Checking the VAT return. Completing the income tax return Line 340 of the income tax return

The procedure for filling out an income tax return depends on the method of paying advance payments. In total, there are three ways to pay advances on income tax:

- quarterly;

- monthly, based on actual profit;

- monthly, based on the profit received in the previous quarter.

Not everyone can transfer the tax quarterly. Firstly, there is a certain list of organizational structures that pay advances only on a quarterly basis. They include budgetary institutions, representative offices of foreign companies, individual NGOs, etc.

Secondly, only those organizations whose income for the previous four quarters did not exceed an average of 15,000,000 rubles are entitled to pay advances on a quarterly basis. for every quarter.

Other organizations pay tax monthly. By the way, newly created organizations also have the right to pay advance payments on a quarterly basis, but only up to a certain point in terms of monthly or quarterly income indicators.

Who must report income tax

It is necessary to fill out the declaration from the title page and attachments of sheet 02. Next, sheets 03-09 should be filled out if the organization has carried out such operations.

After the necessary sections are completed, you should proceed to filling out sheet 02 "Calculation of corporate income tax" and section 1.

Let's follow this order.

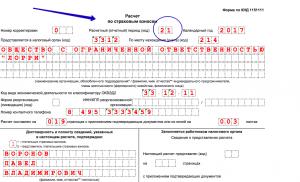

Filling out the title page

When filling out the title page, the TIN and KPP of the organization are indicated in its upper part. These data can be taken from the registration documents. They are in extracts from the Unified State Register of Legal Entities and documents from statistics. One important point that you should pay attention to: the largest taxpayer indicates on the title page of the checkpoint, which was assigned by the inter-district inspection.

When submitting the primary declaration, in the "Adjustment number" field, enter "0". If the organization clarifies the income tax return, then the number of the adjustment is indicated, starting with "1" and further, depending on how many times the data is adjusted.

In the "Tax (reporting) period (code)" field, indicate the code of the tax (reporting) period for which the declaration is being submitted. For our case, this is 9 months, or for the period from January to September. Codes 33 and 43 respectively.

The income tax return is submitted at the place of registration of the organization. To do this, it is necessary to indicate in the declaration the code of the tax authority in whose territory the company is registered. Forgot your code? Then use the tax service.

In the line "at the location (accounting) (code)", enter the code, depending on who the organization submits the declaration as. So, for example, enter code 214 - "At the location of a Russian organization that is not the largest taxpayer."

Particular attention should be paid to the block of lines dedicated to the reorganization or liquidation. The fact is that this data can be filled in by the successor or the liquidated organization.

So, for example, if the successor submits a declaration for the merged company, then these lines are filled with data on the company that was merged (reorganized). In any case, the TIN and KPP of the successor organization are indicated at the top of the title page.

The reorganization codes can be found in Appendix 1 to the Procedure approved by Order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/572.

An example of filling out the title page of the income tax declaration (fragment)

Completing attachments to sheet 02

In practice, it is customary to start filling out the declaration from Appendix No. 3 to sheet 02. After all, the data from the specified application is necessary for the correct reflection of information in Appendix No. 1 and 2 to sheet 02. The author should remember that this application reflects, in particular, such operations, as the sale of depreciable property or transactions under an assignment agreement.

Appendix No. 1 to sheet 02 contains information on the organization's income received for the reporting (tax period). Lines 011-014 are for sales proceeds, depending on what kind of operations the entity is engaged in. On line 010 of Appendix No. 1 to sheet 02, the total amount of income from sales should be indicated.

The data of this line also fall into line 040. Lines 101-106 are intended to reflect non-operating income.

An example of filling out Appendix No. 1 to sheet 02, a fragment of the declaration of an organization engaged in wholesale sales

Appendix 2 to sheet 02 reflects the costs associated with production and sales, non-operating expenses and losses. In this case, special attention should be paid to tax accounting data, operations, the general principles of which are disclosed in the accounting policy.

So, for example, lines 010-030 reflect direct costs. And lines 040-041 reflect indirect costs.

By the way, lines 080-110 are filled in based on the data in Appendix No. 3 to sheet 02. That is why filling out the declaration begins with the above auxiliary section.

Lines 200-206 reflect non-operating expenses.

Have you adjusted the base of previous years in the current period based on the provisions of Article 54 of the Tax Code of the Russian Federation? Then fill in lines 400-403. The lines should reflect the amount of overstatement of the tax base in past periods. It is by this indicator that the base of the reporting period decreases.

