How to calculate phot for a month. The wage fund: principles of its formation

Calculation of payroll (payroll fund) is a practical way of planning personnel costs. Key definitions, ready-made formulas for calculating the annual and monthly payroll, a sample of the staffing table and other useful documents are in the article.

From the article you will learn:

Payroll is a wage fund: what is included in the concept of payroll, how to calculate and plan it, every personnel officer and accountant should know. It is often necessary to operate with this concept, since we are talking about an amount that makes up a significant share of the cost of manufactured products and plays an important role in annual budgeting. The employer pays taxes from the payroll, analyzes it in order to forecast personnel costs, and takes it into account when compiling. An expert will tell you more about the procedure for preparing mandatory statistical reports in Form No. P-4 with information about salaries:

Question from practice

How to fill out and submit a statistical report on Form No. P-4 “Information on the number and wages of employees”?

Nina Kovyazina answers,Deputy Director of the Department of Medical Education and Personnel Policy in Healthcare of the Russian Ministry of Health.

Form No. P-4 must be filled out and submitted at certain intervals by all organizations, regardless of their areas of activity. An exception is provided only for small businesses. If the organization has separate divisions, the form is filled out separately for each division and for the organization as a whole. At the same time, internal...

Payroll is a broad concept that includes, in addition to remuneration for work, also social benefits, compensation, and gifts. See the structure and individual elements of the remuneration system, which clarifies the difference between different types of additional payments and allowances.

There is no single legally approved list of types of payments that make up the payroll: what the wage fund includes, the employer decides independently, based on established practice and the goals pursued. As a rule, the payroll includes wages, vacation pay, insurance contributions, and social benefits to employees.

What is included in the payroll: structural features

Typically, payroll consists of payments to staff in cash, but if you pay part of your earnings in cash, do not forget to include it in the calculations. The wage fund consists of:

- wages and allowances;

- ;

- bonuses and commissions;

- compensation for special labor conditions;

- ;

- vacation pay for basic and additional paid vacations;

- severance pay;

- payment for medical services;

- payment for periods of forced downtime.

The list can be varied by adding gifts, financial assistance to employees, payment for gym memberships, etc. to the number of payments taken into account. In order not to miss anything, analyze the current items of the employer's expenses - from annual bonuses to staff to payments under civil contracts that do not belong to the structure of the wages, but are taken into account when calculating the payroll.

Advice from the editor. When calculating the payroll, do not forget to include payments under contract agreements in the calculation. Despite the fact that performers are not considered employees of the company and are not included in the staffing table, remuneration for services rendered or work performed is reflected in the SZV-M reports and included in the payroll structure. Even if there were no payments under the contracts in the reporting period, the executor. How to properly formalize civil legal relations with contractors, read the article “”.

Payroll calculation for month and year

Typically, when accounting, auditing and forecasting costs, a monthly or annual payroll is used: detailed instructions will tell you how to calculate this indicator. When calculating the annual payroll, data for the past calendar year is taken into account. To determine the annual payroll, you will need three documents:

- salary slips for the past year;

- time sheets for all 12 months;

- organizations.

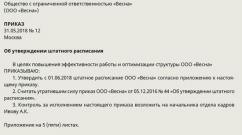

The last document is especially important, since it is the tariff rates of all employees of the organization by position and department. Every employer is required to draw up a staffing table.

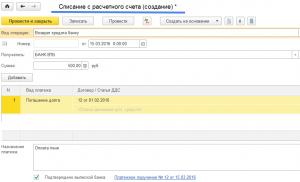

There are two simple ways to find out the size of the payroll: the balance sheet calculation formula is used in accounting, while the other, universal, is used when budgeting expenses and analyzing the financial and economic activities of the company. To calculate the payroll on the balance sheet, you should add up the credits of account 70 (“Settlements with personnel for wages”), 73 (“Settlements with personnel for other operations”) and 69 (“Settlements for social insurance and security”) in correspondence with the accounts :

- 08 “Investments in non-current assets”;

- 20 “Main production”;

- 25 “General production expenses”

- 26 “General business expenses”;

- 91 “Other income and expenses”, etc.

The result obtained reflects data for the past year. Dividing it by 12, we get the average monthly payroll. If you need to determine the indicator for a specific month, you will have to separately analyze the monthly balance data.

