Report pm micro to statistics. Form MP (micro)-nature - information about the production of products

Form MP-1 Information on loading and unloading activities is submitted to the territorial body of Rosstat by all commercial sea ports (stevedoring companies and seaport administrations). The specified statistical report reflects the volumes of loading and unloading of cabotage, export-import and transit cargoes per month.

Sea port administrations submit in the form general information on all stevedoring companies located in the area of responsibility of the IPA. Ports that are not part of the AMP submit a report on their own to Rosmorrechflot.

The main primary document for accounting for the volume of completed loading and unloading works (PRR) is a work order or another document that replaces it, for the production of a RRP, issued to a team of port workers.

The report includes data for the period from 00:00 01.01 to 24:00 of the last day of the reporting period.

The volume of PRR in the report is reflected in physical tons.

Numerical indicators of cargo transshipment (in thousand tons) are transmitted in numbers, with one decimal place. If the monthly volume of traffic through the port is less than 50 tons, 0 (zero) is set. If there are no shipments for a separate nomenclature group of goods, the corresponding position in the report is not filled in. The number of containers is an integer.

- line 111 reflects ores, bauxite, alumina;

- line 112 - coal, coke, including anthracite;

- line 141 - ferrous metals, including cast iron;

- up to line 150, the volumes of loading and unloading of laden large-tonnage containers (universal, specialized) are reflected in total according to their gross weight, in thousands of tons.

On line 151 - the number of loaded large-capacity containers (universal, specialized) in twenty-foot equivalent (TEU), in integers, on line 152 - the number of empty large-capacity containers.

The total volumes of loading and unloading of goods, taking into account the means of cargo consolidation: packages, containers, lighters - on board lighter carriers, vehicles - on ro-ro ships and ferries, railway cars - on ferries, as well as on roll trailers, are determined by weight gross cargo (taking into account the mass of means of consolidation), upon arrival of goods from the sea and when sent to the sea.

The values of indicators in the columns "transit" and "cabotage" are total when loading cargo "on the sea" and "from the sea". When calculating them, the provisions of paragraph 8 of the Procedure should be used regarding accounting for the dead weight of the enlargement means.

The term "transit" refers to the international transit of cargo - transshipment through the port of cargo to / from third countries (including the CIS countries).

Transshipment through the port of empty means of consolidation (containers, trains on ferries, lighters on lighter carriers, motor vehicles and others) is included in the amount of line 146.

Bunkering of ships with solid and liquid fuels is not reflected in the form.

The TZV-MP form and the procedure for filling it out were approved by Order of Rosstat dated July 29, 2016 No. 373 (See ""). It will be required to submit a new form at the end of 2016 to the bodies of Rosstat. What is the deadline for submitting the report? Will it be necessary to submit a new report to all organizations and individual entrepreneurs without exception? How to fill out a new report? Is there liability for failure to submit IOT-IP? In this article, we will consider the most important issues regarding the completion and submission of new reports.

Introductory information

The new form No. TZV-MP is called "Information on the costs of production and sale of products (goods, works and services) and the results of a small business for 2016." Already from the title of the report it is clear that it will be required to report using the new form at the end of 2016.

Deadline for TZV-MP

The report must be submitted before April 1, 2017 to the territorial office of Rosstat at the location of the organization. This period is indicated on the title page of the TZV-MP form. However, April 1, 2017 falls on a Saturday. In this regard, the report can be submitted on the next business day. That is, April 3, 2017, on Monday.

Moreover, if the organization does not carry out activities at its location, then the TZV-MP can be handed over at the place of actual implementation of activities (section 1<Указаний по заполнению ТЗВ-МП>, approved Order of Rosstat dated July 29, 2016 No. 373).

But who exactly is obliged to submit the TZV-MP form to the Rosstat authorities? Before answering this question, we consider it appropriate to explain what types of statistical observation exist in principle.

Selective and continuous statistical observation

Federal statistical observation is selective and continuous (Article 6 of the Federal Law of November 29, 2007 No. 282-FZ).

