Code of the vehicle type truck tractor. Vehicle codes

On line 030 of the transport tax declaration, which type of vehicle code for the loader should be indicated?

Enter code 570 01.

The rationale for this position is given below in the materials of the Glavbukh System and in GOST 27721-88 (ISO 7131-84).

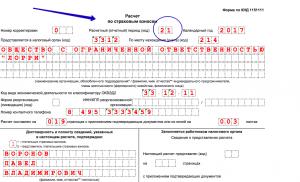

Line 030 Mode of transport

Sergei Razgulin,

Acting State Councilor of the Russian Federation, 3rd class

2. ORDER OF THE FTS OF RUSSIA DATED 20.02.2012 No. ММВ-7-11/ [email protected]"On approval of the form and format for submitting a tax return for transport tax in electronic form and the procedure for filling it out"

"Appendix No. 5

to the order of filling

tax return

on transport tax,

approved by order

Federal Tax Service of Russia

dated February 20, 2012 N ММВ-7-11/ [email protected]

Vehicle type codes

3. GOST 27721-88 (ISO 7131-84). Earthmoving machines. Loaders. Terms, definitions and specifications for commercial documentation

4.1. Loader - self-propelled tracked or wheeled machine * with a lever system and a front-mounted bucket, filled with the forward movement of the machine, which lifts, transports and dumps material (see ISO 6165).

In what cases is a preliminary notification filled out when transporting goods by road?

When placing arriving goods and vehicles under the customs procedure of customs transit, it is necessary to provide preliminary information in the form of:

- Goods Transit Notices (Transit Declaration),

- Notifications on the transit of goods using the TIR Carnet.

If the arriving goods are planned to be placed under other customs procedures, then it is necessary to provide preliminary information in the form of:

- Notifications of the arrival of goods transported by road.

I can not find the product code in the TN VED directory. What to do?

If you cannot find the product code in the TN VED directory, then, most likely, the service updated the directories, as a result of which the codes of some goods could be changed. Find a similar product in the current directory and indicate its modified code.

Why is the sent advance notice in the Draft status?

Review the result of processing the pre-registration information request, view the error message in Exchange log. For this:

Error when registering preliminary information on the TIR Carnet (Violation of the uniqueness of the number and series of the TIR Carnet). What to do?

In service Preliminary information the number and series of the TIR Carnet are checked automatically, so the error can be explained by the following reasons:

- the TIR Carnet with the indicated series and number has already been used by the customs authorities;

- the validity of the TIR Carnet with the specified series and number has expired.

Registration in the service Preliminary information two or more prior notifications with the same series and number of the TIR Carnet is not possible! Check the correctness of filling in the series and number of the TIR Carnet.

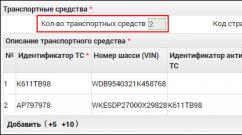

How to fill in information about vehicles with a tractor and trailer (for vehicle type codes - 31 and 32)?

Vehicle type code

If a tractor and one or more trailers are used for the transportation of goods, then information about each vehicle is filled in, indicating the code for the type of vehicle:

- 31 "Composition of vehicles (tractor with semi-trailer or trailer)"

- 32 "Composition of vehicles (tractor with trailer(s) and semi-trailer(s))"

If the vehicle code is specified 30 , then information about trailers - NOT filled!

For Advance Notice of Transit of Goods and Advance Notice of Transit of Goods using a TIR Carnet

- Vehicle identifier (tractor number);

- VIN of the tractor;

- Code of the country of ownership of the vehicle.

For tractor: field Active vehicle ID –NOT filled!

For each of trailers the following fields are filled in:

- Vehicle identifier (trailer number);

- trailer VIN;

- Active vehicle identifier (tractor number);

- Code of the country of ownership of the vehicle.

Fill example 31 . At the same time, in the table, in the 1st line, the data of the tractor are entered, in the 2nd - the data of the trailer.

Fill example when specifying the vehicle code - 32 . At the same time, in the table Vehicle Description in the 1st line, the data of the tractor is entered, in the 2nd, 3rd - the data of the trailers.