The general formula for calculating payroll is presented in two versions. The first option is the most optimal, which does not require additional calculations, looks like:

FOTg = ZPg + Dg + Ng

where FOTg is the annual wage fund, ZPg is the salary accrued for the year, Dg is all additional payments for the year, Ng is all allowances for the year. If the organization’s personnel receive, take them into account in the calculations. The second option is more complex:

FOTg = ZPSm * Chsm * 12

where FOTg is the annual wage fund, ZPSm is the average monthly salary, Chsm is the average monthly number of personnel, 12 is the number of months in the year.

Certificate of monthly payroll

Tax authorities who carry out control measures and check how deductions from the payroll are paid and accounted for can request a certificate of the monthly wage fund. A similar document is requested by insurance funds, banks when applying for a loan, etc.

compile it without fail.

- A unified form has not been developed for such cases. When submitting a certificate, please indicate:

name and details of the enterprise; How it will help:

name and details of the enterprise; establish the most profitable remuneration system for the company and register it in personnel documents.

correctly reflect in the documents salaries and tariff rates, regional coefficients, incentive payments.

Payroll is a very important indicator used in statistical reporting and allows one to draw conclusions about the effectiveness of company management. Analyzing labor costs is useful in planning personnel decisions. To calculate payroll, use simple formulas and documents that each enterprise maintains: staffing schedule, pay slips,

Remuneration is the main mechanism for regulating labor relations and a powerful incentive for staff to be interested in the quality of the work performed. Employee wage costs are one of the main expenses of any enterprise. Therefore, the resolution of issues related to the formation of the wage fund (WF) should always be under the control of the company’s management, and resolved in a timely manner and in favor of the staff. The article will discuss the meaning of payroll, its difference from the wages and salaries, structure, and calculation procedure.

What is the wage fund?

With the help of the wage fund, they analyze the costs of paying remuneration to employees of various structural divisions, regulate, optimize, and adjust rates, salaries, and prices. It is from this amount that all payments provided for by current legislation are calculated: contributions to social, insurance funds, pension contributions, etc. Therefore, the payroll is not only a mechanism for the rational distribution of company funds, but also a tool for stimulating and encouraging its employees.

This amount is regulated not only by organizations, but also by legislative acts, so any employee has the opportunity to independently find out what is included in the payroll and calculate its amount.

What does the payroll include?

To calculate the total cost of paying staff salaries, a wage fund is calculated, the structure of which includes the following data:

- wages accrued to employees, regardless of their job responsibilities;

- if payment for work to employees is accrued in the form of manufactured products, then the cost of these products is included in the calculation;

- all incentives accrued to employees in the form of monetary remuneration;

- if free meals are organized for the company’s employees, then the fund will include the funds allocated for it;

- bonuses for performing work without interruption, for length of service;

- funds accrued for compensation for sick leave or absenteeism through no fault of the employees;

- allowances for payment to employees transferred to lower positions;

- funds allocated for travel and accommodation for workers working on a rotational basis;

- funds for salaries of employees of third-party organizations or individual entrepreneurs providing various services;

- funds for payment of pensions if the employee had to retire due to the occurrence of a special situation (for example, an industrial injury was received that caused disability before the employee reached the retirement age provided for by law).

The following amounts are excluded from the calculation:

- dividends;

- loans issued to employees without accruing interest for the use of funds;

- social benefits accrued and paid from the state budget;

- bonuses given to staff for quality work throughout the year;

- any types of financial assistance;

- compensation caused by rising prices.

Also, the calculation does not take into account one-time or non-permanent payments, funds that workers receive from insurance funds.

Differences between payroll and wages

Despite the similar formulation between these two indicators, they have one fundamental difference:

- the payroll amount includes the amount of accrued wages and social benefits for a certain time period;

- The wages and salaries include the amount of earnings (salaries, allowances, bonuses, compensation related to working conditions) minus social benefits for the same period of time. That is, all the amounts that are due to the employee for the time actually worked and the work performed.

The difference will be clearer if you give a specific example:

The company accrued 500,000 rubles for November 2017, payments for this month were:

– 130,000 rubles – the amount of accrued advance payment to employees for November 2017.

Thus, the payroll amounted to 500,000 rubles, and the wages and salary amounted to 430,000 rubles.

The two indicators may coincide in value with each other in those enterprises where there is no incentive for employees in monetary terms or any other incentive, and only wages are paid. Then, when planning the current and future expenses of the company, only the payroll is taken into account. It is a broader concept and includes the amounts of all accruals, including the wage fund (WF).

