts paid (cost paid).

Please note: we are talking about the service life, which is established when the object is put into operation. And not about the one that remains to be “finalized.”

Entries about fixed assets in Section 2 of the Income and Expense Book are made only after they have been paid for and put into operation. In section 1 - as the cost of fixed assets is written off for the last number of reporting (tax) periods.

Please note that expenses do not include the cost of fixed assets received as a contribution to the authorized capital (contribution to property), as well as free of charge (subclause 1, clause 1, article 346.16, subclause 2, clause 1, article 346.16 of the Tax Code RF, letters of the Ministry of Finance of Russia dated 02/03/2010 No. 03-11-06/2/14, dated 01/29/2010 No. 03-11-06/2/09). This is due to the fact that when calculating the single tax, the “simplified” tax can only take into account expenses actually incurred, that is, paid or repaid in another way (Clause 2 of Article 346.17 of the Tax Code of the Russian Federation). When receiving property free of charge or as a contribution to the authorized capital (contribution to property), the organization does not incur costs to pay their cost. Therefore, it cannot be taken into account as expenses.

How to take into account fixed assets purchased in installments under the simplified tax system

Write off the cost of property purchased in installments as expenses under the simplified tax system as it is paid for (subclause 4, clause 2, article 346.17 of the Tax Code of the Russian Federation and letter of the Federal Tax Service of Russia dated 02/06/2012 No. ED-4-3/1818). However, do not take into account the amount paid immediately in the current quarter, but distribute it over the quarters remaining until the end of the year. That is, do it as if you were accounting for the entire asset received. At the same time, assign the price to expenses on the last day of each reporting (tax) period. This opinion is also shared by specialists from the financial department in their letter dated May 17, 2011 No. 03-11-06/2/78.

For example, if you made the first payment for property in the first quarter (for example, in January), then include it in expenses under the simplified tax system every quarter: March 31, June 30, September 30 and December 31. When the amount is given in the second quarter, distribute it over three quarters (June, September, December). Accordingly, if the payment was made in the fourth quarter, then its entire amount should be attributed to expenses on December 31.

If you do not pay off the debt on the project by the end of the year (this is possible when the installment plan is given for several years), then transfer the unpaid portions to the next year. And continue to consider them in the same order. That is, after payment, it is distributed across quarters.

An example of writing off expenses for fixed assets purchased in installments

In December 2016, Zvezda LLC acquired and commissioned production equipment worth RUB 5,300,900. The debt to the supplier was paid in two parts. The first 2,000,000 rubles. were paid on February 24, 2017, the remaining RUB 3,300,900. - April 2, 2019. The equipment was put into operation in 2016.

Since the payment was made in parts, the first paid part was RUB 2,000,000. - an entry should have been made in section 2 of the Income and Expense Accounting Book on February 24, 2017. In section 1, it was supposed to be written off in four stages in equal shares of 500,000 rubles. (RUB 2,000,000: 4 quarters) March 31, June 30, September 30 and December 31, 2017.

The second paid part of the cost of the object should have been entered into section 2 of the Book of Income and Expenses on April 2, 2019. Already from the second quarter of 2019, expenses reduce the tax base in three stages. In Section 1 of the Book for 2019, they should have been shown in three equal parts - 1,100,300 rubles each. (RUB 3,300,900: 3 quarters) June 30, September 30 and December 31.

How to reflect the acquisition of a fixed asset in the Income and Expense Accounting Book

Record expenses for the purchase of fixed assets in Section II of the Accounting Book - separately for each object. Moreover, make entries for the last day of the reporting (tax) period in the amount of amounts actually paid (subclause 4, clause 2, article 346.17 of the Tax Code of the Russian Federation). Transfer the final data from section II to section I of the Accounting Book. Namely, in column 5 “Expenses taken into account when calculating the tax base.”

Is it necessary to record “input” VAT on the cost of fixed assets as a separate line in the Accounting Book? No. In the Accounting Book, reflect the price of objects along with VAT. Do not record the tax as a separate line, as it is taken into account in the value of the property (clause 3 of Article 346.16 and subclause 3 of clause 2 of Article 170 of the Tax Code of the Russian Federation, clause 8 of PBU 6/01).

