Mn information on the main performance indicators of the micro-enterprise. Calculation of man-hours for MP (micro)

All small enterprises, except micro, must report on key performance indicators.

However, small businesses are required to submit any statistical reporting only if they are included in the sample. If the organization has not received a request from the statistical authorities, it is not necessary to submit the PM form.

When to take

The form is submitted once a quarter.

For the first quarter, you need to submit the PM form by April 29, for the first half of the year - by July 29, for 9 months - by October 29, for the year - by January 29.

Download the new PM form for free

Instructions for filling out the PM statistics form

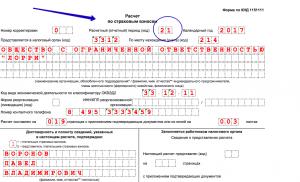

Title page

The title page of the form includes standard data: name, address, organization codes. In this case, you should indicate the full name of the company according to the registration documents, and write a short name in brackets. In the address bar, you need to reflect the full legal address and the actual address (if it differs from the legal one).

In columns 2 and 3 of the title page, the OKPO and OKVED codes, respectively, should be noted. Column 4 should be left blank.

All indicators in sections 1 and 2 are entered on an accrual basis.

First section

If the company applies the simplified tax system, you need to make a note in section 1.

Second section

The second section is filled out based on the number of employees and their salaries.

For each indicator, you need to make a mark, for this you should circle the corresponding word - “yes” or “no”.

The table includes indicators for the average headcount, wage fund and social benefits. Line 03 reflects the average number of employees. Line 03 is equal to the sum of lines 04, 05 and 06.

The accrued wage fund (FZP) by categories of employees is reflected in lines 07-11.

Calculation of man-hours for MP (micro)

Rosstat Order No. 414 dated August 11, 2016 approved the annual statistical reporting form “Information on the main performance indicators of a micro-enterprise” No. MP (micro). This form is filled out by micro-enterprises and submitted for the reporting year to the territorial body of Rosstat no later than February 5 of the next year. We will tell you how to calculate man-hours for MP (micro) in our consultation.

MP (micro) instruction: man-hours

The MP (micro) form consists of 5 sections. In section 2 "Number, accrued wages of employees and hours worked" on line 12, you must indicate the number of man-hours worked by employees on the payroll for the year.

This line reflects the hours actually worked by employees, taking into account overtime and hours worked according to the schedule on non-working holidays and weekends, including hours of work on business trips (clause 20 of the Instructions, approved by Order of Rosstat dated 02.11.2016 No. 704). This takes into account hours worked both in the main job (position) and in the framework of internal part-time work.

Worked man-hours do not need to include paid and unpaid absence of employees from work, including:

- the time spent by employees on vacation (annual, additional, educational, at the initiative of the employer);

- time for advanced training with a break from work;

- time of illness;

- downtime;

- hours of breaks in the work of mothers to feed the child;

- hours of reduction in the duration of work of certain categories of employees who, in accordance with the law, have reduced working hours;

- time to go on strike.

MP (micro) for 2017: man-hours

To determine man-hours, the calculation (formula) for MP (micro) for the year is similar to the order that we have already considered in

The two most important indicators of the activity of small enterprises are the costs of production and sale of products (services) and the quantitative, volumetric, and financial results of the activities of individual entrepreneurs.

Rosstat, by its Order No. 373 dated July 29, 2016, approved the TZV-MP form, as well as the procedure for its execution and submission. According to this order, new reporting for small business TZV-MP was introduced.

In this article, we will consider the nuances of the process of preparing this type of reporting, find out who should submit it, how and when, and also offer you instructions for filling out the report.

At the bottom of the page there is a button with which the reader can download the TIA-IP form for 2017 in 2018 for free.

When is the TZV-MP form for 2017 to be submitted in 2018?

Form No. TZV-MP is provided for reporting, which bears the official name "Information on the costs of production and sale of products (goods, works and services) and the results of a small business for 2016."

That is, a report on the named parameters for 2017 will be required. The deadline for submitting the TZV-MP for 2017 is before April 1, 2017 to the Rosstat body located at the location of the organization or at the place of actual implementation of its activities. However, April 1 next year is Sunday. This means that the report can be submitted on the next business day, April 2. This is the deadline.

