126 114 deduction amount. Reflection of deductions in certificates

Deduction code 114 in personal income tax certificate 2- This is a deduction that applies to the first child. The child must be no more than 18 years old. But, the parents of children under 24 years of age also have the right to receive a deduction if the children are students of a day hospital. The deduction belongs to the standard form and can be issued by any employee.

Help 2 Personal income tax today is considered the main element of the reflection of all income and tax deductions of an employee. This certificate by law includes all types of income. Let us draw your attention to the fact that certain incomes are not taxed at all, however, such incomes are not included in the certificate, which means they are not taken into account when calculating the tax base.What is a standard deduction and how to use it?

Parents, guardians and trustees of a minor child can receive a standard deduction. In simpler terms, this deduction implies the absence of accounting for the amount of funds that is used to support the child when deducting to tax funds.The deduction in the certificate is displayed as a specific three-digit code. When filling out certificates, accountants must certainly be guided by specialized code reference books. Make sure that the guide is up-to-date and includes all tax data.

- The deduction can be provided in various forms:

- Reducing the amount of income that is subject to mandatory tax deductions;

To describe everything in a more understandable language, I will give the simplest example. The employee's salary is 20,000, of which the employee spends 3,000 rubles a month on the maintenance of his child. This means that the amount of 3,000 rubles cannot be taxed; income in the amount of 17,000 rubles is subject to taxation. To make all calculations correctly, it is mandatory to specify the standard deduction code.

What does deduction code 114 mean in personal income tax certificate 2?

This code displays information about the deduction for the first child who has not yet reached the age of majority. At the same time, such a deduction is also given to those parents who teach their child in a higher educational institution. The term is extended (the period of deductions is extended) up to 24 years of age.Thus, it becomes clear that almost everyone can receive the tax deduction of the standard option. The main thing is to correctly complete all the documents.

There is also a property deduction, which involves a refund of the amount of tax for the purchase of real estate. More complex are the calculations for the professional deduction. But social deductions are provided only to low-income families, and such deductions must be properly processed.

Source: korrespondent.net

The deduction code 115 in the personal income tax certificate 2 is a deduction for the second child, who must be a minor or study at a university but exclusively on a paid basis. This deduction can...

In our country, one of the reasons for the dissatisfaction of citizens is rather high tax rates. But at the same time, the state seeks to slightly compensate for these costs with the help of various deductions. The most common tax deduction codes for the purchase of property or medicines, tuition fees, as well as for children 114 and 115.

The deduction code 114 can be distinguished as the most common in Russia; it is assigned quite often to children until they reach the age of majority or until graduation.

There are some specifics when parents with minor children are entitled or not entitled to income tax refunds, namely:

- Payments are due when the mother and father have official employment and transfer thirteen percent in personal income tax;

- Payments are not due if the mother or father does not have an official income, is registered with an employment center, or arrives on maternity leave;

- Only the mother or father can receive the tax refund, but only if the second writes a refusal to receive;

- State assistance is also due to guardians, trustees or adoptive parents of a child;

- The maximum possible refund amount can be 280 thousand Russian rubles. However, if the recipient receives such an amount, then in the future he will be deprived of the right to receive income tax refunds;

- The amount of the refund is affected by the number of children, that is, if there are many children in the family, then the amount of compensation for the next child will be higher. It is worth noting that in this situation all children are taken into account, even those who have already reached the age of majority or have completed their studies.

The state has established the following amounts of compensation for children:

- for the first child is 1,400 rubles;

- on the second is 1,400 Russian rubles;

- on the third will be 3 thousand rubles;

- for a child with a disability is 12 thousand rubles for parents or adoptive parents, but guardians and trustees have the right to receive 6 thousand rubles.

Making tax payments for children

The standard tax deduction of codes 114 and 115 can be issued at the place of work, only with official employment. The required package of documents must be submitted every year. In a situation where one of the parents has written a refusal to receive payments, then the second parent receives compensation in double the amount, but must provide all the necessary documents every month.

List of documents and references to be submitted:

- An identity document, namely the applicant's passport;

- Birth certificate of the child (children);

- Marriage certificate;

- Certificate of income form 2-NDFL;

- If the applicant's son or daughter is an adult, then a certificate from his place of study;

- Application for compensation, the application is written in the name of the employer.

In situations where the employer does not make a refund, or the applicant submitted documents too late, he can contact the tax office to which he belongs at the place of residence. In this case, in addition to the standard package of documents, you will also have to fill out a tax return indicating all available income for the year, in addition to the official salary.

There are the following income options:

- receiving income from the sale of real estate or movable property (car and so on);

- rental of housing;

- profit that was received for the one-time provision of various services or work under a civil law contract;

- other income generating options.

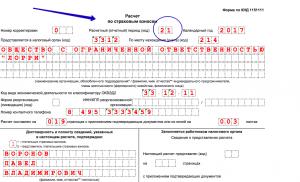

How deductions 114 and 115 are displayed in certificates

Please note that changes to the table have been made and the standard codes 114 to 125 are no longer relevant. Now parents and adoptive parents have one code, but trustees, guardians are completely different.

In Russia, the most common tax deduction codes are 114 and 115 codes, now they have been changed. 114 code became 126 for parents, and 130 for guardians. The deduction 115 changed and became 127 for parents, and 131 for guardians and trustees. These changes also affected other codes.

Now, for personal income tax in 2017, compensation will be displayed in a new way, and signed in more detail. If earlier code 114 meant that the payment relies on the first child, who is either a minor or a student, and this applied to both parents and guardians, now these points are indicated in different codes. The same situation applies to the second, third and subsequent children.

It is worth noting the fact that if the applicant indicates an incorrect or outdated code, then most likely he will be refused or the calculation will be made incorrectly. For this reason, it is necessary to carefully read the changes regarding compensation and code 114 in the personal income tax certificate 2, it must be replaced with either code 126 or 130 (depending on the situation). Basically, the correctness of filing documents is monitored by a tax agent or other authorized person. And if an error was found, then he must report it to the applicant within 10 days in order to correct it.

Despite everything, getting compensation for children is quite simple and does not require much effort and time, especially if you apply directly at the place of work. But only citizens of the Russian Federation with the status of a resident, that is, officially residing in the country for more than 183 days during the year, can use it. When submitting documents in 2017, it is necessary to take into account the nuance that the tax deduction codes for children 114 and 115 have been changed.

Deduction codes 114 and 115 when filling out the 3-NDFL declaration

Since November 2015, the Federal Tax Service has introduced new digital deduction codes for filling out 2-NDFL certificates. Deductions with the designation 114 and 115 are most often found in wage certificates.

What do deductions 114 and 115 mean?

Deduction 114 is the standard deduction for the first child, 115 for the second. These benefits are provided to the parents of the child - mother and father, who have income subject to personal income tax. If one of the parents, or both, does not have taxable income, deductions are not provided to them.