Appendix No. 4 to sheet 02 reflects the tax base minus losses from previous years. However, the application is included in the declaration only for the first quarter and for the tax period as a whole. Do not fill it out for 9 months.

Appendix No. 5 to sheet 02 is filled out by organizations that have separate divisions. The procedure for filling out an income tax return in this case has a number of specific features. In particular, they are related to the calculation of the share of the taxable base attributable to the parent organization and division and the situation when the division is liquidated during the tax period.

Annexes No. 6, 6a and 6b to sheet 02 must be completed only by members of consolidated groups.

Filling out sheets 03-09

The filling of sheets 03-09 is determined by the operations that are indicated in them.

Sheet 03 of the income tax return is filled out only by tax agents who pay dividends and interest on state and municipal securities.

And sheet 04 is filled out if the organization receives, for example, dividends from equity participation in Russian and foreign organizations.

Sheet 05 serves as the basis for recording transactions with securities or financial instruments of forward transactions.

Sheet 06 is intended for non-state pension funds. The procedure for filling out the sheet has a complex structure and largely depends on the application of the norms of the Tax legislation.

Sheet 07 is filled in by target groups - non-profit organizations and other organizations that have targeted revenues (targeted financing) of HOA organizations, for example.

And finally, Sheet 09 and Appendix 1 are filled in by organizations that are controlling persons in relation to a controlled foreign company (CFC).

After the necessary auxiliary sections and individual sheets of the declaration are filled out, you should proceed to filling out sheet 02 itself.

Filling out sheet 02

Sheet 02 is filled out on the basis of the data specified in the annexes to it.

Lines 010-050 indicate income and expenses, on the basis of which the profit or loss is calculated.

For example, line 010 is filled in on the basis of line 040 of Appendix 1 to sheet 02. The amount of non-operating income from line 100 of Appendix 1 to sheet 02 is transferred to line 020.

Lines 030 and 040 of Sheet 02 are reflected on the basis of the data in Appendix No. 2 to Sheet 02.

On line 060, profit or loss is calculated using a simple formula:

page 060 = page 010 + page 020 – page 030 – page 040 + page 050

An example of filling out sheet 02. A fragment of filling in data on income, expenses and results

By the way, if the result is negative, that is, the organization has suffered a loss, line 060 indicates an indicator with a minus!

On line 100, the tax base for income tax is calculated according to the formula specified in the declaration. The indicator of the base for calculating the tax is indicated on line 120.

On line 140, you should set the income tax rate (20%), which is divided into federal (3%) and regional (17%). This is the general regional rate, the value of which the region can reduce.

An example of filling out sheet 02. A fragment of filling in data at a rate

An example of filling out sheet 02. A fragment of filling in data on tax calculation

So, lines 210-230 indicate advances for the reporting period. In our case, they are:

- 9 months of 2017;

- January-September 2017.

On lines 210-230 of sheet 02 of the income tax declaration, only accrued advance payments are reflected. So, for example, if an organization transfers monthly advance payments based on the profit of the previous quarter, these lines for 9 months indicate the sum of lines 180 and 290 of sheet 02 of the declaration for the half year of the current 2017.

Organizations that pay tax on a monthly basis, based on the actual profits, indicate in lines 210-230 the amount of advance payments on the declaration for the previous reporting period (January-August lines 180-200 of the previous declaration).

It may also happen that the amount of accrued advance payments for the previous period is greater than the amount of tax calculated at the end of the next reporting period. Then an overpayment is added, which must be reflected in lines 280-281 of sheet 02.

Lines 240-260 of sheet 02 are intended to reflect tax paid outside of Russia. The procedure for offsetting the specified tax in the presence of a loss in the current period and the timing of the transfer have their own characteristics.

Lines 265-267 reflect the trading fee. This information is relevant for business representatives from the capital.

Lines 270-281 of sheet 02 should indicate the tax to be paid or reduced. Take into account accrued advance payments.

Lines 290-340 reflect advances for the next quarter. This line is filled in by an organization that pays income tax on a monthly basis, based on the profit received in the previous quarter. These lines should reflect the advance payments that the organization must transfer during the next quarter.

By the way, in lines 320-340, show the amount of advance payments for the first quarter of the next 2018.

The final amount of tax payable or deductible should be reflected in section 1. It will not be difficult to fill it out if you have all the necessary information.