Continuous observation

As part of continuous observation, statistical reporting must be submitted by all (without exception) respondents of the study group. Continuous statistical monitoring of small and medium-sized businesses is organized once every five years (part 2 of article 5 of Law No. 209-FZ). The last time a continuous observation was already carried out in 2016. Until April 1, 2016, as part of continuous monitoring, all small (including micro) enterprises - legal entities and all individual entrepreneurs were required to submit reports to Rosstat divisions in the forms approved by Rosstat order No. 263 dated 09.06.15:

- for small organizations - form No. MP-sp "Information on the main indicators of the activity of a small enterprise for 2015";

- for individual entrepreneurs - form No. 1-entrepreneur "Information on the activities of an individual entrepreneur for 2015".

Thus, in 2016, a complete observation in 2016 has already been carried out. Accordingly, it will not be held in 2017. And the form of TZV-MP has nothing to do with continuous observation.

Selective observation

Selective observation is carried out to collect statistical data of certain groups of respondents, which are determined on the basis of the Rosstat sample. As part of the sample observation, specific organizations or individual entrepreneurs that were included in the sample must submit statistical reports. At the same time, Rosstat bodies are obliged to notify those who were in the sample about the forms and methods of reporting.

The TZV-MP form will be used specifically within the framework of selective statistical observation. Accordingly, you will need to submit this form only if a particular organization is included in the Rosstat sample. All companies without exception do not need to submit the TZV-MP form.

Who can get into the Rosstat sample

IN<Указаниях по заполнению ТЗВ-МП>, approved by the Order of Rosstat dated July 29, 2016 No. 373, it is said that only organizations (including peasant farms) that are small enterprises should submit this report. Thus, individual entrepreneurs (IEs), medium-sized and micro-enterprises should not be included in the Rosstat sample in any way and they will not need to submit the TZV-MP form in 2017.

| Criterion | Indicator |

| The limit value of the average number of employees for the previous calendar year. | - 15 people - micro-enterprise; - 16 -100 people - small business; - 101-250 people - medium enterprise. |

| Income for the year according to the rules of tax accounting. | - 120 million rubles - microenterprise; - 800 million rubles - small business; - 2000 million rubles - Medium business. |

| The total share of participation in the authorized capital of LLC RF, constituent entities of the RF, municipalities, public, religious organizations, foundations. | 25% |

| The total share of participation in the authorized capital of LLC of other organizations that are not small and medium-sized businesses, as well as foreign organizations. | 49% |

Is an organization included in the sample: how to find out

As we have already said, information about the inclusion of an organization in the list of selective statistical observation should be reported by Rosstat divisions (clause 4 of the Regulation, approved by Decree of the Government of the Russian Federation of August 18, 2008 No. 620). However, the procedure for bringing such information to organizations is clearly regulated.

Therefore, in practice, Rosstat authorities solve this issue in different ways:

- some publish lists of organizations included in the sample on their websites;

- some inform organizations about inclusion in the sample by sending letters to the addresses indicated in the Unified State Register of Legal Entities.

But it also happens that Rosstat departments do not notify organizations at all that they are included in the sample. Therefore, a situation is not ruled out when an organization can be included in the sample, but not receive any notification from Rosstat. Therefore, if for some reason the organization does not know whether they are included in the list of selective statistical observation, then it makes sense to contact your Rosstat department and find out if the company is included in the sample and whether it needs to pass the TZV-MP before April 1, 2017.

Filling TZV-MP: sample

The TZV-MP form for 2016 must include information on the whole organization: for all branches and structural divisions, regardless of their location.

The composition of the TZV-MP form is as follows:

- title page;

- section 1 "Information on the proceeds from the sale of products (goods, works, services) and their production";

- section 2 "Expenses for the production and sale of products (goods, works and services)".

Let us give a sample and an example of filling out the TZV-MP.

Title page

On the title page of the form, you must indicate the full name of the organization according to the constituent documents, and in brackets - a short one.