The amount of the deduction for both the first and second children is 1,400 rubles. per month. Despite the same amount in the 2-NDFL certificate, these deductions are divided. Child deductions are provided until the month in which the parent's income reaches 350,000 rubles.

In addition to parents 114 and 115, adoptive parents, adoptive parents, guardians, trustees, as well as spouses of all listed categories can use tax deductions.

The most common way to use child deductions is with the payer's employer. For their application, it is enough to write an application to the accounting department of the employer and attach the birth certificates of the children. If an employee has not used deductions during the year, he can receive benefits when filing a declaration with the tax authority.

Child deductions apply until age 18 or, if the child is studying, age 24.

Confused about how to complete the paperwork? Don't worry, we we will make a 3-NDFL declaration or zero reporting for you.

What deductions are not subject to 114, 115 codes

For the third and subsequent children, the deduction code 116 is provided. The order of children is determined by the order of birth. The youngest child remains first, even if he is past the deductible age.

For single parents, double the amount of the deduction is provided. In the table of deduction codes:

- for the first child of a single parent, code 118 is used;

- on the second - 119.

If one parent waives their right to receive a child allowance in favor of the other, double the amount of the benefit is also applied. The deductions carry a digital code:

- 122 - for the first child;

- 123 - on the second.

An increased benefit is also provided for children with disabilities. Regardless of the order, deductions are made to parents according to code 117.

Reflection of deductions in 3-personal income tax

When transferring information from the 2-NDFL certificate to the income declaration, deductions are not reflected in the annual report. Information on codes can only be used to read 2-NDFL. If there are no deductions 114, 115 on the salary certificate, they can be obtained through the tax service.

When filling out 3-NDFL, digital deduction codes are not used.

Deduction code 126, 127 and others in 2-personal income tax

Standard deductions are reflected in the first section of sheet E1. In this section of the declaration, there is no separation of children depending on the order. The sum of the months in which the total income did not reach the deduction limit is indicated, and the annual amount of the deduction for all children.

Separate deductions are considered for single parents, parents of disabled children, and parents whose spouse refused the deduction.

New codes for standard deductions for children - 2017

From December 26, 2016, when filling out 2-personal income tax, legal entities will need to apply new codes standard deductions for children.

The Federal Tax Service has increased the number of standard deduction codes for children.

Instead of the previously used 12 codes (114-125), from December 26, 24 (126-149) will be used in the list.

There are more codes, as one deduction received two codes, depending on who it is provided to. Until December 26, 2016, there was no such division.

For example

, in the adjusted list, the deduction for the first child has two codes:

- code 126 is assigned to a deduction for a child provided to a parent, his husband or wife, an adoptive parent;

- code 130 indicates the same deduction, but already provided to the guardian, trustee, foster parent, his spouse or spouse.

In the previous list, the deduction for the first child, which is provided to all listed persons, was marked with code 114.

Separation of codes was required because since 2016 the amount of the deduction for a disabled child began to differ depending on who it is provided to. If a parent, his husband or wife, an adoptive parent, then 12 thousand rubles. If the foster parent, his spouse, guardian, trustee, then 6 thousand rubles.

In the same way, the amount of the deduction for a full-time student, graduate student, intern, intern, student under the age of 24, if he is a disabled person of group I or II, changes.

See Section 218 Standard Tax Deductions

ORDER

dated November 22, 2016 No. ММВ-7-11/ [email protected]

About making changes and additions to applications

to the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected]

"On approval of codes for types of income and deductions"

CODES OF TYPES OF TAXPAYER DEDUCTIONS

|

Deduction code |

Deduction name |

|

The standard tax deductions provided for in Art. 218 Tax Code of the Russian Federation |

|

| 104 | 500 rubles per taxpayer belonging to the categories listed in subparagraph 2 of paragraph 1 of Article 218 of the Tax Code of the Russian Federation |

| 105 | 3,000 rubles per taxpayer belonging to the categories listed in subparagraph 1 of paragraph 1 of Article 218 of the Tax Code of the Russian Federation |

| (114 — 125) | Excluded - Order of the Federal Tax Service of Russia dated November 22, 2016 N MMV-7-11 / [email protected] |

| 126 | 1400 rub. On the first parent |

| 127 | 1400 rub. On the second a child under the age of 18, as well as for each full-time student, graduate student, intern, intern, student, cadet under the age of 24 parent, spouse (wife) of the parent, adoptive parent, on whose provision the child is |

| 128 | 3000 rub. On the third parent, spouse (wife) of the parent, adoptive parent, on whose provision the child is |

| 129 | 12000 rub. On the disabled child parent, spouse (wife) of the parent, adoptive parent, on whose provision the child is |

| 130 | 1400 rub. On the first a child under the age of 18, as well as for each full-time student, graduate student, intern, intern, student, cadet under the age of 24 guardian |

| 131 | 1400 rub. On the second a child under the age of 18, as well as for each full-time student, graduate student, intern, intern, student, cadet under the age of 24 guardian, guardian, foster parent, spouse (spouse) of the foster parent, on whose provision the child is |

| 132 | 3000 rub. On the third and each subsequent child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 guardian, guardian, foster parent, spouse (spouse) of the foster parent, on whose provision the child is |

| 133 | 6000 rub. On the disabled child under the age of 18 or a full-time student, graduate student, intern, intern, student under the age of 24, who is a disabled person of group I or II guardian, guardian, foster parent, spouse (spouse) of the foster parent, on whose provision the child is |

| 134 | 2800 rub. Personal income tax deduction code 115IN double size single parent, adoptive parent |

| 135 | 2800 rub. IN double size for the first child under the age of 18, as well as for each full-time student, graduate student, intern, intern, student, cadet under the age of 24 sole guardian |

| 136 | 2800 rub. IN double size single parent, adoptive parent |

| 137 | 2800 rub. IN double size for the second child under the age of 18, as well as for each full-time student, graduate student, intern, intern, student, cadet under the age of 24 sole guardian, guardian, adoptive parent |

| 138 | 6000 rub. IN double size single parent, adoptive parent |

| 139 | 6000 rub. IN double size for the third child under the age of 18, as well as for each full-time student, graduate student, intern, intern, student, cadet under the age of 24 sole guardian, guardian, adoptive parent |

| 140 | 24000 rub. IN double size single parent, adoptive parent |

| 141 | 12000 rub. IN double size for a disabled child under the age of 18 or a full-time student, graduate student, intern, intern, student under the age of 24 who is a disabled person of group I or II sole guardian, guardian, adoptive parent |

| 142 | 2800 rub. IN double size for the first child under the age of 18, as well as for each full-time student, graduate student, intern, intern, student, cadet under the age of 24 one of the parents |

| 143 | 2800 rub. IN double size for the first child under the age of 18, as well as for each full-time student, graduate student, intern, intern, student, cadet under the age of 24 one of the adoptive parents |