Liability for failure to submit a declaration

As a general rule, if an organization submits declarations out of time, then this is an offense (Article 106 of the Tax Code of the Russian Federation, Article 2.1 of the Code of Administrative Offenses of the Russian Federation).

The penalty under Article 119 of the Tax Code of the Russian Federation is 5 percent of the amount of tax that should have been paid (paid) on the basis of the declaration, but was not transferred within the prescribed period.

However, it is impossible to fine an organization under Article 119 of the Tax Code of the Russian Federation for late submission of an income tax return for the reporting period. The thing is that during the year the organization transfers advances, and not the tax itself. Therefore, the provisions of Article 119 of the Tax Code of the Russian Federation cannot be applied in such cases. But a fine can be applied under Article 126 of the Tax Code of the Russian Federation.

Recall! For error-free preparation and submission of an income tax return, use the My Business online service. The service automatically generates reports, checks them and sends them electronically. You will not need to personally visit the tax office, which will undoubtedly save not only time, but also nerves.You can get free access to the service right now at the link.

In 2018, filling in line 041 of the income tax return causes a lot of ambiguity, so we made detailed instructions on what taxes to reflect on line 041 of Appendix 2 to sheet 02 of the income tax return, and when the accountant reflects insurance premiums in the declaration.

Line 041 of Appendix 2 to sheet 02 of the income tax return

The profit declaration form was approved by order of the Federal Tax Service dated October 19, 2016 No. ММВ-7-3/572, so profit reports in 2018 must be done as in the previous year. The changes, in particular, affected line 041 of Appendix 2 to Sheet 2. Now it must include insurance premium payments - everything except those paid to the FSS (for injuries).

Important! During inspections, the tax authorities demand to explain why the “profitable” revenue does not match the VAT base. We considered when inconsistencies are justified and they are easy to explain. Take advantage of

What taxes to take into account in 2018 on line 041

Line 041 of Appendix 2 of the income tax return sheet for 2018 includes the taxes referred to in paragraphs. 1 p. 1 art. 264 of the Tax Code of the Russian Federation. These are amounts paid to the state associated with the manufacture and sale of products, and therefore reduce the amount of profit. Specifically, these payments include:

- customs duties,

- property fees,

- insurance premiums.

For more information about taxes in line 041, see the table.

What taxes to reflect in line 041 |

What taxes should not be reflected in line 041 |

|---|---|

|

Property and transport tax |

income tax |

|

Land and water tax |

Contributions for environmental pollution |

|

For mining and hunting resources |

|

|

Customs duties |

All kinds of fines, penalties, fees for sanctions |

|

Insurance premiums: health insurance, pension insurance, social insurance |

Voluntary insurance and contributions for injuries |

|

Government duty |

Trading fee |

|

Recovered VAT, but only the one that you have related to other expenses |

VAT and excises that the company presented to the buyer |

Filling in line 041 of Appendix 2 to sheet 02

Filling out line 041 of Appendix 2 to sheet 2 in 2018 is not as difficult as it seems, if you know exactly which taxes and contributions to include in this column (see the table above). You must also follow the following rules:

- line 041 is intended to reflect indirect taxes in the income tax return, in particular those fees and contributions that companies take into account as other expenses (Letter of the Federal Tax Service dated 11.04.2017 No. SD-4-3 / [email protected]);

- enter the amount of accrued fees, contributions, and advances for the reporting period;

Important! Check the company's accounting policies to see if you use all the savings methods. Moreover, from January 1, 2018, the company has the right to provide additional favorable conditions. Make changes to your "account" or approve a new document.

- all data are shown on an accrual basis;

- the total amount of line 041 should be included along with other columns in line 040 - indirect taxes.

Sample line 041

To better understand what needs to be indicated in line 041 of the income tax return, we have made a small sample for you with an example.

Example. Fill in line 041

Let's take the following initial data:

* This is the amount we will enter in line 041 of Appendix 2 of sheet 2 of the income tax return for the 2nd quarter of 2018

Attention! When filling out line 041 for other reporting periods, everything is done in the same way, only the data for the corresponding period changes

If advance payments in pp. 320-340 are not reflected in the income tax return for 9 months, is it necessary to resubmit the Declaration?

Yes, if the organization has accrued monthly advances for the IV quarter of 2016 on lines 290-310 of Sheet 02 of the declaration for 9 months, and if the organization remains a payer of income tax in 2017, it is better to draw up and submit an updated declaration for 9 months. Lines 320-340 of Sheet 02 reflect advance payments for the I quarter. In the declaration for the year, lines 290-340 are not filled.