Accountingfixed assets in 2019 in accounting

For accounting purposes, when recording transactions related to fixed assets, PBU 6/01 is used. The main difference from the requirements of the tax code is the absence of a cost criterion for classifying an object as 01 account.

The Ministry of Finance in this PBU only provides for the possibility of classifying objects that meet the criteria of fixed assets, but costing less than 40,000 rubles. to inventory accounts. It should be noted that this is a right, not an obligation of the organization. The only strict criterion is objects worth 40,000 rubles. and it can no longer be attributed to the MPZ.

In the accounting policy, you can prescribe any cost minimum (within 40,000 rubles) for an asset, extending it both to all fixed assets and to a separate group. Or you can exclude the cost criterion altogether.

Those costs that form the initial cost of an asset are specified in clause 8 of PBU 6/01. The list of such expenses is open, i.e. In addition to the specific costs listed, there is a sub-item that includes other costs associated with the acquisition of the OS, its construction, etc.

What is an inventory object

An inventory object is a unit of accounting for fixed assets, which can include either one item or several (complex).

Objects are separated into a complex only if individually they cannot perform their functions.

For example, a personal computer. All computer devices and accessories are included in a single object (Letter of the Ministry of Finance of Russia dated June 2, 2010 No. 03-03-06/2/110).

However, it is also worth noting that if one object contains parts that have different useful lives, then each such part will be accounted for as an independent inventory item (clause 6 of PBU 6/01 “Accounting for fixed assets”, clause 10 of the Guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

The company keeps records of fixed assets for inventory items according to the classifier (OKOF). If the facility was put into operation after January 1, 2017, then the taxpayer needs to use new OKOF (OK 013-2014) .

Each inventory item has its own number and card (form OS-6), which reflects:

- information about property as of the date of its transfer and acceptance for accounting

- revaluation data

- information about movements within the company

- operations that led to a change in the initial cost (completion, modernization, etc.)

- brief description of the object

What does the initial cost consist of?

Fixed assets are taken into account at their original cost, which consists of the costs of acquiring this property:

- fare

- services for bringing into a condition suitable for use

- expenses under construction contracts

- agent (intermediary) remuneration

- customs duties and fees paid at the border (on import)

- consulting and information services

- non-refundable taxes

Thus, taxpayers using the simplified tax system take into account VAT in the initial cost of all their fixed assets.

Please note that in accounting, in order to recognize an object as a fixed asset, the initial cost must be more than 40,000 rubles.

A change in the original cost can only be caused by the completion, retrofitting, modernization, reconstruction, revaluation or partial liquidation of the object.

Accounting for fixed assets

Acceptance of fixed assets for accounting is carried out using forms OS-1 “Act of acceptance and transfer of fixed assets” and OS-6 “Inventory card”. All expenses that form the initial cost are accumulated on account 08 “Investments in non-current assets”, and then transferred to account 01.

Let's consider how to take into account the receipt of fixed assets.

Basic equipment has been purchased.

The fixed asset was received as a contribution to the authorized capital.

The main product was received free of charge.

How to determine useful life

The useful life (USI) of a fixed asset is calculated in months. As a rule, data is taken from the Classification of Fixed Assets (approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1), taking into account changes dated July 7, 2016.

In order to understand which fixed assets are included in the group specified in the Classification, use OKOF.

If the SPI of your fixed asset is not indicated in the Classification and OKOF, then keep records based on the period specified in the technical specifications. documentation or recommendations given by its manufacturer.

SPI must be indicated in the inventory card of the fixed asset.

Please note that the SPI may be increased due to its modernization, reconstruction, technical. rearmament. The new period cannot be greater than the maximum established for the depreciation group to which your fixed asset belongs.

How to calculate depreciation

For accounting purposes, depreciation is calculated using the formula:

In the accounting accounts, depreciation is reflected in the form of the entry: Dt 44 Kt 02 (for a trading company).

Depreciation should be stopped in the following cases:

- the original cost is “0” (i.e. written off completely)

- main product in conservation (more than 3 months)

- fixed asset retired

- fixed asset for modernization/reconstruction (more than 12 months)

How often can fixed assets be revalued?

In accordance with clause 15 of PBU 6/01, the company has the right to revaluate fixed assets no more than once a year (at the end of the reporting period).