Before talking about who should take the TZV-MP for 2017, we will consider the features of continuous and selective statistical observation, we will need this to complete the picture of the process.

Nuances of continuous and selective statistical observation

Article 6 of Federal Law No. 282-FZ of November 29, 2007 establishes two forms of federal statistical observation: selective and continuous.

Continuous observation provides for the need to submit statistical reports by all respondents of the study group. Once every five years, it is held for small and medium-sized businesses.

Last held in 2016. All individual entrepreneurs and small (micro) enterprises that are legal entities submitted reports to their branches of Rosstat in accordance with the forms contained in Order No. 263 of Rosstat dated 06/09/15:

For small and micro-organizations, reporting was carried out according to the format No. MP-sp "Information on the main indicators of the activity of a small enterprise for 2015"; . for individual entrepreneurs - according to the form No. 1-entrepreneur "Information on the activities of an individual entrepreneur for 2015".

For the next 4 years, this type of reporting as a continuous observation will not be required.

Rosstat determines the circle of participants in the sample observation. Those specific organizations and individual entrepreneurs that were in the sample should be warned in advance that they will have to submit reports in the TZV-MP form within the period established by law.

Who must take the TZV-MP for 2017 in 2018?

To figure out who submits the TZV-MP for 2017 in 2018, we will find out who exactly does not need to submit this report. Order No. 373 of Rosstat dated July 29, 2016 clearly states that they do not fall under this reporting form:

- individual entrepreneurs;

- medium enterprises;

- microenterprises.

Accordingly, organizations are required to submit a TZV-MP report, including peasant farms officially registered as small enterprises. Can joint-stock companies get the status of a small business entity? They can, but only in exceptional cases stipulated by law. For example, if the JSC is a member of the Skolkovo project.

On what grounds is a company classified as a small business?

In electronic form through the web collection system, if such an opportunity exists on the resource of the territorial division of Rosstat. Here you will need to submit an application and receive a login and password to access the service. Also, a necessary condition is the availability of a qualified electronic signature key certificate.

If there are problems

In case of late submission of reports or provision of incomplete, as well as inaccurate data, the territorial authorities of Rosstat consider these violations and, as a rule, impose fines. This form of punishment for inattentive company executives is provided for in Article 23.53 of the Code of Administrative Offenses of the Russian Federation. The time to make a decision is two months from the last reporting date. Since the TZV-MP report is required to be submitted no later than April 2, 2018, it means that employees of Rosstat will be able to fine for violation of the deadline for its submission or other inconsistencies no later than June 2, 2018.

- for organizations, the amount is in the range from 20,000 to 70,000 rubles, and “scissors” from 100,000 to 150,000 rubles are provided for a repeated violation;

- the head of the company will pay 10-20 thousand rubles, and for a repeated violation - from 30 to 50 thousand rubles.

Free download the TZV-MP form for 2017 in 2018

By clicking the button below, the reader can download the TZV-IP form for 2017 in 2018 for free.

At the beginning of this year, the statistics authorities sent letters to many small enterprises with a request to submit a form to statistics. MP-SP observations. It consists in filling in information on important performance indicators of firms over the past year. The form is drawn up in accordance with federal law without fail if the company belongs to small businesses.

The norms of the act determine that the requirement to submit forms applies to small businesses, including farms and peasant farms. The assignment of firms to this category is based on the indicators specified in the Federal Law No. 209 of July 24, 2007. Basically, this is the number, revenue, etc.

If the company has divisions, then it must send general information to its legal address. In cases where the enterprise partially temporarily did not work during the year, it also needs to submit a form of MP SP in the general manner.

Deadlines and penalties

Statistics form MP SP is a one-time report. It is submitted either on paper or in electronic form before April 1 of the year following the reporting year at the place of registration of the company, regardless of the actual address.

In cases where an enterprise does not complete and send the form of statistical observation to the smp sp on time, or incorrect data is indicated when filling it out, administrative measures may be applied to it, in particular the provisions of Art. 13.19 of the Code of Administrative Offenses of the Russian Federation.

According to these standards, fines are provided for the company from 20,000 rubles. up to 70,000 rubles, for its responsible persons from 10,000 rubles. up to 20000r. If this violation is repeated, the organization can be fined from 100,000 to 150,000 rubles, officials - from 30,000 to 50,000 rubles.