Formula for calculating annual payroll

At the enterprise, the accounting department handles the calculations, but if desired, any employee can independently calculate the value of this indicator.

All employees who calculate payroll must be aware of the documents on which basis and by what rules this indicator is determined. The size of the payroll is directly influenced by the remuneration system existing in the organization.

The following factors are taken into account:

- salary amount;

- tariff scale sizes;

- prices for piecework work;

- various allowances and bonuses.

The calculation is carried out based on data obtained from the following documents:

- pay slips for the year, which reflect all payments made by the enterprise to all employees without exception;

- time sheets. Responsible persons are responsible for maintaining this documentation. They are the ones who enter into the timesheets the number of hours actually worked, as well as missed and overtime hours worked;

- staffing table for all employees, which indicates tariff rates, salary bonuses, production indicators, etc.

There is no standard formula for calculating the annual fund. However, to determine the value of the indicator in digital terms, two methods are used:

FOT g = Szp * H * 12, Where

Payroll g – annual wage fund;

Сзп – average salary at the enterprise for a certain time period (year);

H – the average number of all employees of the enterprise.

To obtain the average salary, the amount of all payments that were accrued and paid to staff is divided by 12 months.

FOT g = (Zg + Dd) * K, Where

Zg – wages accrued to employees for the year;

Дд – additional payments and other personnel incentives;

K is a fixed coefficient for enterprises operating in the Far North or areas close to it.

Formula for calculating monthly payroll

To determine the monthly fund, use a modified formula for finding the annual indicator:

FOT m = Szp * H, Where

Payroll m – monthly wage fund;

Сзп – average monthly salary;

H – average number of employees.

A conscious and balanced approach when planning the activities of any enterprise is the key to stability and successful development in the future. Payroll is one of the most important financial indicators, the correct calculation of which will become a fundamental factor in forecasting work activity and developing a set of measures aimed at stabilizing the company’s balance sheet.

Since the fund is formed by enterprises that independently engage in their own financing, when planning and calculating this indicator, it is necessary to separately allocate funds for the formation of reserve funds. Such measures will help not only to repay debts to staff, but also to reserve the remaining excess funds.

Conclusion

Thus, remuneration is a multifactorial concept that includes many different elements, the action of which is aimed at setting wages and rationalizing the expenditure of the organization’s funds. Therefore, when forming a payroll, it is important to take into account not only the interests of the company, but also all employees, as well as the specifics of the company’s activities.

Each employee is interested in his own, but at the legislative level such a concept as “wage fund” is more important, and it is no less important to understand what it includes.

Payroll – all the funds of an organization designed to pay employees for their services for a certain period of time (most often we are talking about annual payroll).

This amount is regulated not only by the company itself, but also by the legislation of the Russian Federation, and the employee can find out how it is calculated, what it depends on and what it affects.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to know how to solve exactly your problem - contact the online consultant on the right or call free consultation:

Legislative regulation

According to Federal Law 201077-3 (Payment in non-budgetary organizations) There are three funds:

- FOT-1– wage fund for full-time employees of the organization;

- FOT-2– wage fund for freelance workers;

- FOT-3– is formed directly from the company’s profits.

Payroll for civil servants and government officials is separately regulated. It is adjustable directly by the President of the Russian Federation(Federal Law 79-FZ) or, if we are talking about a subject, the legislative body of that subject.

Payroll and wages

Rarely does an employee know what payroll and wages are. Hidden behind these abbreviations are the wage fund and the wage fund, and it is important to understand how they differ from each other.

Payroll, as a rule, includes a full salary, as well as various bonuses, social benefits, as well as all possible incentives that the employer considers necessary to provide to the employee.

Payroll, as a rule, includes a full salary, as well as various bonuses, social benefits, as well as all possible incentives that the employer considers necessary to provide to the employee.

The financial wage, in turn, consists only of all funds intended for payment salary directly due to employees of the organization. Of course, there are organizations where the payroll is equal to the full salary, but in them the employer does not pay the employee anything above, even if he shows exceptional results or overworks.

In addition to the fact that the legislation divides the payroll into three types, there is a temporary division for basic payroll, monthly payroll and annual payroll.

The main (general) wage fund includes the amount of money calculated to pay salaries, but most often this amount is considered as calendar month(monthly payroll) or in a year(annual).