When determining the “new” value, you can rely on:

- expert opinion

- information about the price level published in the media and special. literature

- technical bureau assessment inventory

- information on the government price level. statistics

- data from manufacturing companies for similar fixed assets

How to record expenses for repairs of fixed assets

The accounting entries will depend on the method in which it is carried out: contract or business.

If the company has a repair service, then accounting for repair costs will be carried out through account 23 “Auxiliary production”.

Expenses for modernization and reconstruction, which entailed a change in the joint venture capital, capacity and other indicators of fixed assets, must be reflected in account 08 “Investments in non-current assets”. As soon as the repair work has come to an end, the costs must be transferred to account 01 “Fixed assets”. Thus, the initial cost of the object will be increased.

Do not forget that the events that led to a change in the initial cost of the fixed asset must be recorded in its inventory card.

How to write off a fixed asset

Documentation of the disposal of a fixed asset depends on the reason for which the object is written off.

For example it could be:

- sale

- liquidation

- emergency circumstances

So, in the event of liquidation of a fixed asset, OS-4 “Act on the write-off of a fixed asset object (except for motor vehicles) is drawn up.” When writing off several objects at the same time - OS-4b. For motor vehicles - OC-4a.

The transfer of fixed assets under contracts of sale, exchange, and donation is formalized by OS-1, OS-1a, OS-1b.

In accounting, the disposal of a fixed asset in connection with its sale is reflected as follows:

Upon liquidation:

Costs of fixed assets in accounting

Costs for fixed assets are collected on the debit of account 08 - investments in non-current assets. And the credit will be the cost accounts - 60, 76 depending on the costs.

In general, the initial cost of fixed assets is the sum of the organization's actual costs for acquisition, construction and production, excluding VAT and other refundable taxes. But for the “simplified” people, VAT is a non-refundable tax. Therefore, VAT under the simplified tax system also goes into the costs of fixed assets.

When putting fixed assets into operation, the object is transferred to account 01. Posting: Debit 01 Credit 08.

If the fixed asset requires state registration (real estate, land), then these objects are also accounted for in account 01, but you can enter a subaccount “Real estate objects, the ownership of which is not registered.”

Cost of fixed assets in accounting

The cost of fixed assets is repaid through depreciation.

Objects of fixed assets whose consumer properties do not change over time are not subject to depreciation (land plots; environmental management facilities; objects classified as museum objects and museum collections, etc.).

Depreciation is the gradual transfer of the cost of a fixed asset to the cost of products, works, and services.

Depreciation is calculated monthly for each object. Depreciation is accrued from the first day of the month following the month in which the object is recorded in accounting. Depreciation ends on the first day of the month following the month in which the cost of the object is fully repaid or the object is written off from accounting. The service life is in the classifier of fixed assets (Government Decree No. 1 of 01.01.2002).

Postings

Below are the entries for fixed assets. See all postings in our service "".

Purchase of fixed assets

|

Account correspondence |

Note |

|||

|---|---|---|---|---|

|

Debit |

Credit |

|||

|

The acquired fixed asset was capitalized |

Document from the supplier for the shipment of the object |

If property is purchased through an accountable person in a retail trade organization, then instead of account 60 “Settlements with suppliers and contractors”, account 71 “Settlements with accountable persons” is used. |

||

|

Accounting information |

On account 08, the operation is reflected in the subaccount “Purchase of fixed assets” |

|||

|

The services (work) of third-party organizations acquired in connection with the purchase are reflected (if such expenses were incurred in the process of forming the initial cost of the object) |

On account 08, the operation is reflected in the subaccount “Purchase of fixed assets” |

|||

|

Acquired fixed assets that are not intended to be rented out are included in fixed assets. |

On account 08, the operation is reflected in the subaccount “Purchase of fixed assets” |

|||

|

Fixed assets purchased specifically for rental are taken into account |

Certificate of acceptance and transfer of fixed assets |

On account 08, the operation is reflected in the subaccount “Purchase of fixed assets” |

||

|

Accounting information |

||||

|

Reflects the services (work) of third-party organizations purchased in connection with the purchase (if such expenses were incurred after the initial cost of the object was formed) |

Acceptance certificate for work performed (services provided) |

On account 91, transactions are reflected in the subaccount “Other expenses” |

||

Construction of fixed assets

|

Account correspondence |

The primary document on the basis of which this transaction is reflected in accounting |