The line "Postal address" indicates the legal address with a postal code. You should also note the actual address, if it does not match the legal one. In the code part of the title page, write down the OKPO assigned by Rosstat. Here is an example of filling out the title page.

Section 1

The first section is information about the organization's revenue. It needs to decipher the organization's income in 2016. In total there are 7 lines in the section. Explain what needs to be reflected in them.

| Section line 1 TZV-MP | filling |

| 01 | Total revenue for the year. It must equal the income from the income statement. |

| 02 | Proceeds from the sale of products, services of own production. |

| 03 | The organization - the general contractor must show the cost of construction work performed by the subcontractor without VAT. At the same time, it is not necessary to reflect the cost of installation and adjustment of process equipment. |

| 04 | The organization - the general contractor must show the cost of the scientific and technical work performed by the subcontractor and accepted (excluding VAT). |

| 05 | Revenue from the sale of goods purchased for resale, as well as raw materials, materials, components, fuel purchased for production, but sold to the side without processing or processing. |

| 06 and 07 | Filled by agricultural organizations. |

Section 2

In section 2, break down the expenses for 2016. In total, there are 2 lines in the section from 08 to 54. Let us explain the features of filling in some of them.

| Line section 2 ТЗВ-МП | filling |

| 08 | Purchase value of goods without VAT purchased in 2016 for resale. And regardless of whether they were sold in the reporting year or remained in stock. The line reflects the goods recorded on the debit of account 41. |

| 09 and 010 | Remains of goods purchased for resale, at the actual cost of their acquisition, excluding VAT. Data as of the beginning and end of 2016. |

| 11 | The cost of tangible assets acquired in 2016, regardless of what part of them was used or remained in the warehouse in the reporting year. In this line, reflect the acquired production tangible assets, which were taken into account at the cost of acquisition in the debit of accounts 10, 11, 15, 16. |

| 12 | The cost of fuel of all types purchased in 2016. Expenses in this line reflect at purchase prices without VAT. |

| 14 and 15 | The value of the balance of inventories - raw materials, materials, fuel, purchased semi-finished products, components, containers - intended for use in production or for sale at the beginning and end of the reporting year. |

| 16 | The purchase cost of raw materials, materials, semi-finished products, components, fuel purchased for production, but sold in 2016 without processing. |

An official responsible for providing statistical information on behalf of the organization must sign the TZV-IP report. That is, the director can write the report. Or, say, an accountant, if he has the appropriate authority.

Note that the sample may include an organization that did not conduct financial and economic activities in 2016. At the very least, we will not rule out the possibility that the sample will include a company that had no account movement at all in 2016. Is it then necessary to take the TZV-MP and how to fill it out? Yes, if an inactive organization is included in the sample, then a report must be submitted. But then, in the form No. TZV MP, simply fill out the title page, and in sections 1 and 2, put dashes.

Delivery method TZV-MP

The TZV-MP form can be submitted (clause 10 of the Regulations approved by Decree of the Government of the Russian Federation of August 18, 2008 No. 620):

- “on paper” (in person, through a representative or by sending a report by mail);

- in electronic form through a special operator providing electronic document management services (using an enhanced qualified electronic signature);

- in electronic form through the web collection system, if it is organized on the website of the territorial division of Rosstat (for example, such a system is implemented on the website of Mosoblstat). To use this reporting method, you will need to submit an application and receive a login and password to access the service. In this case, you will definitely need a certificate of a qualified electronic signature key.

Responsibility

If you do not pass the TZV-MP on time or provide false and incomplete data, you will have to pay a fine. Its size is indicated in article 13.19 of the Code of Administrative Offenses of the Russian Federation:

- the organization will pay an amount of 20,000 rubles. up to 70,000 rubles, and for a repeated violation from 100,000 rubles. up to 150,000 rubles;

- the director will pay from 10,000 rubles. up to 20,000 rubles, and for a repeated violation from 30,000 rubles. up to 50,000 rubles

Cases related to these violations are considered by the territorial bodies of Rosstat (Article 23.53 of the Code of Administrative Offenses of the Russian Federation). In order to impose a fine, controllers have two months from the date of the violation, that is, from the date of the deadline for reporting (Article 4.5 of the Code of Administrative Offenses of the Russian Federation). This means that if the TZV-MP report must be submitted no later than April 3, 2017, then Rosstat employees will be able to fine for its failure to be submitted no later than June 3, 2017.