In addition, at enterprises where there are daily and hourly outputs, payroll is calculated for periods such as a day and even an hour.

Payroll structure

Payroll of any enterprise consists of several payment directions:

- Basic salary fund– this is the “skeleton” of payments, that is, what the employee receives for his actual services, according to a certain condition specified in the contract; this also includes payment for downtime that is not related to the employee’s activities. Also, if at an enterprise part of the salary is paid in material resources (products or products), this is considered to be precisely this direction.

- Additional salary fund– this includes various allowances provided for by the organization itself or the legislation of the Russian Federation (additional allowance for “harmfulness”, regional coefficient), this also includes payment for vacations, payment for business trips and sick leave.

- Incentives, compensation, bonuses, which the organization gives to all employees.

We must also understand what is not included in the payroll, according to the law:

- One-time bonus per year;

- Dividend payment;

- Prize from a special fund of the organization;

- Loans and benefits provided to employees.

Watch a visual video of what the payroll consists of:

Calculation

In the organisation accounting department calculates payroll, however, if necessary and desired, a simple employee can find out how to calculate the payroll. In order to do this, you need:

- Have payslips for the calendar year– they spell out all the payments that the organization makes for all employees.

- Have time sheets– documents that are kept by the responsible person, and in which information is entered about all hours worked, missed, and overtime.

- Have staffing table, which presents all the information about employees, their rates, their pay per hour, as well as the hours they work.

Of course, the likelihood that an ordinary employee will be allowed to access all the papers is minimal, so you can use the following formulas:

Please note that in larger companies it may be appropriate dividing employees into groups according to their salaries.

This is much easier to do, because finding out the average salary of a business manager and a cleaner is not very practical. And this way you can add up the resulting values and get a true picture.

Calculation of payroll in the estimate is carried out by most budgetary institutions; the accounting department is involved in drawing up estimates, but it is better for this to be done by a specialist estimator.

When estimating the wage fund, parameters such as hourly wages and production volumes are most often taken. Knowing these parameters, and also adding all allowances, payments, sick leave and travel allowances, the amount in the estimate is obtained.

At the same time, it is necessary to understand that taxes are not deducted in the estimate, which the employee himself pays from his income. That is, the payroll in the estimate is 13% more than the actual one.

Planning

No financial decisions in a company are made just like that, especially when millions are involved, every organization makes a plan, on the basis of which all payments to employees will be made.

No financial decisions in a company are made just like that, especially when millions are involved, every organization makes a plan, on the basis of which all payments to employees will be made.

Any enterprise has an “untouchable” amount of its funds, which is designed to pay wages. The payroll amount is determined per year, To do this, the number of employees is multiplied by the average monthly salary and multiplied by 12 months. The resulting figure determines how much money will be needed for payments.

Any enterprise is also designed for growth, for the fact that the volume of its productivity will increase, and if this happens, then the number of employees will increase, and therefore the amount of the salary will increase. That's why planning also includes forecasting growth rates, as well as an assessment of the possible associated costs.

The most productive planning method is extrapolation. This is planning, which is carried out in several stages:

- The size of the payroll for the past year is analyzed;

- Calculations are being made on how to reduce this figure, if possible;

- An analysis of external factors that may affect the size of the fund is carried out;

- The plan is submitted to management, who approves or finalizes it.

Of course, under ideal conditions this should be done planning Department, but if it is not there, then the financial department or accounting department can carry out the calculations.

Usage Analysis

This operation is directly related to the previous paragraph. Making a plan and paying wages is not everything. It is necessary to analyze how much the planned diverged from the actual.

This operation is directly related to the previous paragraph. Making a plan and paying wages is not everything. It is necessary to analyze how much the planned diverged from the actual.

The company has drawn up a payroll plan. This is a specific figure that was planned to be spent on paying workers. There are rare cases when the actual amount spent and the planned amount agree, and any discrepancy must be analyzed.

If the discrepancy occurs in favor of the company, then you can plan a smaller payroll for next year, if the planned funds were not enough, then you need to understand what contributed to this. Perhaps production rates increased, more labor was needed, or a crisis occurred.

If this was not predicted, then it is necessary to work with the planning department or accounting department so that everything is taken into account in the future.

In large companies, there may be a discrepancy between the plan and actual payments of several millions, and the task of the financial department is to make sure that there was always a way to pay salaries, despite force majeure.