How to prepare and submit an income tax return

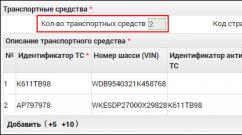

Lines 290–340 Advances for the next quarter

Calculate the advance payment to the regional budget on line 310 using the formula:

line 290, calculate by the formula:

| page 290 | = | page 300 | + | page 310 |

If the amounts turned out to be negative or equal to zero, advance payments do not need to be transferred.

In lines 320–340, show the amount of advance payments for the first quarter of the next year. These lines must be completed once a year:

- in the declaration for nine months, if the organization transfers income tax on a monthly basis from the profit received in the previous quarter;

- in the declaration for January-November, if the organization transfers income tax on a monthly basis based on actual profit, but from the next year is going to pay tax on a monthly basis based on the profit received in the previous quarter.

Do not reflect advances for the first quarter of the next year in the annual declaration. After all, the annual declaration can be submitted until March 28. And by this time, the organization must already transfer advances for January, February and March to the budget. And if you do not declare them in advance, the payments will fall into the category of "unclarified", and the accountant will have to explain himself to the tax office.

On line 330, indicate the amount of advance payments to the federal budget, on line 340 - to the regional budget.

Calculate the total amount of monthly advance payments on line 320 using the formula:

| page 320 | = | page 330 | + | page 340 |

Important: if next year the organization remains a payer of income tax, fill in lines 320-340 based on the indicators of the current year. Even if at the date of the declaration it is known that the amount of profit or the amount of tax in the first quarter of the next year will be different. In particular, it is necessary to calculate monthly advance payments for the 1st quarter based on the indicators of the current year if:

- from January 1, the organization will be entitled to pay income tax at preferential rates (for example, it will become a member of the free economic zone);

- at the end of the year, the organization will receive a loss;

- Starting January 1, reduced income tax rates will be introduced in the region.

This follows from the provisions

The tax authorities will check the correctness of filling it out using the control ratios established by the letter of the Federal Tax Service of Russia dated March 23, 2015 No. GD-4-3 / [email protected]. It is also useful for accountants to use the ratios before submitting the declaration to the tax office in order to make sure that there are no errors when filling it out.

In total, the tax authorities cited 44 ratios. In this article, we will consider only those that relate to the majority of VAT payers, as well as the ratios provided for the new sections of the declaration.

Control ratios for new sections

The tax authorities will check the correctness of filling in sections 8, 9 and annexes to them using control ratios 1.22, 1.23, 1.32-1.43. There are no control ratios for sections 10 and 11. And for section 12, one ratio 1.44 is provided. Let's consider them in more detail.

Section 8

This section displays information from the purchase book about transactions recorded for the past tax period. Recall that each entry in the purchase book corresponds to a separate page of section 8, line 180 of which shows the amount of VAT on the corresponding invoice, accepted for deduction. On the last page of section 8, line 190 is filled in, indicating in it the total amount of VAT on the purchase book to be deducted.

When checking the declaration, the tax authorities will compare the sum of the values of lines 180 of all pages of section 8 of the declaration with the indicator of line 190 on the last page of section 8 (ratio 1.32). These values must be equal. The excess of the indicator of line 190 over the sum of the values of lines 180 is evaluated in control ratios as a possible overstatement of the amount of VAT to be deducted. The word "possibly" is used here because, for example, some invoices may be omitted when transferring data to section 8 of the purchase book. In this case, the sum of lines 180 of all pages of section 8 of the declaration will be less than the total VAT amount for the purchase book, which is indicated in section 8 on line 190. But this will not lead to an overestimation of the VAT amount to be deducted. After all, the amount indicated on line 190 will be correct.

Annex 1 to Section 8

It serves to reflect information from additional sheets of the purchase book.

Line 005 of the application shows the total amount of tax from the line "Total" of the purchase book. The value of line 005 of Appendix 1 to Section 8 must be equal to the indicator indicated on line 190 of Section 8 (ratio 1.22). This is explained by the fact that these lines reflect the same value - the total amount of VAT in the purchase book. Since the correctness of the value on line 190 of section 8 has already been verified by the tax authorities (ratio 1.32), a violation of the control ratio of 1.22 will be considered an excess of the value of line 005 of Appendix 1 to section 8 over the indicator of line 190 of section 8. It indicates an overestimation of the VAT amount to be deducted. Let's explain why.