For Advance notification of the arrival of goods transported by road

The following fields are filled in for the tractor:

- Vehicle number (tractor number);

- VIN of the vehicle (VIN of the tractor);

- Vehicle type code;

- Number of the first trailer (if there is a trailer);

- Number of the second trailer (if there is a second trailer);

- Code of the country of ownership of the vehicle (tractor).

For each of trailers the following fields are filled in:

- Vehicle number (trailer number);

- VIN of the vehicle (VIN of the trailer);

- Vehicle type code;

- Code of the country of ownership of the vehicle (trailer).

For trailer: fields First trailer number And Second trailer number – NOT filled!

There are two cases of filling in information about vehicles when transporting goods using a tractor and trailer.

Fill example when specifying the vehicle code - 31 . At the same time, in the group Vehicle #1 tractor data is entered, Vehicle #2– trailer data.

Fill example when specifying the vehicle code - 32 . At the same time, in the group Vehicle #1 tractor data is entered, Vehicle #2 and #3– trailer data.

How to change the value of the field "Total items of goods"?

In the notification of the arrival of goods (road transport) and the notification of the transit of goods (TD and TIR), the number of goods is counted and the field is filled in automatically. The field is not editable.

Total items of goods / Total number of goods under the TIR Carnet will automatically be filled with the value 1 , because

Section VII. Codes of types of vehicles (TC)

providing information about at least one product is mandatory.

By button Add under the table Product Details() a new row is added to the table to fill in data about the next product, and the field value Total items of goods / Total number of goods under the TIR Carnet increases by one.

By button ( Delete) in a table row Product Details (Commodity part / Goods in the TIR Carnet) this row with product data is deleted from the table, and the value of the field Total items of goods / Total number of goods under the TIR Carnet decreases by one.

How to change the value of the "Number of vehicles" field?

In the Goods Transit Notification (TD and TIR), the number of vehicles is automatically counted. Field on tab Transport / Shipping Details not available for editing.

Goods Transit Notice (TD)

When creating a new notification, the field Number of vehicles tab Transport- empty.

By button Add in section Vehicle Description fields are opened for filling in information about the vehicle, and the value of the field Number of vehicles increases by one.

By button Delete in section Vehicle Description corresponding section is deleted Vehicle Description, and the field value Number of vehicles decreases by one.

Goods Transit Notification (TIR)

When creating a new notification, the field Number of vehicles tab Shipping Information contains a value 1 (according to the default number of rows in the table Vehicle Description).

By button Add under the table Vehicle Description a new row is added in the table to fill in the details of the vehicle, and the value of the field Number of vehicles increases by one.

By button ( Delete) in a table row Vehicle Description the corresponding line with vehicle data is deleted, and the value of the field Number of vehicles decreases by one.

What code should be indicated in the "Customs authority" field of the "General information" section when filling out a preliminary notification on the transit of goods using a TIR Carnet?

In field customs Department indicate the code of the border crossing point where the goods are expected to arrive.

I cannot find the code of the customs authority in the directory (in the "General information" section) when filling out a preliminary notification on the transit of goods using a TIR carnet. What to do?

If you cannot find the code of the customs authority in the directory, then, most likely, in the service Preliminary information the directories were updated, as a result of which the codes of some customs authorities could be changed. It is necessary to find a similar address in the current directory and indicate its modified code.

I plan to cross the border of the Customs Union NOT through the border of the Russian Federation. When filling out a preliminary notification on the transit of goods using the TIR Carnet in the "General Information" section, I can't find the code of the customs authority in the directory. What to do?

If you plan to cross the border of a state other than Russia, then use the service Preliminary information you shouldn't. The directory lists only those customs authorities that belong to the Russian Federation.

In order to prepare a transport declaration, it is necessary to determine the code for the type of vehicle, and accountants often have difficulties with this. This article is devoted to this problem: here we will provide explanations regarding the instructions and everything that will have to be guided when defining the code. Coincidence of characteristics To determine the code for the type of vehicle, you must first of all be guided by the TCP, as well as the Procedure, which was approved in 2012 by order of the Federal Tax Service of the Russian Federation (MMV-7-11-99). From the latter, the corresponding code is selected, which matches the characteristics of the vehicle that must be indicated in the declaration. If it is not possible to find out all the characteristics using the passport, it is necessary to seek help from technicians or mechanics and consult on all unclear points that are associated with the features of this car.