Note |

||

|---|---|---|---|---|

|

Debit |

Credit |

|||

|

Salaries paid to employees involved in construction |

Payroll or payslip |

|||

|

Insurance premiums are calculated from the salaries of employees involved in construction |

Accounting information |

If construction is carried out by auxiliary production, then the costs are preliminarily reflected in account 23 and upon completion of construction are written off to the debit of account 08 |

||

|

Depreciation was calculated on fixed assets used in construction |

Accounting information |

On account 08, the operation is reflected in the subaccount “Construction of fixed assets”. If construction is carried out by auxiliary production, then the costs are preliminarily reflected in account 23 and upon completion of construction are written off to the debit of account 08 |

||

|

The cost of materials used in construction, including during installation of equipment, is reflected |

Report on materials consumed |

On account 08, the operation is reflected in the subaccount “Construction of fixed assets”. If construction is carried out by auxiliary production, then the costs are preliminarily reflected in account 23 and upon completion of construction are written off to the debit of account 08 |

||

|

Reflects the purchase of equipment that requires installation and is intended for installation in a facility under construction |

Document from the supplier for the shipment of equipment; equipment acceptance certificate |

If property is purchased through an accountable person in a retail trade organization, then instead of account 60 “Settlements with suppliers and contractors”, account 71 “Settlements with accountable persons” is used. |

||

|

Reflects the transfer of equipment (or its part) for installation |

Certificate of acceptance and transfer of equipment for installation |

On account 08, the operation is reflected in the subaccount “Construction of fixed assets”. If construction is carried out by auxiliary production, then the costs are preliminarily reflected in account 23 and upon completion of construction are written off to the debit of account 08 |

||

|

Reflects the services (work) of third-party organizations purchased for construction, including work on installation of equipment (if such expenses were incurred in the process of forming the initial cost of the facility) |

Acceptance certificate for work performed (services provided) |

On account 08, the operation is reflected in the subaccount “Construction of fixed assets”. If construction is carried out by auxiliary production, then the costs are preliminarily reflected in account 23 and upon completion of construction are written off to the debit of account 08 |

||

|

Included in the initial cost of the object is the state duty for state registration of ownership of the object (if such expenses are incurred in the process of forming the initial cost of the object) |

Accounting information |

On account 08, the operation is reflected in the subaccount “Construction of fixed assets” |

||

|

A completed construction project, which is not intended to be rented out, was accepted for accounting as part of fixed assets. |

Certificate of acceptance and transfer of fixed assets |

On account 08, the operation is reflected in the subaccount “Construction of fixed assets” |

||

|

A completed construction project intended specifically for rental has been accepted for accounting |

Certificate of acceptance and transfer of fixed assets |

On account 08, the operation is reflected in the subaccount “Construction of fixed assets” |

||

|

The state duty for state registration of ownership of an object is reflected as part of other expenses (if such expenses are incurred after the initial cost of the object was formed) |

Accounting information |

On account 91, transactions are reflected in the subaccount “Other expenses” |

||

|

Services (work) of third-party organizations purchased in connection with construction are reflected (if such expenses were incurred after the initial cost of the object was formed) |

Acceptance certificate for work performed (services provided) |

On account 91, transactions are reflected in the subaccount “Other expenses” |

||

|

Recorded write-off of an unfinished capital construction project (during liquidation) |

Accounting certificate, write-off order |

On account 91, transactions are reflected in the subaccount “Other expenses”. On account 08, the operation is reflected in the subaccount “Construction of fixed assets” |

||

Basic entries for accounting for fixed assets

Let's consider the main entries for accounting of fixed assets for taxpayers of the simplified tax system. The difference from OSNO in this case will be the acceptance of the object for accounting along with VAT. So here are the basic wiring:

- acquisition of fixed assets – Dt 08 Kt 60;

- construction of the facility on your own - Dt 08 Kt 60, 69, 70, 10;

- putting the operating system into operation - Dt 01 Kt 08;

- depreciation calculation - Dt of the cost account that is used to reflect expenses for the activities in which the property is used Kt 02;

- sale of an asset - Dt 62 Kt 91 for accrual of revenue, Dt 02 Kt 01 for writing off depreciation accrued during the period of use, Dt 91 Kt 01 for writing off the residual value of the property.