| 144 | 2800 rub. IN double size for the second child under the age of 18, as well as for each full-time student, graduate student, intern, intern, student, cadet under the age of 24 one of the parents at their choice on the basis of a statement about the refusal of one of the parents from receiving a tax deduction |

| 145 | 2800 rub. IN double size for the second child under the age of 18, as well as for each full-time student, graduate student, intern, intern, student, cadet under the age of 24 one of the adoptive parents at their choice on the basis of a statement about the refusal of one of the adoptive parents from receiving a tax deduction |

| 146 | 6000 rub. IN double size for the third and each subsequent child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 one of the parents at their choice on the basis of a statement about the refusal of one of the parents from receiving a tax deduction |

| 147 | 6000 rub. IN double size for the third and each subsequent child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 one of the adoptive parents at their choice on the basis of a statement about the refusal of one of the adoptive parents from receiving a tax deduction |

| 148 | 24000 rub. IN double size one of the parents at their choice on the basis of a statement about the refusal of one of the parents from receiving a tax deduction |

| 149 | 12000 rub. IN double size for a disabled child under the age of 18 or a full-time student, graduate student, intern, intern, student under the age of 24 who is a disabled person of group I or II, one of the adoptive parents and at their choice on the basis of a statement about the refusal of one of the adoptive parents from receiving a tax deduction |

What does the deduction code 115 mean in the 2-NDFL certificate

Deduction code 115 in personal income tax certificate 2- this is a deduction for the second child, who must be a minor or study at a university but exclusively on a paid basis. This deduction can be received by single parents, guardians, foster parents or trustees who provide for the child.

Deductions for children

Help 2 personal income tax, in principle, reflects all types of employee earnings. This certificate includes various types of income, including those income that a person receives not from professional activities - interest on deposits, benefits from the acquisition of securities, rental of premises ...

All data on various types of income must be reflected in the certificate. The procedure for issuing a document accepts the indication of all information in a code format. Income is reported as a four-digit code. Also, the certificate displays all the necessary deductions.

Today there are such types of deductions:

- Standard deductions;

- Social deductions;

- professional deductions;

- property deductions.

Standard deductions can be used by any resident of the country. Such deductions are provided to parents, guardians, trustees or adoptive parents who are raising children.

The deduction implies a reduction in the amount of income that is taxed. That is, the amount necessary for the maintenance of the child is deducted from the amount of income, and this amount is not taxed at 13%.

All deduction codes can be found in specialized directories. When issuing a 2 personal income tax certificate, it is very important not to make mistakes in filling out coded information, since in automatic tax calculation programs, the entire algorithm of actions is based on such codes.

In our country, all residents are required to pay tax on their income - personal income tax. For each employee, a specialized certificate is mandatory issued, which indicates all possible types of income of an individual.

What does deduction code 115 mean in personal income tax certificate 2?

Today, children's deductions, which are standard deductions, can be used by everyone. Please note that code 115 reflects the following information:

- A deduction for a second child who has not reached the age of 18 or has not reached the age of 24 but is studying at a higher education institution;

- Guardians, parents and trustees can receive the deduction.

At the same time, it must be borne in mind that tax deductions cannot be issued:

- Individual entrepreneurs who make personal income tax deductions according to special schemes;

- Officially unemployed people.

That is, in order to receive a deduction, you must certainly have official employment. The deduction will be the amount of tax funds that is deducted from the amount that is spent on the maintenance of the child. That is, for example, a salary of 20,000 is spent on maintenance of 3,000, which means that tax will not be deducted from the amount of 3,000. Accordingly, 20,000 - 3,000 = 17,000, which are subject to personal income tax.

All articles The Ministry of Finance does not consider bonuses as salaries and requires the transfer of personal income tax from them immediately upon payment to the employee (Vaitman E., Chaplygin D.)

Why does the department not include employee benefits as wages?

It is important to distinguish between one-time and regular bonuses.

The day of receipt of income and the day of transfer of personal income tax are not the same thing.

Over the past few months, the Russian Ministry of Finance has issued a number of letters on when employers should withhold and transfer personal income tax from various payments to employees. Including from the advance and the final calculation of wages, bonuses, vacation pay, temporary disability benefits.

For most payments, the point of view of the department has not changed. But for some of them, the explanations of officials were unexpected. First of all, in terms of bonuses paid to employees. About everything in order.

You do not need to withhold personal income tax from the amount of the advance on wagesand transfer it to the budget

All employers are required to pay salaries to employees at least every half a month (part 6 of article 136 of the Labor Code of the Russian Federation). That is, to issue an advance and then make the final payment. Each organization sets its own payroll dates. They are prescribed in the internal labor regulations, labor or collective agreement.

The Ministry of Finance of Russia believes that personal income tax from wages should be withheld from the employee and transferred to the budget only at the final payment for the month (Letter dated 04/10/2015 N 03-04-06 / 20406). When paying an advance, you do not need to calculate tax. Indeed, the day of receipt of income in the form of wages is recognized as the last day of the month for which wages are accrued (clause 2, article 223 of the Tax Code of the Russian Federation). Until the end of the month, income is not considered received. Therefore, the organization cannot calculate personal income tax from him.

Note. Personal income tax from a salary paid twice a month is transferred to the budget once at the final settlement.

The department held a similar opinion before (Letters of the Ministry of Finance of Russia dated 18.04.2013 N 03-04-06 / 13294, dated 03.07.2013 N 03-04-05 / 25494 and dated 09.08.2012 N 03-04-06 / 8-232 ).

The period in which the company must transfer the personal income tax withheld in the final calculation depends on the method of payment of wages (read more in the box below). The tax must be paid to the budget (clause 6 of article 226 of the Tax Code of the Russian Federation):

- if the organization pays salaries in cash received for this from the bank, - on the day the funds are withdrawn from the current account;

- if the company pays a salary from the cash proceeds received at the cash desk from the sale of goods, works or services, - the next day after the payment to the employee of the money;

- if the organization transfers salaries to bank cards or employees' accounts - on the day of transfer.

Read on e.rnk.ru. More useful stuff

The employer has the right to give out part of the salary with his own products or goods. The main thing is that this method of payment should be provided for in an employment or collective agreement (part 2 of article 131 of the Labor Code of the Russian Federation). But this is not the only condition that the organization will have to fulfill. Written consent will need to be obtained from each employee to pay salaries in kind. Usually it is made out as a statement.

An approximate form of this document is given on the website e.rnk.ru in the article "Six nuances that are important to consider when paying salaries to employees in kind" // RNA, 2015, N 10. It also talks about other restrictions that need to be taken into account when paying salaries in kind.

The same rules are followed if the salary for the second half of the month is paid at the beginning of the next month. This is exactly what most organizations do. Most often, the deadline for the final payment for the past month falls on the period from the 3rd to the 7th day of the next month.