Often, when analyzing, large manufacturers use not only their data, but also competitor data. All information necessary for this is open, so this analytics is legal and uncomplicated. And its advantage is that you can use the experience of other companies - both positive and negative.

Certificate of monthly payroll

Let's start with the question of why to take this certificate and who can request it. If a loan or loan is taken out, the bank may require you to provide this data in order to verify the citizen's solvency.

Employees of the Social Insurance Fund, the Pension Fund of the Russian Federation or the tax office may also need a certificate if they have any doubts about the organization's activities. In budgetary organizations this situation is quite common, but it concerns private enterprises less often.

If there is a need to obtain this certificate, then you need to contact the accounting department, where it will be drawn up for you, then the chief accountant or the head of the enterprise signs the paper, and the organization’s seal must also be affixed.

The form of the certificate is regulated either by the enterprise(if the bank requests it), or by the requesting authority(FSS, tax and Pension Fund of Russia have their own forms for preparing this paper).

The certificate indicates who initiated it, who issues it, for what period it is, and also a table is printed there, with complete information about the payroll amount. If a future period is requested, then it is necessary to refer to the payroll planning data.

The procedure for obtaining this certificate is familiar, so its preparation does not take much time and is not energy-intensive.

Competent planning, analysis and distribution of payroll – the key to successful operation of the enterprise, because wages are among the constant and largest costs, and the orderly nature of their payments will save the company’s management from many problems and headaches.

As you know, the financial condition of any enterprise includes profits and costs, which, in turn, are divided into variable and constant. Payment of wages is a fixed cost, because without systematic payment, not a single employee will work. In order to correctly form the economy of an organization, it is necessary to calculate the wage fund: this will allow you to avoid unpleasant situations and predict the net profit after deducting costs.

At the legislative level, the concept of “wage fund” is not fixed in any way, but in general it means the total amount of money paid by the employer to employees performing work duties.

It is worth noting that payroll is needed in enterprises primarily for planning costs, which sometimes reach 70% of profit. Most often, it is planned for a year or quarter, and at the end of the reporting period, thanks to it, it is possible to compare planned and actual costs in order to further optimize the company’s expenses.

Let's look at an illustrative example:

The number of employees of Parus LLC reaches 20 people. The payroll provided 4,000,000 rubles for the payment of salaries along with monthly bonuses for 2016. According to Art. 134 of the Labor Code of the Russian Federation, the employer is obliged to systematically carry out indexation, i.e. increase employee salaries in accordance with its level. At the beginning of 2017, the indexation rate was 5.4%, which was taken into account when forming the payroll for the second quarter, and it was compiled taking into account indexation. This made it possible to increase wages and predict the overall costs of the enterprise.

PHOT: what does it consist of?

When forming a payroll, employers must take into account all costs in cash or in kind:

- Salaries of employees;

- Natural products issued as wages;

- Compensation for work on holidays, weekends, and at night;

- Any bonuses paid systematically: for an increased volume of work, length of service, etc.;

- Additional pay for work in dangerous or harmful conditions;

- Salaries to employees who are not part of the staff and perform one-time services under a civil contract;

- Payment for unworked time: being on educational or maternity leave, participating in public works, annual paid leave, compensation for downtime through no fault of the employees, forced time off, etc.;

- Incentive payments: incentives for conscientious work, benefits for the purchase of shares in the organization, etc.;

- Additional payments: payment for business trips, payment of temporary disability benefits, compensation for damage caused, transfers for sick leave.

What does not need to be included in the payroll:

- One-time bonuses;

- Financial assistance to employees;

- Dividends to employees;

- Loans, benefits, compensation for vacation trips, etc.;

- Awards from individual company funds.

Very often, payroll is confused with the wage fund, but in the latter case the concept includes only wages, while payroll includes salaries, sick leave, vacation pay and any other types of payments. The wages and salaries include only bonuses, additional payments, allowances, salaries and compensation for work in dangerous or harmful conditions.

In fact, the wage fund is a component of the wage fund and must be taken into account when planning it. The amount of the salary is determined with the deduction of social payments. For example:

In January 2017, Spectra LLC received 450,000 rubles, of which 220,000 were paid as salaries, and 150,000 rubles. – in advance for the next month (February). Thus, the payroll for January is 450,000 rubles, and the salary for the same month is 370,000 rubles, because it included salaries and advance payments. The balance is 80,000 rubles, which can be spent on incentive payments, sick leave, etc.