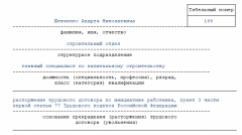

Sample of filling out the MP SP form

For the preparation of this statistical reporting, the instructions for filling out the mp sp form are used as a guide.

The report must indicate the name of the company, its address at the place of registration with the inclusion of a postal code, registration numbers, TIN.

IN line 01 the start date is recorded as a month and a year. Next, a mark is placed on whether the activity was carried out, and in the case of a positive answer, for how many months. If the actual and legal addresses do not match, then the place of business should be entered in line 5.

Clause 1.5 fill only joint-stock companies, in it they must reflect whether there was a change of founders or not in the reporting period.

IN section 2.1 you need to fill in the data on the main indicators in relation to employees. Here you need to indicate the number on average per year for total employees and with a breakdown by payroll. The funds of accrued wages for all employees and for the payroll are also indicated.

IN line 16 information is recorded on the average number for the previous year.

IN section 2.2 it is necessary to record information on the costs of production and sale in the context of the cost of goods sold, the cost of goods used in the reporting period, rent for equipment, premises, and other services and works.

If the processing of raw materials and materials was carried out, then you need to fill out line 18.

IN section 2.4 it is noted whether the company provided services to the public, and it is necessary to decipher whether it is a manufacturer, intermediary, etc.

The next line should reflect whether there were export operations in the reporting period.

IN section 2.6 information is filled in on the proceeds from sales in general for the reporting period in comparison with the previous one with a breakdown by type of activity. If construction services were provided, then the revenue is recorded in line 30.

IN section 2.8 it is necessary to fill in the proceeds from construction work, if, upon receipt, the services of third-party enterprises were used with a breakdown for services of a construction and scientific and technical nature.

Further, data on the implementation of technological, organizational and marketing innovations are noted.

IN section 3.1 information on the availability of fixed assets and intangible assets is filled in. In the relevant sections, it is necessary to reflect the balances of funds at the beginning and end of the year at the initial and residual value. Information about the receipt of property during the year is also entered here. The last column of the section records information about the presence of intangible assets at the beginning and end of the year, as well as their receipt.

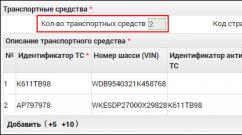

IN section 3.2 You need to make an appropriate record of the presence of freight transport.

Then information about state support is filled in. Here you need to write down whether there was help in the framework of special programs and decipher which one. In the case when state support is not provided, it is necessary to indicate whether the company is informed about it or not.

The report is signed by the responsible official, with a description of the position, full name. The date of signing, contact phone number, and e-mail are also indicated here.

An example of filling out the MP JV form can be viewed below, the picture in the article shows only part of it.

Nuances

If the company has a truck, but leases or leases it, then it needs to fill in line 40.

The TZV-MP form and the procedure for filling it out were approved by Order of Rosstat dated July 29, 2016 No. 373 (See ""). It will be required to submit a new form at the end of 2016 to the bodies of Rosstat. What is the deadline for submitting the report? Will it be necessary to submit a new report to all organizations and individual entrepreneurs without exception? How to fill out a new report? Is there liability for failure to submit IOT-IP? In this article, we will consider the most important issues regarding the completion and submission of new reports.

Introductory information

The new form No. TZV-MP is called "Information on the costs of production and sale of products (goods, works and services) and the results of a small business for 2016." Already from the title of the report it is clear that it will be required to report using the new form at the end of 2016.

Deadline for TZV-MP

The report must be submitted before April 1, 2017 to the territorial office of Rosstat at the location of the organization. This period is indicated on the title page of the TZV-MP form. However, April 1, 2017 falls on a Saturday. In this regard, the report can be submitted on the next business day. That is, April 3, 2017, on Monday.

Moreover, if the organization does not carry out activities at its location, then the TZV-MP can be handed over at the place of actual implementation of activities (section 1<Указаний по заполнению ТЗВ-МП>, approved Order of Rosstat dated July 29, 2016 No. 373).

But who exactly is obliged to submit the TZV-MP form to the Rosstat authorities? Before answering this question, we consider it appropriate to explain what types of statistical observation exist in principle.