Despite the fact that the day of receipt of income in the form of wages is the last day of the month for which it is accrued, personal income tax does not need to be paid on this day. The organization will have to transfer tax to the budget only after paying money to employees or withdrawing them from a bank account (clause 6, article 226 of the Tax Code of the Russian Federation).

Personal income tax from vacation pay and disability benefitstransfer to the budget without waiting for the end of the month

Vacation pay must be paid to the employee no later than three days before the start of the vacation (part 9 of article 136 of the Labor Code of the Russian Federation). The Ministry of Finance of Russia claims that vacation pay is an independent type of income. They do not apply to payments for the performance of labor duties (Letter dated 10.10.2007 N 03-04-06-01 / 349). After all, during the vacation, the employee is free from the performance of these duties (Articles 106 and 107 of the Labor Code of the Russian Federation).

In addition, the amount of other employee benefits for this month is not important for calculating vacation pay. That is, the organization does not need to wait until the end of the month to determine the final amount of vacation pay.

This means that the company has no obstacles to immediately calculate personal income tax from them when calculating vacation pay. Therefore, the Ministry of Finance of Russia believes that personal income tax withheld from vacation pay should be transferred to the budget not within the time frame provided for paying this payroll tax. This must be done earlier (see the sidebar on page 56 for more details).

Important. From 2016, the deadline for paying personal income tax by tax agents will change

Significant amendments to personal income tax were made by Federal Law No. 113-FZ of May 2, 2015. Most of them will come into effect on January 1, 2016.

A single deadline will be set for the transfer of personal income tax by tax agents. From the new year, they will have to transfer the withheld personal income tax to the budget no later than the day following the day the income is paid (paragraph 1, clause 6, article 226 of the Tax Code of the Russian Federation in a new edition). This period no longer depends on the method of payment to the employee.

In addition, there will be special rules for paying personal income tax on vacation pay and temporary disability benefits. Personal income tax from these payments can be transferred to the budget later than now. The new deadline for paying tax is no later than the last day of the month in which the tax agent paid vacation pay or disability benefits (paragraph 2, clause 6, article 226 of the Tax Code of the Russian Federation, as amended).

The same Federal Law introduced a number of other important amendments to personal income tax. This includes quarterly reporting by tax agents on personal income tax (clause 2, article 230 of the Tax Code of the Russian Federation, as amended).

For failure to fulfill this obligation or violation of the deadlines for the delivery of the calculation, a fine of 1000 rubles is established. for each full or incomplete month from the day when it had to be submitted to the inspection (p.

2-NDFL: decoding deduction codes

1.2 Art. 126 of the Tax Code of the Russian Federation in new. ed.).

Depending on the method of payment of vacation pay, personal income tax is transferred from them (Letters of 04/10/2015 N 03-04-06/20406, 01/26/2015 N 03-04-06/2187, 06/06/2012 N 03-04-08/8 -139 and dated 11/15/2011 N 03-04-06 / 8-306):

- on the day of receipt of cash from the bank for the payment of vacation pay;

- on the day the vacation pay is transferred to a bank card or employee's account;

- the next day after the payment of vacation pay from the cash proceeds received by the organization from the sale of goods, works or services.

Similarly, the department recommends doing the same when paying benefits for temporary disability (Letters of the Ministry of Finance of Russia dated 04/10/2015 N 03-04-06/20406 and dated 10/10/2007 N 03-04-06-01/349). Indeed, for their calculation, the amount of other employee income for the month also does not matter. Yes, and the allowance itself is not wages, since during the illness the employee is released from work.

If the bonus was paid separately from the salary,Personal income tax from it is transferred as from independent income,that is, on the date of payment to the employee

Such a conclusion can be drawn from the Letter of the Ministry of Finance of Russia dated March 27, 2015 N 03-04-07 / 17028<1>. In it, officials indicated that personal income tax from the bonus should be withheld on the day it is paid to the employee.

———————————

<1>The Federal Tax Service of Russia sent this Letter to lower-level inspections and ordered it to be used in work (Letter dated 04/07/2015 N BS-4-11 / [email protected]).

It is not news if an organization pays bonuses along with the final payroll for the past month. From the entire amount issued to the employee, she will still withhold personal income tax and transfer it to the budget (paragraphs 4 and 6 of article 226 of the Tax Code of the Russian Federation).

The clarifications of the Russian Ministry of Finance are important for those employers who pay bonuses separately from wages or together with an advance payment. For example, based on the order of the CEO or other document.

The agency considers the date of receipt of income in the form of a bonus the day it is paid in cash or the day the funds are transferred to a bank card (clause 1 clause 1 article 223 of the Tax Code of the Russian Federation). And not the last day of the month in which it was accrued (clause 2 of article 223 of the Tax Code of the Russian Federation). That is, officials consider bonuses as an independent type of income and do not attribute them to wages. But they don't say it directly. At least, in Letter No. 03-04-07/17028 dated March 27, 2015 (see the sidebar below for the point of view of the Supreme Court of the Russian Federation on this issue).

Arbitrage practice. The Supreme Court of the Russian Federation for the payment of personal income tax in the same period as with the salary

Almost simultaneously with the appearance of the Letter of the Ministry of Finance of Russia of March 27, 2015 N 03-04-07 / 17028, the Supreme Court of the Russian Federation considered the issue of withholding and transferring personal income tax from bonus payments (Determination of April 16, 2015 N 307-KG15-2718).

The judges came to different conclusions. In their opinion, just because the bonuses are stimulating in nature, they are associated with the performance of work duties by employees. This means that bonuses are elements of the remuneration of employees (part 1 of article 129 of the Labor Code of the Russian Federation).

The Labor Code does not provide for a special procedure and terms for the payment of bonuses. Therefore, personal income tax from premiums must be withheld and transferred to the budget according to the same rules that are established for salaries. That is, the tax must be paid only at the final settlement with employees for the month in which the organization accrued a bonus to them (clause 2 of article 223 and clause 6 of article 226 of the Tax Code of the Russian Federation).

Several years ago, the Ministry of Finance of Russia already spoke about the date of transfer of personal income tax from bonus payments (Letter dated November 12, 2007 N 03-04-06-01 / 383). It was about the bonus to employees for the implementation of the plan and the achieved production results, which the organization paid on the 17th.

Then the department indicated that for the purpose of calculating personal income tax, bonuses are incentive payments, and not remuneration for the performance of labor duties. That is, they do not relate to income in the form of wages. Therefore, personal income tax from them must be withheld and transferred not at the end of the month in which the premium was accrued, but immediately upon its payment (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

Now, officials have considered the general rules, without specifics on the types of bonuses and the date of payment. But they gave similar explanations, although they gave fewer arguments.

As a result, personal income tax from any premiums is safer to transfer to the budget (clause 1 clause 1 article 223 and clause 6 article 226 of the Tax Code of the Russian Federation):

- when paying a bonus from cash received for this at the bank - on the day the funds are withdrawn from the current account;

- when paying a bonus from cash proceeds received by the cash desk from the sale of goods, works or services, - on the next day after its payment to the employee;

- for non-cash payments - on the day the bonus is transferred to a bank card or employee's account.