Statistical reporting of micro-enterprises is a minimal obligation of organizations with the status of a micro-enterprise to report to the statistical authorities. One of these reports, submitted at the end of the year, is called “MP-micro Form”: this article will tell you who should submit this report and in what time frame.

Statistical reporting applies to absolutely all organizations, regardless of their size. Some reports need to be submitted regularly, in particular accounting results for the year, and some - after a certain period and only to those respondents who were included in the Rosstat sample. Such a report is the MP-micro form, approved by the Order of Rosstat dated November 2, 2018 No. 654. The report is called "Information on the main indicators of the micro-enterprise" and is annual. Let's consider its features in more detail.

Form MP-micro: who is required to take

This report is intended solely for legal entities that are categorized as microenterprises. These are the organizations that in 2018:

- no more than 15 employees worked;

- annual income from doing business amounted to no more than 120 million rubles;

- the share of participation of state entities, public and religious organizations and foundations did not exceed a total of 25%;

- the share of participation of other companies (including foreign ones) did not exceed 49% in total.

Exceeding the limit values for 3 consecutive calendar years results in loss of status.

If the firm fits these parameters, it is necessary to check whether it fell into the sample of statistical observation. This can be done using a special service on the Rosstat website. It is enough for an organization to enter all its data in the proposed form (name, OKPO, TIN or OGRN) and receive information about all reports to statistics that must be submitted in 2019. In addition, Rosstat authorities notify the respondents in the sample in advance of the need to report. Rosstat sends such written notifications to the addresses of companies known to it.

MP-micro: deadlines 2019

In 2019, the due date for the MP-micro report for 2018 falls on February 5th. There are no reschedules as it is Tuesday. It is this date that appears in the Order of Rosstat as the last day for fulfilling the obligation to report. Being late carries a heavy fine.

Features and order of filling

Filling out the MP-micro is not at all difficult, it is in the form of a questionnaire. In the header, as usual, you must write the details and name of the organization, as well as its postal address.

Next, in MP-micro comes section 1, in which you need to answer only one question: does the company apply a simplified taxation system. There are obviously two possible answers: “yes” and “no”. Check the box next to the correct option.

The second section in the MP-micro form is more voluminous. It is intended for information about the number and wages of employees. To fill it out, you will need to calculate the average headcount, as well as indicate the number of external part-time workers and persons who work under civil law contracts. By the same principle, it is necessary to divide the wage fund. At the end, you need to provide information on social benefits to employees, as well as indicate the number of man-hours worked.

The third section is small and is called "General economic indicators". You need to fill in information about the shipment of goods, the performance of work and services. Also in the same section, you need to inform the statistics agency about investments in fixed capital. All data must be given in rubles, and VAT and excises must be deducted from the cost.

The fourth section of the MP-micro form is intended for firms that are engaged in wholesale and retail trade or are catering establishments. It should indicate whether or not there are such turnovers, as well as indicate their volume for the reporting period.

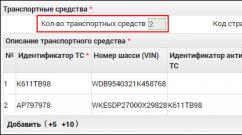

The final, fifth section of the MP-micro report must be filled out by organizations if they have drivers on their staff and they use any freight or passenger transport for their needs. Even one car obliges the accountant to complete this section.

At the end, the report must be signed by the accountant who filled it out. You also need to put down the date of filling and indicate your email and phone number.