Online journal for an accountant

How not to make a mistake when defining the code, what you need to be guided by when defining it, and what will help you in this besides the instructions, is discussed in this article. How to determine the vehicle type code In order to determine the vehicle type code, you will need a Title and Appendix 5 to the Procedure approved by order of the Federal Tax Service of Russia dated February 20, 2012.

MMV-7-11/99. It is from it that you should select the code corresponding to your vehicle. If the full characteristics of the vehicle are not clear to you from the passport, you will need the help of technicians or mechanics of the organization to advise you on unclear points related to the features of the vehicle.

Having dealt with the characteristics of the vehicle, having found out its design features, select in Appendix No. 5 the corresponding code for the type of vehicle.

Other self-propelled vehicles, machines and mechanisms on pneumatic and caterpillar tracks 570 01 - self-propelled machines and mechanisms on pneumatic and caterpillar tracks (except for those included under codes 53001-53005) Mobile lifting and transport equipment (in particular, general-purpose cranes on pneumatic wheels, automobile and caterpillars), Other self-propelled machinery and equipment (in particular, excavators, bulldozers, self-propelled scrapers and graders, ditch diggers and sewer cleaners, land reclamation machines, road construction machines, snow plows, road rollers), Machines for transporting drilling equipment (equipment for transporting drilling pipes; complexes for transportation of drilling equipment), Other self-propelled machines and mechanisms on pneumatic and caterpillar tracks, included in other groups 14 2915020, 14 2924020, 14 2928030, etc.

Section 7. codes of types of vehicles (TC)

Info

When all questions are clarified and design features are clarified, you need to select in Appendix No. 5 the code for the type of vehicle that corresponds to it. It is necessary to do this because the amount of transport tax that is payable to the state budget directly depends on the correct choice.

If the vehicle type code is defined incorrectly, an incorrect tax rate will be taken into account. In this case, the calculated tax will be overestimated or underestimated.

Both of these are unacceptable. That is why you need to understand that filling out the declaration is a responsible matter, and you need to approach it with all the attention and meticulousness. In accordance with the Instructions (clause 5.3 regarding filling out this document), which was approved by order of the Federal Tax Service of the Russian Federation in 2012, the code must be entered in section 2, in line 030 (calculation of the amount).

Vehicle code according to vehicle classifier

Other self-propelled vehicles, machines and mechanisms on pneumatic and crawler tracks 57001 - self-propelled machines and mechanisms on pneumatic and caterpillar tracks (except for those included under codes 53001-53005) Mobile lifting and transport equipment (in particular, general purpose cranes on pneumatic wheels, automobile and crawler), Other self-propelled machinery and equipment (in particular, excavators, bulldozers, self-propelled scrapers and graders, ditch diggers and sewer cleaners, land reclamation machines, road construction machines, snow plows, road rollers), Machines for transporting drilling equipment (equipment for transporting drilling pipes; complexes for transportation of drilling equipment), Other self-propelled machines and mechanisms on pneumatic and caterpillar tracks, included in other groups 14 2915020, 14 2924020, 14 2928030, etc.

Vehicle type code in 2017

Specialized civil aircraft 15 3531210, 15 3531220, 15 3531230 411 24 — other aircraft Initial training training aircraft, sports aircraft 15 3531210, 15 3531220, 15 3531230 412 00 Helicopters 412 10 Cargo and cargo helicopters1 — 4 passenger, civil transport and cargo helicopters 15 3531301, 15 3531302 412 20 other helicopters 412 21 — firefighting helicopters specialized civil helicopters 15 3531303 412 22 — emergency service helicopters specialized civil helicopters 15 3531303 412 23 — specialized helicopters for air ambulance and medical service civil 15 3531303 412 24 — other helicopters Initial training training helicopters, etc.