To avoid problems, you can pay bonuses only together with the final salary calculation. It is advisable to prescribe such a condition in the regulation on remuneration, internal labor regulations or employment contracts.

Then it does not matter whether the tax authorities consider the bonus part of the salary or recognize it as an independent payment. The organization will determine personal income tax from the entire amount paid and transfer it to the budget in one payment order.

If you did not find the information you need on this page, try using the site search:

Basic principles of work in the PRO100 program

The method of operation depends on the task set by the user when working in the PRO100 program. We will create a kitchen project from library elements, with the addition of MDF facade textures, using materials for wall and floor decoration, and set lighting in the virtual room. Familiarization with the appearance and functionality of the program allows you to create a project as quickly as possible if you have site libraries.

Program interface

When you first start the program, four icons are available, each of which symbolizes the way you work with the program:

* New project - allows you to start working on creating a new project;

*Open project - opens a standard window for opening a previously saved document to continue working on an already started and saved project;

*Template - allows you to create a project using standard templates available in the program;

*Last opened - opens the last project the user worked on. (Fig. 1)

Click on the New Project icon to start working with the program - the Project Properties window (Fig. 2) will open, where you need to fill out the form by entering the project number, the names of the customer and the designer.

Press the OK button to continue working - the Project Properties window will close and the Room Properties window will open (Fig. 3).

In the numeric fields Length, Width and Height, using the counter buttons, enter the dimensions of the room in which the furniture will be placed, and press the OK button - the window will close and the editor window will open (Fig. 4).

Along with the main window of the program, at the first start, the additional Library window is automatically loaded, located in the right part of the PRO100 window. The main window of the program is divided into four main parts.

*Menu - contains all the commands and settings of the program and is located immediately below the window title.

*Toolbar - provides efficient work by providing quick access to the most useful commands, which are selected by clicking on the appropriate button. To find out the function of the button, you need to move the mouse pointer over it - a tooltip will appear in a second.

*Workspace - a virtual room in which you can create furniture and design the interior.

Deduction code 115 in personal income tax certificate 2

The red grid defines the limits of the room in 3D space.

*Status bar - shows the necessary technical information: mouse pointer coordinates, element dimensions, tooltips, etc. In the right part of the window there is an additional Library window, in which all available components are selected, located on the Furniture, Elements, Materials and Other tabs.

The Furniture tab contains sketches of furniture items, the Elements tab contains sketches of interior items, accessories, kitchen equipment and much more. The Materials tab has a rich collection of floor sketches, textures, and a wide variety of materials in various textures and colors. The Other tab contains components that do not fit into any of the above categories.

All components of the library are divided into folders with a generalized group name.

To select a component in the library, you must go to the appropriate tab and click on the folder of the group of materials or elements, and then select the required component in the group folder.

Toolbars

Consider toolbars. As in any program with a window interface, panels in PRO100 can be hidden or moved using the panel management command View, Toolbars (Fig. 5).

There are five toolbars in the menu: Standard, View, Toolbox, Properties, Move/Align. To display the panel in the program window, check the box next to its name. If the panel is not needed, then you need to uncheck the corresponding box.

The Standard panel is located immediately below the main menu of the program (see Fig. 4) and contains tools inherent in programs running under the Windows operating system, as well as original buttons available only in this application:

*New - opens a new project;

*Open - loads a previously saved project into the working window of the program;

*Save - allows you to save the current project;

*Project Properties - opens the Project Properties window, in which you can edit project data, such as the name of the customer and contractor, the dates of creation and end of the project, and more;

*Print - prints documents created in the program;

* Print Preview - allows you to preview the future document and its appearance after printing before printing;

*Delete, Cut, Copy, Paste - buttons for standard actions;

*Undo/Redo - cancels an action or redoes a canceled action;

*Properties - opens the properties window of the selected object;

*Libraries of furniture, Libraries of materials - open the corresponding libraries;

*Structure, Price list, Reports and calculations - allow you to work with documentation and specifications on order;

*Configuration - opens a settings window where you can customize the appearance, specify folders for storing libraries, set up automatic project saving at specified intervals.

Directly below the Standard panel is the View panel (Fig. 6), which allows you to edit the representation of objects in the project.

The View panel contains the following buttons:

* Wireframe - displays only the wireframe of the object;

*Sketch - allows you to present the object in the form of a sketch;

*Colors - shows the color of the object;

*Textures - reflects the texture of the object;

*Contours - displays only the contours;

* Translucent - makes the object translucent;

* Shading - allows you to add shadows to the object;

* Smoothing edges - rounds, smoothes the edges;

* Photorealistic display - when adding a light source, it allows you to create a realistic picture of the light falling from the light source;

*Labels - represents an object in the project along with its labels according to the classification in the library of materials and elements;

*Dimensions - displays the dimensions of the room and installed furniture on the drawing;

* Grid - makes the grid in the workspace of the program available for viewing or removes it;

*Snap to grid - snaps objects to the grid;

*Auto-centering - enables automatic centering;

*Centering - centers one object;

*Zoom bar - contains the Zoom In, Zoom Out buttons and a drop-down list of zooms.

Above the View panel is the Properties panel (Fig. 7).

Above the View panel is the Properties panel (Fig. 7).

The Properties panel contains the following buttons:

*Select all - selects the volume occupied by objects;

*Expand Selection, Select Inside, Select Hidden - allow you to apply various options for selecting objects;

*Group, Ungroup - groups objects that behave as a whole, and also performs the opposite effect;

*Rotate 90° counterclockwise and Rotate 90° clockwise rotate the object 90°;

*Rotation - opens the Rotation window, in which you can set the rotation, that is, specify the axis of rotation and angle;

*Move - opens the Move window, in which the move is configured, that is, the axis and distance are selected;

* Flip - flips the object

* Cover with a surface - covers the selected object with a surface, automatically loading the selected element into the workspace;

*Center - aligns to the center.

Next to the Properties panel is the Move/Align toolbar (Fig. 8).

Next to the Properties panel is the Move/Align toolbar (Fig. 8).

The panel contains buttons that simplify the placement of selected objects in the working area of the program window and help to correctly determine the location of objects: Move Left, Move Right, Move Up, Move Down, Move Forward, Move Back. Button names clearly indicate their functional purpose.

Create your own project

To do this, follow these steps:

1. Launch the application and click the New Project icon in the Welcome window to open the Project Properties window.

2. Enter all the necessary data about the project and click the OK button - the Room Properties window will open.

3. In the numeric fields Length, Width, Height, use the counter buttons to enter the dimensions of the room - 5000, 4000 and 2700 - and press the OK button - the window will close and the editor window will appear.

Let's create a kitchen project from library elements, with the addition of MDF facade textures, using materials for wall and floor decoration, and adding lighting to the virtual room.