Selective and continuous statistical observation

Federal statistical observation is selective and continuous (Article 6 of the Federal Law of November 29, 2007 No. 282-FZ).

Continuous observation

As part of continuous observation, statistical reporting must be submitted by all (without exception) respondents of the study group. Continuous statistical monitoring of small and medium-sized businesses is organized once every five years (part 2 of article 5 of Law No. 209-FZ). The last time a continuous observation was already carried out in 2016. Until April 1, 2016, as part of continuous monitoring, all small (including micro) enterprises - legal entities and all individual entrepreneurs were required to submit reports to Rosstat divisions in the forms approved by Rosstat order No. 263 dated 09.06.15:

- for small organizations - form No. MP-sp "Information on the main indicators of the activity of a small enterprise for 2015";

- for individual entrepreneurs - form No. 1-entrepreneur "Information on the activities of an individual entrepreneur for 2015".

Thus, in 2016, a complete observation in 2016 has already been carried out. Accordingly, it will not be held in 2017. And the form of TZV-MP has nothing to do with continuous observation.

Selective observation

Selective observation is carried out to collect statistical data of certain groups of respondents, which are determined on the basis of the Rosstat sample. As part of the sample observation, specific organizations or individual entrepreneurs that were included in the sample must submit statistical reports. At the same time, Rosstat bodies are obliged to notify those who were in the sample about the forms and methods of reporting.

The TZV-MP form will be used specifically within the framework of selective statistical observation. Accordingly, you will need to submit this form only if a particular organization is included in the Rosstat sample. All companies without exception do not need to submit the TZV-MP form.

Who can get into the Rosstat sample

IN<Указаниях по заполнению ТЗВ-МП>, approved by the Order of Rosstat dated July 29, 2016 No. 373, it is said that only organizations (including peasant farms) that are small enterprises should submit this report. Thus, individual entrepreneurs (IEs), medium-sized and micro-enterprises should not be included in the Rosstat sample in any way and they will not need to submit the TZV-MP form in 2017.

| Criterion | Indicator |

| The limit value of the average number of employees for the previous calendar year. | - 15 people - micro-enterprise; - 16 -100 people - small business; - 101-250 people - medium enterprise. |

| Income for the year according to the rules of tax accounting. | - 120 million rubles - microenterprise; - 800 million rubles - small business; - 2000 million rubles - Medium business. |

| The total share of participation in the authorized capital of LLC RF, constituent entities of the RF, municipalities, public, religious organizations, foundations. | 25% |

| The total share of participation in the authorized capital of LLC of other organizations that are not small and medium-sized businesses, as well as foreign organizations. | 49% |

Is an organization included in the sample: how to find out

As we have already said, information about the inclusion of an organization in the list of selective statistical observation should be reported by Rosstat divisions (clause 4 of the Regulation, approved by Decree of the Government of the Russian Federation of August 18, 2008 No. 620). However, the procedure for bringing such information to organizations is clearly regulated.

Therefore, in practice, Rosstat authorities solve this issue in different ways:

- some publish lists of organizations included in the sample on their websites;

- some inform organizations about inclusion in the sample by sending letters to the addresses indicated in the Unified State Register of Legal Entities.

But it also happens that Rosstat departments do not notify organizations at all that they are included in the sample. Therefore, a situation is not ruled out when an organization can be included in the sample, but not receive any notification from Rosstat. Therefore, if for some reason the organization does not know whether they are included in the list of selective statistical observation, then it makes sense to contact your Rosstat department and find out if the company is included in the sample and whether it needs to pass the TZV-MP before April 1, 2017.

Filling TZV-MP: sample

The TZV-MP form for 2016 must include information on the whole organization: for all branches and structural divisions, regardless of their location.

The composition of the TZV-MP form is as follows:

- title page;

- section 1 "Information on the proceeds from the sale of products (goods, works, services) and their production";

- section 2 "Expenses for the production and sale of products (goods, works and services)".

Let us give a sample and an example of filling out the TZV-MP.

Title page

On the title page of the form, you must indicate the full name of the organization according to the constituent documents, and in brackets - a short one.

The line "Postal address" indicates the legal address with a postal code. You should also note the actual address, if it does not match the legal one. In the code part of the title page, write down the OKPO assigned by Rosstat. Here is an example of filling out the title page.