How to calculate the wage fund?

The importance of correctly calculating the payroll cannot be underestimated: this allows you to predict the amount of costs for wages and other payments included in the fund, as well as motivate the team to a higher level of performance of work duties.

What documents will be needed to determine the payroll:

- Orders and payslips. The latter contain information about accrued salaries and are documented in the accounting department;

- Staffing table: the salary amount is indicated depending on the employee’s position, as well as the number of staff members. Compilation is usually carried out by personnel department employees;

- Time sheets include information about the number of hours and days worked for a certain period, as well as vacation and sick leave days. Managed by shift seniors, department heads or personnel officers.

Certain time intervals are used for calculation (for example, a calendar year), while a clear formula for determining the wage fund is not established by law. Most employers for this purpose use the method of calculating the average monthly salary of employees, multiplied by their number and by the billing period. For example:

The average salary, taking into account monthly bonuses and various allowances for the employees of Alliance LLC, is 45,000 rubles; there are 15 employees on staff. The payroll amount for one month will be 900,000 rubles, and for a year – 10,800,000.

If the organization has a large number of personnel, to determine the payroll, it is more convenient to distribute it into subgroups:

- management team;

- middle management;

- ordinary employees;

- service workers.

To determine the payroll amount in this case, you must do the following:

- Determine the average salary, multiply by the number of people in each of the above subgroups;

- Calculate the average monthly salary at the enterprise, multiply by the number of months in the reporting period.

If the enterprise uses a complex incentive policy and has a large number of employees, it is more advisable to use the following formula to calculate the payroll:

Salary * (salary or tariff + various allowances + regional coefficient).

This formula is best used to calculate the payroll when calculating for each of the subgroups (categories of employees).

- The time sheet establishes the total number of hours worked for each employee;

- The total number of employees is identified, then the number of personnel in each subgroup is calculated depending on the positions;

- The total hours worked are divided by the average number of employees of individual categories;

- The resulting amount of time is multiplied by the average number of payments in each category;

- The amount of money transferred to account for all categories of employees is determined, then it is multiplied by the total number of days worked during the year.

- Determine the amount of all funds paid for the year;

- Calculate the average monthly number of days worked;

- Divide the total number of working days by 12 months.

When calculating the daily payroll, a similar algorithm to the monthly one is used, but it is worth considering that the number of days in a month will be equal to 30, even if the period actually has 28, 29 or 31 days.

Payroll fund: how is it calculated?

There is no statutory formula for calculating the wage fund, so it must be approved in the company’s internal regulations. What can be included in the FZP:

- Payment for time worked, bonuses, etc.;

- Costs of food, travel, compensation for utilities, etc.;

- Payment for unworked periods (vacations, sick leave, etc.);

- Incentive and incentive payments.

To calculate the gross pay, you can use any of the following formulas:

- Average salary of employees * their number * 12 months;

- Average earnings in the company * index in the company in general * number of employees. This option is suitable for determining the payroll for each department of the organization.

If, at the end of the reporting period, overexpenditure of the wages and salaries was identified, it is necessary to improve the enterprise’s marketing policy and financial planning deficiencies in order to optimize its economy and avoid mistakes. In addition, the dynamics of payroll and wages can determine the material well-being of not only employees, but also the company as a whole.

The current financial and economic crisis in our country has a certain significant impact on the decrease in the income of organizations, which is associated with a decrease in demand for goods and services among the population. In turn, rising prices for goods and services increase the demands on employers regarding wages. On this basis, conflicts often arise between them. Therefore, careful consideration of remuneration is the key to the success of the company, as it affects the productivity of personnel as a whole.

In the coming years, there is a possible scenario of worsening business development conditions in our country, which will put many enterprises on the brink of bankruptcy. Management is thinking about optimizing its costs and maximizing profits, including by rationalizing wage costs.

In modern conditions of instability of the global economy, any organization faces the question of how to effectively cope with the current economic crisis with the least losses.

Overcoming economic difficulties is facilitated by the rationalization of wages as an integral part of the functioning of the organization as a whole.

Remuneration is the most important mechanism for regulating labor relations and a powerful means of stimulating the productive behavior of the organization's employees. Remuneration, its organization, forms and systems, additional benefits and compensation, bonus systems are an important element of company personnel management. It allows you to connect the material interests of employees with the strategic goals and objectives of the organization.