Line 005 is filled in only on the first page of Appendix 1 to Section 8. There will be as many such pages as there are entries in the additional sheet of the purchase book. On each of the pages, line 180 shows the amount of VAT on the corresponding invoice, which is accepted for deduction. On the last page of Appendix 1 to Section 8, in line 190, the total VAT for Appendix 1 to Section 8 is given. It should be equal to the sum of the values of line 005 and lines 180 of Appendix 1 to Section 8 (ratio 1.33). Therefore, if the value in line 005 is overstated, this will lead to a distortion of the indicator in line 190 of Appendix 1 to Section 8, and, therefore, to an overestimation of the VAT amount to be deducted.

Section 9

This section is intended for information from the sales book on transactions for the past tax period. Each section page corresponds to one sales book entry.

The sales value of the invoice is shown in lines 170 (sales taxed at 18%), 180 (sales taxed at 10%) and 190 (sales taxed at 0%). VAT amounts on the invoice are recorded in lines 200 (18%) and 210 (10%).

The last page of section 9 shows the totals of sales taxed at different rates: in line 230 - at a rate of 18%, in line 240 - at a rate of 10%, in line 250 - at a rate of 0%. And the total VAT values are indicated in lines 260 (18%) and 270 (10%). All these totals are taken from the sales book.

The correctness of filling in section 9 will be evidenced by the fulfillment of the following control ratios:

1) the sum of lines 170 of section 9 = line 230 of section 9 (ratio 1.34);

2) the sum of lines 180 of section 9 = line 240 of section 9 (ratio 1.35);

3) the sum of lines 190 of section 9 = line 250 of section 9 (ratio 1.36);

4) sum of lines 200 of section 9 = line 260 of section 9 (ratio 1.37);

5) the sum of lines 210 of section 9 = line 270 of section 9 (ratio 1.38).

That is, the amounts of sales and the amount of VAT on all invoices issued for transactions taxed at one rate must match the total sales value taxed at that rate and the VAT calculated from it. The correctness of these ratios is obvious.

Failure to comply with the ratios will signal to the tax authorities about a possible underestimation of the amount of VAT calculated to be paid to the budget.

Annex 1 to Section 9

Data from additional sheets of the sales book is transferred to this application.

On lines 020 (18%), 030 (10%), 040 (0%), it shows the total amounts of sales taxed at different rates from the sales book, and on lines 050 (18%) and 060 (10%) - VAT totals from the sales book. Line 070 reflects the total value of tax-exempt sales.

The values of lines 020, 030, 040, 050, 060, 070 must be equal to the similar data indicated in lines 230, 240, 250, 260, 270, 280 of section 9 (ratio 1.23).

If the values of lines 020, 030, 040, 050, 060, 070 of Appendix 1 of Section 9 are less, this will indicate an understatement of the amount of VAT payable to the budget. Let's explain in more detail.

The data of lines 020, 030, 040, 050, 060, 070 are filled in only on the first page of Appendix 1 to Section 9. There will be as many such pages as there are entries in the additional sheets of the sales book. On each page, in lines 250, 260, 270, the value of sales on an invoice is recorded, taxable at rates of 18, 10 and 0%, respectively. And on lines 280 (18%) and 290 (10%) - the amount of VAT on the invoice. On the last page of Appendix 1 to Section 9, the total data from the additional sales sheets is indicated:

- sales - in lines 310 (18%), 320 (10%), 330 (0%);

- for VAT - in lines 340 (18%), 350 (10%).

The control ratios for them look like this:

- line 310 = line 020 + sum of lines 250 of all pages of appendix 1 to section 9 (ratio 1.39);

- line 320 = line 030 + sum of lines 260 of all pages of appendix 1 to section 9 (ratio 1.40);

- line 330 = line 040 + sum of lines 270 of all pages of appendix 1 to section 9 (ratio 1.41);

- line 340 = line 050 + sum of lines 280 of all pages of appendix 1 to section 9 (ratio 1.42);

- line 350 = line 060 + sum of lines 290 of all pages of appendix 1 to section 9 (ratio 1.43).

As you can see, understating the values of lines 020, 030, 040, 050, 060, 070 will lead to an underestimation of the total data for Appendix 1 to Section 9, and hence to an underestimation of VAT payable to the budget.

Section 12

This section contains information from invoices issued by persons specified in paragraph 5 of Art. 173 of the Tax Code of the Russian Federation, namely:

- exempt from fulfilling the obligations of a VAT taxpayer;

- non-VAT taxpayers;

- VAT taxpayers when shipping goods (works, services), the sale of which is not subject to VAT.