1. Go to the Furniture tab in the Kitchens folder of the additional Library window — the window will display the available options for kitchen furniture objects.

2. Double-click on the object you like, for example, the bottom cabinet - the object will be added to the working area of the program window (Fig. 9).

3. To determine the correct location of the object in the room, you can use the wide range of features of the program. Select an object by clicking on it with the mouse button - the object will change color and be highlighted with blue lines with selection markers - black squares.

- ADVICE

If you need to quickly select all elements in a certain rectangular area, then you can apply multiple selection by moving the mouse pointer to the empty space of the work area and holding down the Shift key and the mouse button, stretch the selection area. All elements within the stretched rectangle will be selected.

4. Bring the mouse pointer to the selection marker - the pointer will change its appearance.

5. Press the mouse button without releasing it, drag the marker to the side and release the mouse button - the size of the object will change. So you can modify the dimensions of the furniture in the editor.

6. Use the Move Left, Move Right, Move Up, Move Down, Move Forward, or Move Back buttons on the Move/Align toolbar to position the object in the desired position in the room.

For greater clarity and consolidation of the progress made, you should add more objects to the project and arrange them using the Move / Align toolbar buttons - all cabinets will line up along the wall. To turn one of the cabinets to another wall, you need to do the following (Fig. 10).

1. Select a cabinet by clicking on it with the mouse button in the program workspace.

2. Click the Rotate 90° counterclockwise or Rotate 90° clockwise button on the Properties toolbar to position the cabinet as desired.

3. Use the Move/Align toolbar buttons to move the cabinet to the wall where you want to install it.

- ADVICE

In a situation where overlapping elements are needed, select the element and start moving or resizing it, press and hold Shift: other objects and walls become "transparent" for the selected object. An object that overlaps with a selection is displayed in red as long as the first one remains selected.

4. Add all the necessary kitchen components from the Furniture and Elements libraries (Fig. 11).

5. Go to the additional Library window on the Elements tab and double-click on the Doors Windows folder to select one of the elements.

6. Click on the door you like, select it and drag it to the working area of the program window, placing it in the right place on the wall (Fig. 12).

Use the Move/Align toolbar buttons to position the door correctly.

Having a group of objects in the room, you can get acquainted with the viewing modes of the project being created.

View modes

At the bottom of the PRO100 program window, above the status bar, there are tabs that switch the view mode: Perspective, Axonometry, Plan, North Wall, West Wall, South Wall and East Wall. Clicking on a tab name switches to the corresponding view mode. The rules for reorienting the virtual workspace are the same in all view modes. If you click on the Perspective tab, the window with the created project will look something like the one shown in Fig. 13.

You can rotate a virtual room and change perspective only in Perspective mode. Place the mouse pointer on a wall or space not occupied by a virtual room in the workspace, and while holding down the mouse button, move the pointer in the direction of the wall you want to see. During rotation, the mouse pointer changes its appearance.

- ADVICE

To control the viewing angle in the Perspective mode, hold down the Shift button and the left mouse button at the same time, move the pointer into the work area space and zoom in or out of the editor work area.

Perspective is the most used viewing mode, providing a three-dimensional display of the project. According to the rules of perspective, elements that are farther from the user are displayed smaller. You can rotate and increase or decrease the perspective. To view the project in Perspective mode, you need to click on the tab of the same name at the bottom of the window.

If you click on the Axonometry tab at the bottom of the program window, the appearance of the editor window and workspace will change according to the properties of the tab.

If you click on the Axonometry tab at the bottom of the program window, the appearance of the editor window and workspace will change according to the properties of the tab.

In Axonometry and orthogonal projections, rotation is not possible, so similar actions will move the image in the workspace. The scroll bars at the bottom and right of the work area duplicate this functionality.

To zoom in or out on an image, follow these steps:

1. Move the mouse pointer to a wall or space not occupied by a virtual room in the workspace.

2. While holding down the mouse button, move the pointer up to zoom in or down to zoom out.

In Axonometry and Orthographic Projections, you can also use the Zoom in/Zoom out menu items of the View menu or similar buttons on the View toolbar.

You can also enlarge the image so that the desired element or group remains in the center of the work area, which is done using the Center and Auto Center buttons on the View toolbar.

Axonometry is an axonometric projection of the project, in which rotation is impossible, and the viewing angle is always 45 °.

Orthographic projections - Plan (Fig. 14), North wall, East wall, South wall, West wall - the result of designing the contents of the project into four pairs of perpendicular walls and a floor.

It is not possible to rotate a virtual room in orthogonal projection, and the viewing angle here is always 90° to the selected wall. In these projections, you can use the Dimensions button on the View toolbar. If you click the Dimensions button, then the dimension lines with the applied dimensions will be displayed in the working area of the window. Dimensions are calculated automatically, focusing on the initially specified dimensions of the room and interior items, which is very convenient.

It is not possible to rotate a virtual room in orthogonal projection, and the viewing angle here is always 90° to the selected wall. In these projections, you can use the Dimensions button on the View toolbar. If you click the Dimensions button, then the dimension lines with the applied dimensions will be displayed in the working area of the window. Dimensions are calculated automatically, focusing on the initially specified dimensions of the room and interior items, which is very convenient.

- ADVICE

For convenience, when arranging furniture objects, you can use different viewing modes by switching to the Axonometry, Plan and others tabs. To keep the desired element or group in the center of the workspace in the Perspective view mode, use the Center button for selected elements.

Now let's start finishing the room and perform a "repair" of the room: place wallpaper on the walls, cover the floor with parquet, add lighting by doing the following:

1. In the additional Library window, go to the Materials tab and select the Coatings folder by double-clicking the mouse button to open it.

2. In the folder that opens, select the Gender folder by double-clicking on it with the mouse button. The folder contains additional folders with floor covering elements: Parquet, Lenolum and Tiles. Select a folder, for example Parquet, and open it by double-clicking the mouse button.

3. Click on the texture you like, select it and drag it to the floor image in the working area of the program window - the floor will be tiled with the selected texture.

4. In the additional Library window, double-click on the folder icon with an arrow to go back two steps in the library directory, that is, return to viewing the Walls folder.

5. Double click on the Walls folder. The folder contains additional folders with wall covering elements: Wallpaper, Tile and Other.

6. Double-click on the Tile folder, click on the tile texture you like, select it and drag it to the wall in the working area of the program window - the wall will be filled with the selected one. All walls are filled in the same way (Fig. 15).

Having arranged all the pieces of furniture, you can change the material from which the furniture is made, the door, the textures of the MDF facades by doing the following:

Having arranged all the pieces of furniture, you can change the material from which the furniture is made, the door, the textures of the MDF facades by doing the following:

1. Select a piece of furniture by clicking on it with the mouse button.

2. On the Materials tab of the additional Library window, open the Wood folder and select a texture for the furniture object by dragging it from the Library window onto the object. Perform this action for all wooden furniture objects, assigning the same or different textures.