Vehicle type code in 2016

Machines for sanitary cleaning of cities, Machines for winter cleaning of cities, Machines for summer cleaning of cities vans for the medical service and for transporting medicines 15 3410346 590 15 - special vehicles (milk trucks, livestock trucks, special vehicles for transporting poultry, vehicles for transporting mineral fertilizers, veterinary care, maintenance) Veterinary service vans, Milk tank trucks, Vans specialized other (in part: livestock trucks, special vehicles for transporting poultry, vans for agricultural workshops), Special vehicles for transporting mineral fertilizers 15 3410351, 15 3410368, 15 3410359, etc.

Vehicle type code in 2017-2018

A bank's refusal to conduct an operation can be appealed The Bank of Russia has developed requirements for an application that a bank client (organization, individual entrepreneur, individual) can send to the interdepartmental commission in the event that the bank refuses to make a payment or enter into a bank account (deposit) agreement.< … «Больничное» пособие: нужно ли выплачивать за отработанные дни болезни В случае, когда в день оформления листка нетрудоспособности сотрудник находился на рабочем месте и получил за этот день зарплату, «больничное» пособие за этот день не начисляется. < … Главная → Бухгалтерские консультации → Транспортный налог Обновление: 22 декабря 2016 г.

When preparing a transport declaration, accountants have difficulties with how to determine the vehicle type code in 2016.

Type of vehicle: code in the transport tax declaration

Precisely because there are discrepancies that have not yet been officially explained, in the code classifier for the type of vehicle, you need to select code 59000 (“Other vehicles”) in order to correctly calculate the tax rate. Pneumatic and caterpillar drive Loaders are also caterpillar, and therefore they have a different code.

They refer to the section that lists other vehicles - self-propelled, as well as mechanisms and machines on caterpillar and pneumatic tracks. In the code table, this code is 57001, and it includes a lot. First of all, mobile hoisting-and-transport equipment (cranes on caterpillar, pneumowheel and automobile running); self-propelled machinery and equipment (excavators, bulldozers, graders and scrapers, sewer cleaners and sewer diggers, reclamation machines, special vehicles for road construction, road rollers and snow plows).

Vehicle code according to vehicle classifier

Attention

Also exempt from taxation are fishing river and sea vessels, cargo and passenger vessels (air, river and sea), which are owned by individual entrepreneurs, organizations on the right of operational management or economic management, if their main activity is cargo or passenger transportation. Combines and tractors of all brands, special vehicles (livestock trucks, milk trucks, for transporting poultry, for applying and transporting mineral fertilizers, maintenance, veterinary care), which are registered to agricultural producers and are used for its production, are not taxed.

All vehicles that belong to the executive branch of federal significance, where military or military service equivalent to military service is provided for by law, are exempt from transport tax.

This article will help the owner of a conventional or special vehicle to correctly determine the final amount of tax from it, since the amount of payment directly depends on the type of vehicle indicated in the declaration in 2019.

Where to take

When accountants prepare a transport declaration, they often encounter difficulty in determining the code for the type of vehicle in the reporting year. There is always a fear of making a mistake.

First of all, it helps to set the transport code:

- passport for him;

- Appendix No. 5 to the order of the Tax Service of Russia dated December 05, 2016 No. ММВ-7-21/668.

Keep in mind: only from the specified Application it is necessary to select a code belonging to any type of transport of the owner.

If the data in the registration certificate is not entirely sufficient to accurately determine the type of vehicle (for example: truck / tractor / crane), you should consult with the appropriate mechanical specialists. Their consultations will help highlight the technical features of the vehicle and clarify incomprehensible points.