How to eliminate discrepancies in accounting and tax accounting of low-value fixed assets

Some ways to eliminate discrepancies in tax and accounting accounting have already been listed above. In this section we systematize the information:

- Depreciation. It is recommended that the accounting policy specify the use of the linear depreciation method for both tax and accounting purposes.

- Initial cost. In accounting policies for accounting purposes, it is recommended to use the rules for the formation of initial cost similar to those used in tax accounting.

- Minimum cost. This discrepancy can be eliminated only if the enterprise applies OSNO. In this case, it is possible in the accounting policy for tax accounting to provide for the write-off of individual groups of material expenses over several reporting periods. Simplificationists will not be able to eliminate this discrepancy.

Accounting for fixed assets worth up to 100,000 under the simplified tax system

That property that, according to all criteria, can be classified as fixed assets, but costs less than 100,000 rubles, is written off at a time as material expenses (subclause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation).

According to sub. 1 item 2 art. 346.17 of the Tax Code of the Russian Federation, such expenses reduce the tax base at the time of repayment of accounts payable that arose during the acquisition of property.

All of the above concerns only the simplification with the object of income minus expenses.

Depreciation of fixed assets in accounting and tax accounting

There are different methods for calculating depreciation in accounting and tax accounting.

Tax depreciation can be calculated:

- linear method;

- nonlinear method.

The method of calculating depreciation is the same for all objects, with the exception of certain cases provided for by law. You can change the depreciation method once every five years.

Accounting provides more ways to calculate depreciation:

- linear;

- reducing balance method;

- method of writing off value by the sum of the numbers of years of useful life;

- method of writing off cost in proportion to the volume of products (works).

Unlike tax accounting, in accounting, the choice of depreciation method is tied to a group of identical fixed assets, and not to all objects at once. But it is also impossible to change the method of writing off the value of a fixed asset through depreciation throughout the entire life of the property.

It should be borne in mind that if a taxpayer switches to the simplified tax system with OSNO, and the object of taxation was income minus expenses, then for further write-off as expenses for the profit of the OS object, the tax residual value of the object is taken (that is, the original cost and accrued depreciation must be calculated according to the norms of Chapter 25 of the Tax Code of the Russian Federation).

If the transition is carried out with UTII, then the accounting value of the fixed asset is taken.

To transition from the simplified tax regime to the general taxation regime for the purposes of calculating income tax, the residual value is taken equal to the part of the initial cost of the fixed asset that was not written off as expenses for the simplified tax system.

Cost of fixed assets for individual entrepreneurs

It should be noted that Chapter 25 of the Tax Code of the Russian Federation and PBU 6/01 apply only to organizations. This is stated in paragraph 1 of Art. 246 of the Tax Code of the Russian Federation and clause 1 of PBU 6/01.

Entrepreneurs are guided by another document - order of the Ministry of Finance No. 86n and the Ministry of Taxes of Russia No. BG-3-04/430 dated August 13, 2002 “On approval of the Procedure for accounting for income and expenses and business transactions for individual entrepreneurs.” In particular, the rules for accepting fixed assets for accounting are prescribed in Section VI of the document.

There are no significant differences when considering organizations. But the lower cost limit is also set for accounting - 100,000 rubles.

Since 2002, only one method of calculating depreciation has been provided for individual entrepreneurs - linear

Fixed assets- means of labor that work in production for a long time, participate in many production cycles, do not change their material form and increase the cost of finished products by means of depreciation.

In the Russian Federation, accounting for fixed assets in transactions is regulated by the corresponding PBU 6/01, which was approved by Order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n. A more detailed description is provided in the Guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91.

What is the main tool?

Paragraph 4 of PBU 6/01 refers to fixed assets :

- assets that must be used to produce products, carry out work or provide services to meet the economic needs of the organization;

- assets intended to be leased to other enterprises.

- The first part of the assets used in business activities is taken into account in transactions on the active synthetic account No. 01 – Fixed assets.

- The second part is assets for rent. Are taken into account on the account 03 – Profitable investments in material assets. The inclusion of such assets in fixed assets further increases the tax base for income on the company's property.

An increase in the value of fixed assets on the balance sheet as a result of new objects, either or existing ones, is reflected in the debit of the corresponding accounts.