On line 060, it shows the cost of goods (works, services) without tax, on line 070 - the amount of VAT, and on line 080 - the cost of goods (works, services) with tax.

There is one control ratio 1.44 for the section:

line 070 = line 080 - line 060.

If the left side of the equation is less than the right side, the amount of VAT payable to the budget will be underestimated.

VAT deduction on received advances

The amounts of VAT calculated by the seller from the amounts of payment, partial payment received on account of the forthcoming deliveries of goods (works, services) are deductible (clause 8 of article 171 of the Tax Code of the Russian Federation). Such a deduction is made upon shipment of goods (works, services), in payment for which an advance was received, in the amount of tax calculated from the cost of shipped goods (works performed, services rendered) (clause 6, article 172 of the Tax Code of the Russian Federation).

The amount of VAT on advances received, subject to deduction from the seller from the date of shipment of the relevant goods (performance of work, provision of services), is shown on line 170 of section 3 of the declaration.

The tax authorities will check it as follows. They will sum up the values of column 5 of lines 010, 020, 030 and 040 of section 3, which show the amounts of VAT calculated on the sale of goods (works, services) at the relevant rates, and compare the resulting value with the amount of VAT on line 170 of section 3. It must be less than or equal to the sum of the values of column 5 of lines 010, 020, 030 and 040 of section 3 (ratio 1.11). Failure to comply with this ratio will signal to the tax authorities that either the declared tax deduction is not justified, or the tax base is underestimated.

Let us show the validity of this relation on a concrete example.

Example 1

The company in the IV quarter of 2014 received advances from buyers:

1) for the supply of goods subject to VAT at a rate of 18%, in the amount of 118,000 rubles. (including VAT - 18,000 rubles);

2) for the supply of goods subject to VAT at a rate of 10%, in the amount of 110,000 rubles. (including VAT - 10,000 rubles).

VAT on advances received was paid to the budget.

In the 1st quarter of 2015, the company, on account of the received advances, shipped:

1) goods subject to VAT at a rate of 18%, in the amount of 82,600 rubles. (including VAT - 12,600 rubles);

2) goods subject to VAT at a rate of 10%, in the amount of 110,000 rubles. (including VAT - 10,000 rubles).

There were no other shipments in Q1 2015.

For part of the advance received for the supply of goods taxed at a rate of 18%, in the amount of 35,400 rubles. (118,000 rubles - - 82,600 rubles) the goods were not shipped. So, according to the provisions of paragraph 6 of Art. 172 of the Tax Code of the Russian Federation, VAT on this part of the unworked advance payment, amounting to 5400 rubles. (18,000 rubles - - 12,600 rubles), the company is not entitled to deduct.

In section 3 of the declaration for the 1st quarter of 2015, the company on line 010 in column 5 will show the amount of VAT calculated on the sale of goods at a rate of 18%, in the amount of 12,600 rubles. And on line 020 in column 5, she will write down the amount of VAT calculated on the sale of goods at a rate of 10%, in the amount of 10,000 rubles.

The sum of the values of these lines will be 22,600 rubles. (12,600 rubles + 10,000 rubles).

Based on the provisions of paragraph 6 of Art. 172 of the Tax Code of the Russian Federation, the company can deduct VAT from advances received:

1) for shipped goods subject to VAT at a rate of 18%, in the amount of 12,600 rubles;

2) for shipped goods subject to VAT at a rate of 10%, in the amount of 10,000 rubles.

Consequently, under line 170 of section 3, she will declare VAT deductible on advances received in the amount of 22,600 rubles. (12,600 rubles + 10,000 rubles).

In this case, the value on line 170 of section 3 is equal to the sum of the values of column 5 of lines 010 and 020. That is, the control ratio 1.11 is fulfilled.

Amount of VAT claimed for reimbursement

If the amount of tax deductions in the reporting period exceeds the total amount of calculated VAT, the resulting difference is subject to reimbursement (clause 2, article 173 of the Tax Code of the Russian Federation). It is shown on line 050 of section 1 of the declaration.

The tax authorities will check the correctness of filling in this line using the control ratio 1.25. It looks like this:

if Art. 050 r. 1 > 0, then:

line 190 of section 8 + (line 190 of Appendix 1 to Section 8 - line 005 of Appendix 1 to Section 8) - (line 260 of Section 9 + line 270 of Section 9) - (the sum of lines 200 and 210 of Section 9 pages, in which line 010 = 06) + (line 340 of Appendix 1 to Section 9 + line 350 of Appendix 1 to Section 9 - line 050 of Appendix 1 to Section 9 - line 060 of Appendix 1 to Section 9) - (sum of lines 280 and 290 of pages of Appendix 1 to Section 9, in which line 090 = 06) > 0.