When the accountant received more complete information about the transport unit on the balance sheet, its features and characteristics became known, then he should again look at Appendix No. 5 and select the code for the mode of this transport.

| Vehicle type codes for transport tax declaration | |

|---|---|

| Code for tax purposes | Category t/s |

| Aircraft | |

| Aircraft | |

| 411 12 | passenger planes |

| 411 13 | cargo planes |

| 411 20 | Aircraft other |

| 411 21 | firefighting planes |

| 411 22 | emergency aircraft |

| 411 24 | other aircraft |

| Helicopters | |

| 412 12 | passenger helicopters |

| 412 13 | cargo helicopters |

| 412 20 | Other helicopters |

| 412 21 | fire helicopters |

| 412 22 | emergency helicopters |

| 412 24 | other helicopters |

| 413 00 | Air vehicles without engines |

| Air vehicles for which jet engine thrust is determined | |

| 414 01 | jet powered aircraft |

| Other air vehicles | |

| 419 01 | other powered aircraft |

| water vehicles | |

| Vessels for sea and inland navigation | |

| 420 10 | Passenger and cargo sea and river self-propelled ships (except for those included under code 421 00) |

| 420 12 | passenger sea and river vessels (except for those included under code 421 00) |

| 420 13 | sea and river self-propelled cargo ships (except for those included under code 421 00) |

| 420 30 | Sports, tourist and pleasure vessels |

| 420 32 | sports, tourist and pleasure craft, self-propelled (except for those included under codes 422 00, 423 00 - 426 00) |

| 420 33 | non-self-propelled sports, tourist and pleasure craft |

| 421 00 | Motor ships |

| 422 00 | Yachts |

| 423 00 | boats |

| 424 00 | jet skis |

| 425 00 | Motor boats |

| 426 00 | Sailing and motor ships |

| 427 00 | Non-self-propelled (towed) vessels |

| 427 01 | non-self-propelled passenger and cargo sea and river vessels |

| 428 00 | Water vehicles without engines (other than rowing boats) |

| 429 10 | Other water vehicles self-propelled |

| 429 11 | fire ships |

| 429 12 | emergency service vessels |

| 429 13 | medical service court |

| 429 14 | other water vehicles |

| Other water vehicles not self-propelled | |

| 429 21 | other non-self-propelled watercraft for which the gross tonnage is determined |

| 429 22 | other water vehicles, not self-propelled |

| Ground vehicles | |

| 510 00 | Cars |

| 510 03 | medical service cars |

| 510 04 | other passenger cars (except for those included under codes 566 00, 567 00) |

| 520 01 | Trucks (except for those included under code 570 00) |

| Tractor, combines and special vehicles | |

| 530 01 | agricultural tractors |

| 530 02 | other tractors |

| 530 03 | self-propelled harvesters |

| 530 04 | special vehicles (except those included under code 590 15) |

| 530 05 | other tractors, combines and special machines |

| Buses | |

| 540 01 | medical service buses |

| 540 02 | city and intercity buses |

| 540 03 | other buses |

| motor vehicles | |

| 561 00 | Motorcycles |

| 562 00 | scooters |

| 566 00 | Motosled |

| 567 00 | Snowmobiles |

| 570 01 | Other self-propelled vehicles, machines and mechanisms on pneumatic and caterpillar tracks (except for those included under codes 530 01 - 530 05) |

| Other vehicles | |

| 590 10 | Cars special |

| 590 11 | fire trucks |

| 590 12 | city cleaning and cleaning vehicles |

| 590 13 | emergency vehicles |

| 590 14 | medical service vans |

| 590 15 | special vehicles (milk trucks, livestock trucks, special vehicles for transporting poultry, vehicles for transporting mineral fertilizers, veterinary care, maintenance) |

| 590 16 | other special vehicles, on the chassis of which various equipment, units and installations are installed |

Keep in mind: this is a completely new list of codes that is valid from the 2017 report.

In practice, most often an accountant needs a vehicle type code for a car. As can be seen from the table, its vehicle type code is 510 00.

Other passenger cars are shown with the vehicle type code 510 04 (except for snowmobiles and snowmobiles). That is, it is necessary to make a choice of code according to the principle of exclusion.

If your vehicle is not a motorcycle, not a motor scooter, not a motorized sledge, and not a snowmobile, then the vehicle type code is 570 01. It is intended for other self-propelled vehicles, machines and mechanisms on pneumatic and caterpillar tracks.

Also, according to the principle of exclusion, it is necessary to approach the code of the type of vehicle 590 16. These are other special cars, on the chassis of which various equipment and units are installed (see the last part of the table).

Apparently, since 2017, all general purpose trucks have a vehicle type code of 520 01.