What reports are submitted to the statistics of microenterprises in 2019

In addition to information about the activities of MP-micro organizations, the smallest companies and individual entrepreneurs are required to send other forms to Rosstat:

- balance sheet and form No. 2 (may be in a simplified version) - until 03/31/2019;

- form No. MP (micro)-nature “Information on the production of products by a micro-enterprise” for firms that manufacture products, mining, manufacturing industries, companies that produce and distribute electricity, gas and water, logging, and also engaged in fishing - until 25.01 .2019 (Order of Rosstat dated July 27, 2018 No. 461);

- annual form No. 1-IP "Information on the activities of an individual entrepreneur" exclusively for individual entrepreneurs - until 03/02/2019.

In addition, other statistical documents may be added depending on the industry in which the firm operates and its field of activity.

Responsibility for failure

Large fines apply for violation of deadlines or ignoring the obligation to submit statistical reports. They are provided article 13.19 of the Code of Administrative Offenses of the Russian Federation, and their size is:

- for officials - from 10,000 to 20,000 rubles;

- for organizations - from 20,000 to 70,000 rubles.

A repeated violation will cost significantly more, the fine rises to 50,000 rubles for officials, and up to 150,000 rubles for legal entities. The statistics agency may be held liable within two months from the date of the violation.

The MP-Micro form for 2016 is submitted by the world business in 2017. These are organizations with up to 15 employees and income for 2016 up to 120 million rubles. IP form is not handed over.

The IP-Micro form was approved by order of Rosstat No. 414 dated August 11, 2016. You can download the form MP-Micro for 2016 for free at the link:

Breaking news for accounting department:. Read in a magazine

Who rents, deadlines in 2017

The annual form is submitted no later than February 5, 2017 to the territorial office of Rosstat at the address established by it.

The form is submitted by organizations with up to 15 employees and income for 2016 up to 120 million rubles. IP form is not handed over.

The form is submitted by those who fell into the Rosstat sample (a letter should come from Rosstat by mail).

- Popular article:

How to fill out the form

The procedure for filling out the MP-micro form was approved by the order of Rosstat dated November 2, 2016 No. 704.

The form of federal statistical observation No. MP (micro) “Information on the main indicators of the activity of a micro-enterprise” is provided by commercial organizations, consumer cooperatives that are micro-enterprises in accordance with Article 4 of the Federal Law of July 24, 2007 No. Federation. Individuals engaged in entrepreneurial activities without forming a legal entity do not provide form No. MP (micro).

Micro-enterprises applying the simplified taxation system, when providing primary statistical data in the form of federal statistical observation No. MP (micro), they are guided by these Instructions.

The form includes information on the whole legal entity, that is, on all branches and structural subdivisions of this micro-enterprise, regardless of their location. The head of the legal entity appoints officials authorized to provide statistical information on behalf of the legal entity.

See the line-by-line order of filling out the form on our website: " Line-by-line filling out the IP-Micro form in 2017".

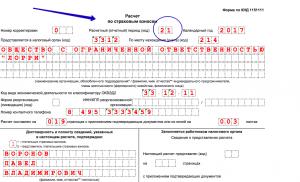

An example of filling out the annual MP-micro form for 2016

LLC "Tour" - a travel agency on the simplified tax system, is a micro-enterprise. For 2016, the organization must submit the MP-micro form to the "statistics". We will show how the accountant of the company will fill out the report.

The data is like this. In 2016, Tur LLC had 5 payroll employees, no one left or entered. The amount of accrued wages for the year is 2,790,500 rubles. There were no social benefits. The number of man-hours worked - 9870.

Revenue from the sale of tourist services for 2016, according to accounting data, amounted to 8,900,400 rubles. During this period, the company acquired one fixed asset - a car worth 570,000 rubles. The organization has no freight vehicles on its balance sheet.

In the header of the report, the accountant will put all the necessary codes. Section 1 will indicate that the firm applies the simplified tax system. Section 2 will reflect the average number of employees, accrued wages and worked man-hours. In section 3, record the amount of revenue and the cost of the purchased car. In section 4, he will put dashes, since Tur LLC did not trade in 2016. And the accountant will not fill out section 5, since the company does not have freight transport.