That is, the tax authorities will first determine the total amount of VAT to be deducted. To do this, they will take the total amount of VAT deductible for the purchase book (line 190 of section 8) and add to it the amount of VAT deductible for additional sheets of the purchase book (line 190 of Appendix 1 to Section 8 - line 005 of Appendix 1 to Section 8).

The total amount of VAT deductible, the tax authorities:

- will be reduced by the total amount of accrued VAT in the sales book (line 260 of section 9 + line 270 of section 9);

- will be reduced by the amount of VAT on invoices issued as a tax agent (the sum of lines 200 and 210 of pages of section 9, in which line 010 = 06);

- will increase by the amount of VAT accrued on additional sheets of the sales book (line 340 of Appendix 1 to Section 9 + line 350 of Appendix 1 to Section 9 - line 050 of Appendix 1 to Section 9 - line 060 of Appendix 1 to Section 9);

- will be reduced by the amount of VAT on invoices issued as a tax agent, reflected in additional sheets of the sales book (the sum of lines 280 and 290 of pages of Appendix 1 to Section 9, in which line 090 = 06).

The resulting value must be greater than zero.

In our opinion, the control ratio formula 1.25 contains one error, namely: the amount of VAT accrued on additional sheets of the sales book (line 340 of Appendix 1 to Section 9 + line 350 of Appendix 1 to Section 9 - line 050 of Appendix 1 to Section 9 - line 060 of Appendix 1 to Section 9) must not be added to the total amount of VAT to be deducted, but subtracted. After all, the amount of VAT recoverable is a positive difference between the amount of tax deductions and the amount of tax calculated on transactions recognized as an object of taxation (clause 2, article 173 of the Tax Code of the Russian Federation).

Taking into account our correction, the control ratio 1.25 can be briefly described as follows:

The amount of VAT deductible on all invoices must be greater than the amount of VAT charged on all invoices.

Let us clarify the validity of our reasoning about the error in the control ratio 1.25 using a numerical example.

Example 2

In the 1st quarter of 2015, according to the sales book, the company made the following shipments:

1) in the amount of 110,000 rubles. (including VAT 18% - 10,000 rubles);

2) in the amount of 59,000 rubles. (including VAT 18% - 9000 rubles);

3) in the amount of 33,000 rubles. (including VAT 10% - 3000 rubles).

The total value of VAT according to the sales book:

At a rate of 18% - 19,000 rubles;

At a rate of 10% - 3000 rubles.

One additional sheet was compiled for the sales book for the 1st quarter of 2015, which indicated one shipment in the amount of 17,700 rubles. (including VAT 18% - 2700 rubles).

The total value of VAT at a rate of 18% on the line "Total" of an additional sheet to the sales book is 21,700 rubles, and at a rate of 10% - 3,000 rubles.

The company did not have transactions in which it acted as a tax agent for VAT.

The total amount of VAT deductible, according to the purchase book, is 24,000 rubles.

In the additional sheet to the book of purchases for the 1st quarter of 2015, one transaction is reflected, the VAT deductible for which is 720 rubles. (18% rate). The total amount of VAT on the line "Total" of the additional sheet of the purchase book is 24,720 rubles.

The amount of VAT calculated for the 1st quarter of 2015 on transactions recognized as an object of taxation will amount to 24,700 rubles. (21,700 rubles + 3,000 rubles). And the amount of VAT to be deducted is 24,720 rubles. Therefore, in accordance with paragraph 2 of Art. 173 of the Tax Code of the Russian Federation, the amount of VAT to be reimbursed is 20 rubles. (24,720 rubles - 24,700 rubles).

In the declaration, the company will show:

on line 190 of section 8 - 24,000 rubles;

on line 005 of Appendix 1

to section 8 - 24,000 rubles;

on line 190 of Appendix 1

to section 8 - 24,720 rubles;

on line 260 of section 9 - 19,000 rubles;

on line 270 of section 9 - 3000 rubles;

on line 050 of Appendix 1

to section 9 - 19,000 rubles;

on line 060 of Appendix 1

to section 9 - 3000 rubles;

on line 340 of Appendix 1

to section 9 - 21,700 rubles;

on line 350 of Appendix 1

to section 9 - 3000 rubles.