In modern economic conditions, one of the central tasks of any organization is changing wages with the goal of making it more flexible, responding to the rapidly changing situation in the labor market, stimulating the material interest of participants in the labor process, i.e. organize effectively to achieve the organization's primary goals.

The concept of payroll. Difference from payroll

Both of these concepts, at first glance, are very similar. In fact, they have a certain difference.

Every manager of a modern company should have an idea of what is included in the payroll.

The first and most important elements of the payroll are salaries and bonuses, as well as numerous additional payments. In the background, various allowances in the form of compensation should be taken into account.

Compound

Let us note four main elements of payroll:

- the salary itself;

- unworked time (for example, vacations, downtime, etc.);

- various types of incentive payments;

- various “support” payments.

The structure of the payroll balance varies from organization to organization. For example, the structure of the “salary” fund of a certain consulting company is the following calculation.

The total payroll amount is 100%, of which:

- management payments - 35%;

- payments to consultants - 40%;

- accounting payments - 15%;

- payments to technical staff - 10%.

Calculation formula. Detailed description

The issue of calculating the wage fund and the formula for its calculation is very relevant for modern companies, since the salary component is part of the cost of production, goods and services (and, often, this is a significant share), and, therefore, it affects the final result of the company’s functioning.

In turn, excessive hyper-economy on the size of the payroll is dangerous because it prevents employees from receiving a decent profit. The final result of this situation may be an increase in staff turnover, a decrease in labor productivity, and the desire of individual employees to steal.

For the wage fund, the calculation formula will be the sum of its individual components. The composition of the indicator elements may depend on the content of intra-company local labor acts.

FOT=ZP+PR+OTP+MP, where:

- ZP - salary, rub.;

- PR - bonuses, thousand rubles;

- OTP - vacation pay, thousand rubles;

- MP - financial assistance, thousand rubles.

The example of calculating the payroll using the formula above is schematic, so the calculation of the payroll in different companies can be carried out according to a more detailed version, depending on the elements.

It should be noted here that to calculate the annual wage fund, the calculation formula takes the following form:

Payroll year = salary mass * H Wed * 12, where:

Payroll year - annual wage fund, thousand rubles;

Salary month - average monthly salary, thousand rubles;

H av - total number of personnel, people.

Balance calculation

The wage fund (balance calculation formula) is discussed below.

It is necessary to summarize the data on credit from debit accounts:

- count 20;

- count 25;

- count 26;

- count 08;

- score 91.

Calculation according to estimate

The main purpose of the wage fund estimate is the more or less systematic use of “salary” funds. In most organizations, such calculations are made for the year with a quarterly or monthly breakdown. Using the estimate, it is predicted in what areas the funds will be spent, as well as the average values of the payroll components.

The wage fund according to the calculation formula in the estimate is the most important element of planning, which reflects the estimated wages of employees.

Accounting for regional coefficient and bonuses

Next point. The wage fund with the regional coefficient and bonuses according to the calculation formula are presented below:

FOT=ZP cm * H * 12 * Rk * Kp, where:

- Salary cm - average per month, thousand rubles;

- N - number of employees, people;

- Rk - regional coefficient;

- Kp - bonus coefficient.

The regional coefficient is an indicator by which wages must be multiplied in order to cover the costs associated with difficult living conditions in a certain area.

Here is an approximate list of coefficients for some regions of Russia:

- Yakutia - 2;

- Sakhalin region - 2;

- Krasnoyarsk Territory - 1.8;

- Kamchatka region - 1.6;

- Tyumen region - 1.5;

- Khabarovsk Territory - 1.4;

- Karelia - 1.15, etc.

The main purpose of the bonus system can be called achieving agreement between the interests of all parties to the enterprise in guaranteeing the growth of the final performance indicators of the company.

Taxes

The formula for calculating the wage fund when taking them into account is also modified. How?

When calculating deductions from an employee's salary, use the formula:

Personal income tax = NB * C/100, where:

- NB - tax base, thousand rubles;

- C - tax rate, %.

The standard tax rate for residents is 13%, for non-residents - about 30%.

The tax base is all income of an individual, excluding the amount of deductions established by law.

Example. Tables

An example of the formula for calculating the wage fund is shown below. So.

Before you begin to analyze and evaluate the wage fund, you should summarize the data on all payments that were made during the specified periods. The source data is the data from the accruals and deductions records. The composition of the wage fund for the period from February to June 2015 and 2016 is presented in tables 1 and 2, respectively.