A decrease in the value of fixed assets as a result of the sale of objects or their decommissioning is reflected in the credit of accounts 01 or 03.

Signs of a fixed asset :

- the object is intended for use directly in production, during the performance of work or provision of services, for management purposes, or for rental on a paid basis to third parties;

- the period of use of the object exceeds 12 months;

- subsequent resale of the object by the organization that acquired it is not planned;

- the object brings economic benefits (income) to its owner.

The following objects are not considered fixed assets:

- having a service life of less than 1 year;

- worth up to 40 thousand rubles, for any service life, except for agricultural machines, weapons, construction mechanized tools.

Classification of fixed assets

It can be carried out according to many criteria, in particular those shown in Fig. 1.

Rice. 1. The most important features of OS classification.

Get 200 video lessons on accounting and 1C for free:

Fixed assets can additionally be classified:

- By the degree of their participation in the production process– into active (tools, machines, equipment, etc.) and passive (not directly involved in, but necessary for the implementation of activities (buildings, roads and access roads, transport, etc.).

- For income tax purposes to calculate depreciation There are 10 groups of fixed assets based on their useful life (from 1-2 years to 30 years or more).

Basic accounting entries for fixed assets

Categories of articles on fixed assets

- Accounting entries for write-off transactions of fixed assets

- Renting and leasing of fixed assets in accounting

Video tutorial on accounting for fixed assets in accounting:

Accounting for fixed assets in 1C 8.3

The most popular program for accountants, 1C Accounting 8.3, implements a full-fledged fixed asset accounting unit. Let's consider the basic operations for accounting for fixed assets.

Video on creating a new fixed asset card, accepting fixed assets for accounting and calculating depreciation:

Receipt of equipment(or Receipt of goods and services with the type of operation “Equipment”) - a document that generates transactions upon the arrival of fixed assets to the organization (for example, Dt 08.04 - Kt 60.01):

The next action is to transfer the fixed asset into operation. Produced using a document Acceptance of fixed assets for accounting. The document makes the posting Dt 01.01 - Kt 08.04:

After the fixed asset has begun to be used, depreciation must be calculated. This is done in 1C 8.3 every month using a routine operation Closing the month. The document makes the following entries:

After the OS is completely worn out (or, for example, was broken), you can formalize its disposal with a document Decommissioning of OS:

The program will write off depreciation balances and write off the residual value of the fixed asset from account 01.01 to account 91.02 (Income (expenses) associated with the liquidation of fixed assets) through 01.09 (fixed assets for disposal).

Fixed assets are material objects that are used by an organization for a long time in the process of producing products (performing work, providing services) or for management needs. Fixed assets include, for example, buildings and structures, machinery and equipment, computer technology, vehicles, household equipment, productive and breeding livestock, perennial plantings, etc.

At the same time, in order to recognize the above objects as fixed assets (fixed assets) in accounting and tax accounting, certain conditions must be met, which we will discuss in our consultation.

OS in accounting

In the accounting of an organization, in order to recognize an asset as an item of fixed assets, it is necessary that the following conditions be met in relation to such an item:

- the object is intended to be used for any of the following purposes (clause 4 of PBU 6/01):

- production of products;

- execution of work;

- provision of services;

- management needs of the organization;

- provision for a fee for temporary possession or use.

- the object is intended for use for a period of time exceeding 12 months;

- the organization does not intend to subsequently resell the asset;

- the object is capable of bringing future economic benefits to the organization.

The above means that they are not fixed assets, in particular (clause 3 of PBU 6/01):

- machines, equipment, and other similar objects that are listed as finished products in the manufacturer’s warehouse or as goods in the warehouse of a trading organization;

- objects that have been commissioned for installation or are to be installed, and are also in transit;

- capital and financial investments.

Let us explain what has been said with examples.

Objects of fixed assets are accounted for by the organization on active account 01 “Fixed Assets” (). If we are talking about finished products, then they are accounted for in account 43 “Finished Products”, and goods must be accounted for in account 41 “Goods”. If the organization decides to use the finished products produced by the organization or purchased goods as an object of fixed assets, it is necessary to first reflect the formation of its initial value in the usual manner on account 08 “Investments in non-current assets” (Order of the Ministry of Finance dated October 31, 2000 No. 94n) :