Since the company did not have transactions in which it acted as a VAT tax agent, it does not have pages of section 9 and appendix 1 to section 9, in which line 010 = 06.

We apply the control ratio 1.25 in our version:

24 000 rub. + (24,720 rubles - - 24,000 rubles) - (19,000 rubles + + 3,000 rubles) - 0 rubles. – (21,700 rubles + + 3,000 rubles – 19,000 rubles – 3,000 rubles) – – 0 rubles = 24,000 rubles. + 720 rub. - - 22,000 rubles. – 0 rub. - 2700 rubles. – – 0 rub. = 20 rubles. > 0.

That is, we received exactly the figure that, in accordance with paragraph 2 of Art. 173 of the Tax Code of the Russian Federation is subject to compensation.

Now we apply the control ratio 1.25 as revised by the tax authorities:

24 000 rub. + (24,720 rubles - - 24,000 rubles) - (19,000 rubles + + 3,000 rubles) - 0 rubles. + (21,700 rubles + + 3,000 rubles - 19,000 rubles - 3,000 rubles) - - 0 rubles. = 24,000 rubles. + 720 rub. - - 22,000 rubles. – 0 rub. + 2700 rub. – – 0 rub. = 5420 rubles.

As you can see, we got a completely incomprehensible figure, which in no way corresponds to the amount of VAT to be reimbursed in the first quarter of 2015.

VAT payable to the budget

It is possible to check whether the amount of VAT payable to the budget in the declaration is underestimated using the control ratio 1.27.

Note that this ratio is given in a universal form, that is, when a company has not only sales transactions (taxed at rates of 18 and 10%), but also transactions taxed at a rate of 0%, as well as transactions where it acts as tax agent for VAT. Because of this, it looks quite bulky.

Since the majority of VAT payers carry out only sales transactions that are taxed at rates of 18 and 10%, we will present this ratio in a form adapted to this situation.

It will look like this:

the total amount of VAT calculated taking into account the restored tax amounts (line 110 of section 3) must be equal to the sum of the total value of VAT in the sales book (line 260 of section 9 + line 270 of section 9) with the value of VAT according to the additional sheets of the sales book (line 340 of the application 1 to Section 9 ++ Line 350 of Annex 1 to Section 9 - - Line 050 of Annex 1 to Section 9 - - Line 060 of Annex 1 to Section 9).

In other words, the total amount of calculated VAT should be equal to the amount of VAT accrued on all invoices reflected in the sales book and additional sheets of the sales book. We think that the validity of this ratio does not cause any doubts. If the total amount of calculated VAT (the value on line 110 of section 3) turns out to be less, this will indicate an understatement of the amount of VAT payable to the budget, shown on line 200 of section 3. After all, its value is determined by subtracting the line indicator from line 110 of section 3 190 section 3 (total VAT deductible). Therefore, if the value of line 110 of section 3 is underestimated, the value of line 200 will also be underestimated.

VAT deductible

To check the fact of overstatement of the VAT amount to be deducted, the tax authorities will use the control ratio 1.28. Like the previous ratio, it is given in a universal form.

If the company carries out only sales transactions taxed at rates of 18 and 10%, the ratio of 1.28 will look like this:

the total amount of VAT to be deducted (line 190 of section 3) must be equal to the sum of the total value of VAT indicated in the purchase book (line 190 of section 8) with the total amount of VAT on invoices reflected in the additional sheets of the purchase book (line 190 of annex 1 to section 9 - - line 005 of Appendix 1 to section 9).

If the value of line 190 of Section 3 is higher, the VAT to be deducted is overstated.

- payers;

- transferring, if from next year they change the method of transferring advances to monthly with a quarterly surcharge.

Line 320: in what period to fill

Organizations paying monthly advances with an additional payment based on the results of the quarter fill out line 320 of Sheet 02 in the declaration for 9 months of the reporting year.

Organizations paying "actual" advances, but planning to switch to a monthly payment with an additional payment based on the results of the quarter, must complete line 320 of the declaration for 11 months (for January - November).

In declarations for other reporting periods, as well as at the end of the year, a dash is put in line 320 of Sheet 02.

Line 320 of the income tax return: what amount to indicate

The value of line 320 depends on the method of payment of advance payments:

Upon receipt of a value less than zero or equal to zero, a dash must be put in line 320, i.e. monthly advance payments in the first quarter of the year following the reporting one will not be made.