For a long time it was not clear what type of vehicle code a forklift had. There are no official clarifications of officials in this regard yet. In our opinion, code 590 16 is most suitable for forklifts.

Where in the declaration

In the transport tax report, the vehicle type code appears in only one place - this is Section 2, where the calculation is carried out for each vehicle.

Why do you need

The payment of tax for it depends on how correctly the transport code is determined. The fact is that the laws of the constituent entities of the Russian Federation establish the amount of tax based on these codes. And when the transport code is determined incorrectly, the payment amount will be lower than it should be, or, conversely, it will be overpriced. This is the reason for the scrupulous approach to determining the characteristics of each transport unit and clarifying its code.

So, when determining the tax code of transport, an organization needs to:

- once specify the type and purpose of the latter;

- find a match in the table we gave above;

- make an appropriate note in the declaration.

This approach will not remain in the dark next year. Although codes may be revised over time, but not so drastically.

When preparing a transport declaration, accountants have difficulties with how to determine the vehicle type code in 2016. How not to make a mistake when defining the code, what you need to be guided by when defining it, and what will help you in this besides the instructions, is discussed in this article.

How to determine the vehicle type code

In order to determine the code for the type of vehicle, you will need a TCP and Appendix 5 to the Procedure, approved by order of the Federal Tax Service of Russia dated February 20, 2012 No. MMV-7-11 / 99. It is from it that you should select the code corresponding to your vehicle. If the full characteristics of the vehicle are not clear to you from the passport, you will need the help of technicians or mechanics of the organization to advise you on unclear points related to the features of the vehicle. Having dealt with the characteristics of the vehicle, having found out its design features, select in Appendix No. 5 the corresponding code for the type of vehicle.

What does the vehicle type code affect?

The choice of vehicle type code directly affects the amount of transport tax payable to the budget. The law of the subject of the Russian Federation establishes transport tax rates depending on the code of the vehicle. If the code is incorrectly determined and the wrong tax rate is taken into account, the calculated tax may be overestimated or, conversely, underestimated. Therefore, the selection of the vehicle type code should be approached responsibly.

Where is the vehicle type code placed in the declaration in 2016?

In accordance with paragraph 5.3 of the Instructions for filling out the transport tax declaration, approved by order of the Federal Tax Service of Russia dated February 20, 2012 No. ММВ-7-11 / 99, the code for the type of vehicle in 2016 is entered in line 030 of Section 2 "Calculation of the amount of transport tax for each vehicle” transport tax declaration.

For example, the vehicle type code 52001 is given for trucks.

Vehicle type code 51004

Passenger cars (with the exception of medical aid cars, snowmobiles and snowmobiles) correspond to code 51004, cars of medical service - code 51003.

Vehicle type code for a forklift that has long been controversial

Discussions about which code to assign to a forklift have been going on for several years. According to the latest opinion, which is taken into account when filling out the declaration, a forklift can be attributed to other vehicles with code 590 00. This is justified by the fact that forklifts are not vehicles that are grouped in a separate subsection "Means of transport" (code 15 0000000) in OKOF codes. In the reference book OK 013-94B, they are included in the subsection "Machinery and equipment" (code 14 0000000) of OKOF under code 14 2915540. Therefore, code 590 00 "Other vehicles" can be selected as the code for the type of vehicle for tax purposes for a forklift. There is still no official position of officials on this issue.

Vehicle type code 57001

Loader (not auto-) refers to code 57001 "Other self-propelled vehicles, machines and mechanisms on pneumatic and caterpillar tracks".

This code includes:

- lifting and transport mobile equipment (in particular, general-purpose cranes on pneumatic wheels, automobiles and caterpillars);

- other self-propelled machinery and equipment (in particular, excavators, bulldozers, self-propelled scrapers and graders, ditch diggers and sewer cleaners, land reclamation machines, road construction machines, snow plows, road rollers);

- machines for transporting drilling equipment (equipment for transporting drill pipes, complexes for transporting drilling equipment);

- other self-propelled machines and mechanisms on pneumatic and caterpillar tracks, included in other groups.