- ADVICE

One way to select a material for elements is to drag and drop the material while holding down the Shift button on the selected element, causing all elements in the project that previously had the same material as the element to also change their material.

3. Go to the Materials tab in the Facades folder and select the MDF texture according to the dimensions for a specific kitchen facade.

4. On the Materials tab, go to the Tabletops folder and select a texture for the tabletops by selecting it and dragging it onto the surface with the mouse button (Fig. 16).

After adding all the necessary items from the Library window, place lighting in the project by following these steps.

After adding all the necessary items from the Library window, place lighting in the project by following these steps.

1. On the Elements tab of the additional Library window, select the Lighting folder by double-clicking on it with the mouse button (the folder contains various lighting objects).

2. Double-click on the required light fixture icon — the fixture selected with markers will be added to the workspace of the project window.

3. Move the luminaire to the planned location by dragging it with the mouse button and orienting it in space using the Object Properties window, Position tab. Similarly, add the required number of lighting fixtures and 3D models.

4. Click the Photorealistic display button on the View toolbar — after processing the data by the PRO100 program, an image of a virtual room will be obtained (Fig. 17).

5.Go to the Reports window, the Calculations tab displays the cost price of the product if there are program price list files for the used site libraries.

Personal income tax deduction codes in 2015–2016: table

To make it easier for accountants who keep records of employee income, personal income tax withheld and transferred to the budget, and who carry out the procedure for calculating tax benefits on income tax from employees, we have placed a valid table in our article. deduction codes on personal income tax, which you can download and study.

The correct display of the codes will help to subsequently avoid errors when compiling 2-NDFL certificates, which are a reporting form for tax agents, on the one hand, and a document that confirms the income of citizens.

Tax agents, at the request of their employees and upon receipt of supporting documents, take into account standard tax deductions when calculating tax.

In addition to the standard ones at the place of work, it is now possible to receive other personal income tax benefits, including social ones.

Classification of tax deductions in the code table

The table of deduction codes for the purpose of reducing the tax base for personal income tax (IT) includes the following categories of deductions provided for by the Tax Code of the Russian Federation:

- Standard. Currently, codes 104, 105, 114–125 are in force in accordance with Art. 218 of the Tax Code of the Russian Federation.

- Social. Codes 320, 321, 324-328 are used, applied in accordance with Art. 219 of the Tax Code of the Russian Federation.

- Property. According to codes 311 and 312 on the basis of Art. 220 of the Tax Code of the Russian Federation.

- Professional. Codes 403–405 are used in accordance with Art. 221 of the Tax Code of the Russian Federation.

- Investment. Codes 617, 618 and 620 are provided for them (Article 219.1 of the Tax Code of the Russian Federation).

In addition, a number of other articles provide for benefits or a special procedure for taxing certain types of income of individuals.

Since this article is focused on personal income tax agents, information on deductions applied on the basis of Art. 217 of the Tax Code of the Russian Federation, for which codes from 501 to 510 are assigned.

What changes have affected codes for tax deductions since 2015

Along with the abolition of obsolete codes, the Federal Tax Service of Russia introduced new ones, replaced a number of old ones tax deduction codes, and also corrected the decoding for some deductions.

In general, the structure of the table remained the same, although an innovation in the form of investment deductions was added to it.

Which codes and what changes have undergone are shown in the table below.

Code change table

|

Excluded |

New codes |

Replacing one code with another |

Description changed |

|

Standard deductions |

|||

|

Transfer from operations with the Central Bank and FISS to REPO operations with the Central Bank |

|||

|

REPO transactions with the Central Bank |

|||

|

property deductions |

|||

|

Social deductions |

|||

|

320, 321, 324–328 |

|||

|

Non-taxable income |

|||

|

Actually 607 by 510 |

|||

|

Investment deductions |

|||

Main sections of the updated table of tax deductions

The 13 sections of the table of deduction codes put into effect since the end of 2015 is a document structured by types of tax preferences.

It is a guideline for taxpayers and tax agents for the correct choice of the digital code assigned to a particular benefit provided for by tax legislation when filling out 2-NDFL certificates on income received by individuals for the period from November 29, 2015.

The table includes sections that include the deductions presented below.

Table of sections of tax deduction codes

|

Deduction name |

Number of sections set aside for deduction |

Assigned code numbers |

Article of the Tax Code of the Russian Federation, which is the basis for the deduction |

|

Standard |

104,105, 114–125 |

||

|

Decreasing base |

201–203, 205–207, 209, 210 |

||

|

Property |

|||

|

Social |

Signed 2 p. 1 art. 219 |

||

|

Signed 3 p. 1 art. 219 |

|||

|

Signed 4 p. 1 art. 219 |

|||

|

Signed 5 p. 1 art. 219 |

|||

|

Professional |

|||

|

Non-taxable income |

|||

|

Reduce the base |

|||

|

Investment |

|||

Who applies the deduction code 104 in the 2-NDFL certificate

As mentioned above, codes 104 and 105 reflect benefits for categories of persons who have special merits to the Fatherland or who have this benefit for other reasons.

Tax deduction under code 104 monthly reduces the taxable base for ND for a specific person from the list below by 500 rubles. Among them:

- Heroes of the USSR and Russia.

- WWII participants.

- Blockade of Leningrad during the Second World War.

- Freelancers who took part in defensive activities in a number of cities during the Second World War.

- Persons who during the Second World War were prisoners of concentration camps and ghettos.

Among others, deductions under code 104 can be applied:

- Disabled people of the first 2 groups and persons who have been disabled since childhood.

- Persons who have been exposed to radiation in accidents involving radioactive releases.

- Individuals who have become bone marrow donors in the name of saving other people.

- Persons evacuated from exclusion zones who were exposed to radioactive contamination in different years.

- Other persons listed in sub. 2 p. 1 art. 218 of the Tax Code of the Russian Federation.

Who is entitled to a deduction with code 105 in the 2-NDFL certificate

Tax deduction with code 105 is provided in the amount of 3,000 rubles. And if code 104 is used mainly by those who have been exposed to radioactive exposure, then the code 105 deduction is granted to persons:

- who directly took part in the liquidation of the consequences of the accidents at the Chernobyl nuclear power plant and the Mayak production facility, who were at the epicenter of events and in the exclusion zones, including civilians and military personnel called up for training;

- other persons who in different years participated in various kinds of nuclear tests, listed in subpara. 1 p. 1 art. 218 of the Tax Code of the Russian Federation.

In addition, these benefits are available to:

- persons who have suffered radiation sickness or become disabled as a result of these global man-made disasters;

- disabled veterans of the Great Patriotic War and persons who became disabled due to injuries or concussions while defending the USSR or Russia;

- other persons named in Art. 218.