Section 1

The first section is information about the organization's revenue. It needs to decipher the organization's income in 2016. In total there are 7 lines in the section. Explain what needs to be reflected in them.

| Section line 1 TZV-MP | filling |

| 01 | Total revenue for the year. It must equal the income from the income statement. |

| 02 | Proceeds from the sale of products, services of own production. |

| 03 | The organization - the general contractor must show the cost of construction work performed by the subcontractor without VAT. At the same time, it is not necessary to reflect the cost of installation and adjustment of process equipment. |

| 04 | The organization - the general contractor must show the cost of the scientific and technical work performed by the subcontractor and accepted (excluding VAT). |

| 05 | Revenue from the sale of goods purchased for resale, as well as raw materials, materials, components, fuel purchased for production, but sold to the side without processing or processing. |

| 06 and 07 | Filled by agricultural organizations. |

Section 2

In section 2, break down the expenses for 2016. In total, there are 2 lines in the section from 08 to 54. Let us explain the features of filling in some of them.

| Line section 2 ТЗВ-МП | filling |

| 08 | Purchase value of goods without VAT purchased in 2016 for resale. And regardless of whether they were sold in the reporting year or remained in stock. The line reflects the goods recorded on the debit of account 41. |

| 09 and 010 | Remains of goods purchased for resale, at the actual cost of their acquisition, excluding VAT. Data as of the beginning and end of 2016. |

| 11 | The cost of tangible assets acquired in 2016, regardless of what part of them was used or remained in the warehouse in the reporting year. In this line, reflect the acquired production tangible assets, which were taken into account at the cost of acquisition in the debit of accounts 10, 11, 15, 16. |

| 12 | The cost of fuel of all types purchased in 2016. Expenses in this line reflect at purchase prices without VAT. |

| 14 and 15 | The value of the balance of inventories - raw materials, materials, fuel, purchased semi-finished products, components, containers - intended for use in production or for sale at the beginning and end of the reporting year. |

| 16 | The purchase cost of raw materials, materials, semi-finished products, components, fuel purchased for production, but sold in 2016 without processing. |

An official responsible for providing statistical information on behalf of the organization must sign the TZV-IP report. That is, the director can write the report. Or, say, an accountant, if he has the appropriate authority.

Note that the sample may include an organization that did not conduct financial and economic activities in 2016. At the very least, we will not rule out the possibility that the sample will include a company that had no account movement at all in 2016. Is it then necessary to take the TZV-MP and how to fill it out? Yes, if an inactive organization is included in the sample, then a report must be submitted. But then, in the form No. TZV MP, simply fill out the title page, and in sections 1 and 2, put dashes.

Delivery method TZV-MP

The TZV-MP form can be submitted (clause 10 of the Regulations approved by Decree of the Government of the Russian Federation of August 18, 2008 No. 620):

- “on paper” (in person, through a representative or by sending a report by mail);

- in electronic form through a special operator providing electronic document management services (using an enhanced qualified electronic signature);

- in electronic form through the web collection system, if it is organized on the website of the territorial division of Rosstat (for example, such a system is implemented on the website of Mosoblstat). To use this reporting method, you will need to submit an application and receive a login and password to access the service. In this case, you will definitely need a certificate of a qualified electronic signature key.

Responsibility

If you do not pass the TZV-MP on time or provide false and incomplete data, you will have to pay a fine. Its size is indicated in article 13.19 of the Code of Administrative Offenses of the Russian Federation:

- the organization will pay an amount of 20,000 rubles. up to 70,000 rubles, and for a repeated violation from 100,000 rubles. up to 150,000 rubles;

- the director will pay from 10,000 rubles. up to 20,000 rubles, and for a repeated violation from 30,000 rubles. up to 50,000 rubles

Cases related to these violations are considered by the territorial bodies of Rosstat (Article 23.53 of the Code of Administrative Offenses of the Russian Federation). In order to impose a fine, controllers have two months from the date of the violation, that is, from the date of the deadline for reporting (Article 4.5 of the Code of Administrative Offenses of the Russian Federation). This means that if the TZV-MP report must be submitted no later than April 3, 2017, then Rosstat employees will be able to fine for its failure to be submitted no later than June 3, 2017.