At the beginning of this year, the statistics authorities sent letters to many small enterprises with a request to submit a form to statistics. MP-SP observations. It consists in filling in information on important performance indicators of firms over the past year. The form is drawn up in accordance with federal law without fail if the company belongs to small businesses.

The norms of the act determine that the requirement to submit forms applies to small businesses, including farms and peasant farms. The assignment of firms to this category is based on the indicators specified in the Federal Law No. 209 of July 24, 2007. Basically, this is the number, revenue, etc.

If the company has divisions, then it must send general information to its legal address. In cases where the enterprise partially temporarily did not work during the year, it also needs to submit a form of MP SP in the general manner.

Deadlines and penalties

Statistics form MP SP is a one-time report. It is submitted either on paper or in electronic form until April 1 of the year following the reporting year at the place of registration of the company, regardless of the actual address.

In cases where an enterprise does not complete and send the form of statistical observation to the smp sp on time, or incorrect data is indicated when filling it out, administrative measures may be applied to it, in particular the provisions of Art. 13.19 of the Code of Administrative Offenses of the Russian Federation.

According to these standards, fines are provided for the company from 20,000 rubles. up to 70,000 rubles, for its responsible persons from 10,000 rubles. up to 20000r. If this violation is repeated, the organization can be fined from 100,000 to 150,000 rubles, officials - from 30,000 to 50,000 rubles.

Sample of filling out the MP SP form

For the preparation of this statistical reporting, the instructions for filling out the mp sp form are used as a guide.

The report must indicate the name of the company, its address at the place of registration with the inclusion of a postal code, registration numbers, TIN.

IN line 01 the start date is recorded as a month and a year. Next, a mark is placed on whether the activity was carried out, and in the case of a positive answer, for how many months. If the actual and legal addresses do not match, then the place of business should be entered in line 5.

Clause 1.5 fill only joint-stock companies, in it they must reflect whether there was a change of founders or not in the reporting period.

IN section 2.1 you need to fill in the data on the main indicators in relation to employees. Here you need to indicate the number on average per year for total employees and with a breakdown by payroll. The funds of accrued wages for all employees and for the payroll are also indicated.

IN line 16 information is recorded on the average number for the previous year.

IN section 2.2 it is necessary to record information on the costs of production and sale in the context of the cost of goods sold, the cost of goods used in the reporting period, rent for equipment, premises, and other services and works.

If the processing of raw materials and materials was carried out, then you need to fill out line 18.

IN section 2.4 it is noted whether the company provided services to the public, and it is necessary to decipher whether it is a manufacturer, intermediary, etc.

The next line should reflect whether there were export operations in the reporting period.

IN section 2.6 information is filled in on the proceeds from sales in general for the reporting period in comparison with the previous one with a breakdown by type of activity. If construction services were provided, then the revenue is recorded in line 30.

IN section 2.8 it is necessary to fill in the proceeds from construction work if, when receiving it, the services of third-party enterprises were used with a breakdown for services of a construction and scientific and technical nature.

Further, data on the implementation of technological, organizational and marketing innovations are noted.

IN section 3.1 information on the availability of fixed assets and intangible assets is filled in. In the relevant sections, it is necessary to reflect the balances of funds at the beginning and end of the year at the initial and residual value. Information about the receipt of property during the year is also entered here. The last column of the section records information about the presence of intangible assets at the beginning and end of the year, as well as their receipt.

IN section 3.2 You need to make an appropriate record of the presence of freight transport.

Then information about state support is filled in. Here you need to write down whether there was help in the framework of special programs and decipher which one. In the case when state support is not provided, it is necessary to indicate whether the company is informed about it or not.

The report is signed by the responsible official, with a description of the position, full name. The date of signing, contact phone number, and e-mail are also indicated here.

An example of filling out the MP JV form can be viewed below, the picture in the article shows only part of it.

Nuances

If the company has a truck, but leases or leases it, then it needs to fill in line 40.