Deduction codes 114, 118 and 122 in the 2-NDFL certificate

Tax deduction under code 114 is provided to individuals as part of the standard deductions for the first child in the family until he reaches the age of majority or 24 years old if he receives full-time education for a fee (upon presentation of a certificate from the educational institution).

In addition to the parents themselves, this deduction is available to persons who have an adopted child, who have taken custody or guardianship of him or who have adopted him.

The deduction for codes 118 and 122 is provided for the same reasons in a double amount (in 2015–2016 - 2,800 rubles):

- according to code 118 - to a single parent (adoptive parent, trustee and guardian (UPO));

- 122 - to one of the spouses in case of refusal of the other parent from the deduction.

Deduction codes 115, 119 and 123

By analogy with codes 114, 118 and 122 and in the same amount, deductions are due if there is a 2nd child in the family. The terms of the deduction fully coincide with the terms of its provision by the codes described in the previous section.

Deduction codes 116, 120 and 124

The 3rd and all other children are entitled to deductions similar to those described in the previous 2 sections for children in accordance with the codes:

- 116 - for the 3rd, 4th, etc. child (in the amount of 3,000 rubles);

- 120 - to the parent (UPO), who is the only one and 124 - in case of refusal of the 2nd parent from tax benefits (in double the amount - 6,000 rubles).

Deduction codes for disabled children (117, 121 and 125)

If the family has a disabled child (confirmation is required in the form of a certificate with the specified validity period), then the following deductions are relied on until they reach the age of 18, and for paid full-time education - up to 24 years:

- by code 117 - 12,000 rubles. not only to parents, but also to the UPR;

- 121 - for single parents and UPR, 125 - if only one of the spouses receives a deduction (the amount of the deduction is also doubled and is equal to 24,000 rubles in such situations).

Property Expenses Deduction Codes

Currently, after documentary verification and obtaining approval from the tax authority, it is allowed to take into account at the place of work in full the benefits for personal income tax related to:

- with the acquisition of housing or its construction (code 311);

- on interest paid on mortgages (code 312).

Numerical designations of social tax deductions

Starting this year, social tax deductions related to tuition fees (up to the age of 24) and treatment (if for children, then up to the age of 18) can also be taken into account with the tax agent, without waiting for the end of the year in which they were received. It is enough to present documents confirming these expenses to the tax office for verification, and after a positive response from the tax authorities in the form of a notification, the deduction can be used at the place of work.

The digital codes of social deductions and their brief descriptions are as follows:

- For training (in the amount of expenses not more than 50,000 rubles):

- 320 - for yourself, brother and / or sister.

- 321 - for children (their own and / or in relation to whom the payer is UPR).

- For treatment:

- 324 - one's own, as well as immediate family members;

- 325 - for the transferred VHI contributions for themselves and family members;

- 326 is expensive.

- Others:

- 327 - for paid contributions to the NPF or voluntary life insurance contracts for one's own and close relatives;

- 328 - expenses for additional savings contributions to the pension fund.

Deductions on non-taxable income received from a withholding agent

For a number of deductions, which, in accordance with Art. 217 of the Tax Code of the Russian Federation are not taxed in whole or in part, in the table of tax deduction codes for personal income tax since 2015, codes from 501 to 510 are highlighted.

Codes 501 to 506 are reserved for deductions related to receiving gifts, prizes, winnings, as well as material assistance and reimbursement for the cost of purchased medicines.

NOTE! The amount of deductions for codes from 501 to 506 is limited to 4,000 rubles. and is applied for each ground listed in paragraph 28 of Art. 217 of the Tax Code of the Russian Federation, separately.

That is, if an employee received a gift in the amount of 4,000 rubles, for the same tax period he can also claim a deduction for medicines actually paid for by him for the same amount.

The deduction under code 508 at birth in the family of a child is limited to the amount of 50,000 rubles.

The deduction under code 510 in connection with the payment of additional insurance premiums for an employee on the funded part of the pension is limited to 12,000 rubles.

Deduction code 501 in the 2-NDFL certificate

Most often, employers reward their employees on the occasion of various holidays or anniversaries with gifts, which provide for a tax deduction for ND under code 501 within an amount not exceeding 4,000 rubles.

Gifts for this amount are not subject to personal income tax. If the value of the gift is more than the tax-free limit, then the entire amount in excess of it is taxed at a rate of 13%, which is reflected in the 2-NDFL certificate.

NOTE! The gift can also be made in cash. In this case, a donation agreement must be drawn up between the donor employer and the employee being gifted so that this amount is not counted by the regulatory authorities as a cash bonus.

Deduction code 503

Financial assistance not subject to income tax within the framework of 4,000 rubles. per year per 1 employee, is the most often used by employers hidden form of employee incentives, which makes it possible not to withhold ND by showing deduction code 503 in 2-NDFL certificates.

Amounts of financial assistance in excess of this established limit are subject to taxation in full, if it is provided not on the occasion of the birth of a child and is not related to the death of an employee's family member.

Deduction code 2012

This deduction code is often found in search queries on the Internet. In fact, there is no such tax deduction code. Code 2012 refers to the income code of individuals on paid vacation pay.

Any accountant must be familiar with tax deduction codes in order to correctly reflect them in the 2-NDFL certificate. And do not forget that the right to apply any tax deductions must be documented.

The deduction codes are indicated in the 2-NDFL certificate. Each deduction has its own code. For what deductions code 114 is used, read the article.

Deduction code in the 2-NDFL certificate

To confirm the amount of income that a person received for a particular period (usually for a year), companies annually submit a certificate in the form of 2-NDFL.

During the year, an employee can contact the accounting department to obtain a 2-NDFL certificate, for example, for a bank. The accountant is obliged to issue it to the employee.

When compiling a certificate in the form 2-NDFL, the Procedure is used, which is approved by order of the Federal Tax Service of October 30, 2015 No. ММВ-7-11/485. Fill in the reference indicators on the basis of information from the tax accounting registers for personal income tax.

The deduction codes are indicated in the table of section 3 of the 2-NDFL form. Each deduction has its own code

You can fill in the deduction codes for free in 2-NDFL for free in the Simplified 24/7 program.

Tax deduction code 114: what is it

Article 218 of the Tax Code of the Russian Federation entitles children to monthly deductions in a fixed amount.

Thus, the deduction for the first child under the age of 18, as well as for each full-time student, graduate student, intern, intern, student, cadet under the age of 24 is 1,400 rubles. per month.

It is provided by:

- each of the parents (including divorced, legally or civilly married, never married);

- spouse (stepfather) or wife (stepmother) of the parent;

- adoptive parent.

Until 2017, code 114 was used to reflect such a deduction in 2-personal income tax. After 2017, this code became invalid. Code 126 is used instead (Appendix 2 to the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/387 (as amended by the orders of the Federal Tax Service of Russia dated November 22, 2016 No. ММВ-7-11/633 and dated October 24, 2017 No. ММВ- 7-11/820).