Table 1

Payroll for the period from February to June 2015

Index | ||||||

| 03.2015 | 06.2015 | |||||

Payment according to salary | ||||||

all the time | 0 | 0 | ||||

including: | ||||||

Another vacation | ||||||

table 2

Payroll for the period from February to June 2016

Index | ||||||

| 04.2016 | ||||||

Payment according to salary | ||||||

Hours not worked | ||||||

including: | ||||||

Another vacation | ||||||

Payment of sick leave at the expense of the organization | ||||||

Leave compensation upon dismissal | ||||||

Table 3

Payroll assessment for the period from February to June 2015 and 2016

| Indicator name | Absolute value | Plan-actual analysis |

|||||

for 2015 | for 2016 |

||||||

absolute deviation, rub. | relative deviation, % | structural dynamics, % |

|||||

Time worked | |||||||

Time not worked | |||||||

including: | |||||||

Another vacation | |||||||

Payment of sick leave | |||||||

Leave compensation upon dismissal | |||||||

The calculation method for Table 3 is presented below.

Salary in% = Salary rub. ×100%÷∑ FOT, where:

- Salary in% - indicator value, %;

- Salary rub. - the value of the indicator in rubles;

- ∑ Payroll - the total amount of the wage fund for the period, rub.

Share of payment for hours worked in 2015 in the total payroll:

Salary in% =840,584.24×100%÷856,313.24=98.16%.

Share of payment for hours worked in 2016 in the total payroll:

Salary in% =3,444,757.54×100%÷3,505,561.82=98.27%.

The share of payment for unworked time in 2015 in the total payroll amount:

Salary in% =15,729.00×100%÷856,313.24=1.84%.

Share of payment for unworked time in 2016 in the total payroll:

Salary in% =60,807.28×100%÷3,505,561.82=1.73%.

Abs. off = Salary rub. 2016 - Salary rub. 2015, where:

- Abs. off - absolute deviation, rub.;

Absolute deviation in payment for time worked:

Abs. off=3,444,754.54-840,584.24=RUB 2,604,170.30

Absolute deviation in payment for unworked time:

Abs. off=60,807.28-15,729.00=45,078.28 rub.

TR = Salary rub. 2016 ÷ Salary rub. 2015, where:

- TP - growth rate, %;

- ZP rub. 2016 - the value of the indicator in rubles in 2016;

- Salary RUB 2015 - the value of the indicator in rubles in 2015.

TR=3,444,754.54÷840,584.24=4.10.

Growth rate of pay for hours worked in 2015:

TR=60,807.28÷15,729.00=3.87.

SD = Salary %2016 - Salary %2015, where:

SD - structural dynamics in %;

ZP %2016 - the value of the indicator in % in 2016;

Salary %2015 - the value of the indicator in % in 2015.

Structural dynamics of payment for time worked:

SD=98.27%-98.16%=0.10%.

Structural dynamics of payment for unworked time:

SD=1.73%-1.84%=-0.10%.

Payment at JSC Russian Railways

A good example. The wage fund according to the calculation formula at JSC Russian Railways is presented below:

FOT=ZP * (T+N+Rk), where:

ZP - salary, thousand rubles;

T - fixed tariff (salary), thousand rubles;

N - additional allowances, thousand rubles;

Rk - a certain regional coefficient, thousand rubles.

Using this formula, calculations are made for each subgroup of employees of JSC Russian Railways separately.

Improving wages in modern enterprises

Among these areas, we note the following points:

- Calculate the performance criteria on the basis of which wages are formed.

- Develop a special criterion for customer satisfaction with service quality. This criterion will be the main one when determining salaries.

- Determine the effectiveness of the project.

- Conduct a set of information events for staff about plans for the upcoming improvement of the payroll.

- Develop a draft amendment to the Regulations “On remuneration”.

- Amend the Regulations “On Remuneration”.

- Make the necessary changes to the job descriptions of agency department managers.

conclusions

Remuneration is a multifactorial concept, consisting of many elements aimed at establishing wages and rationalizing the costs of the enterprise. An important element of the remuneration system is taking into account the individual, collective and general contribution of the organization’s employees.

However, it should be taken into account that remuneration should be based on the specifics of the activity of the enterprise or organization itself.

To implement the principles and functions of remuneration, factors that determine the scope of the organization’s activities should be taken into account.