Forms, types and types of leasing. Types of car leasing

Subjects of leasing

lessor- physical or entity which, at the expense of borrowed and (or) own funds, acquires property in the course of the implementation of a leasing agreement into ownership and provides it as a subject of leasing to the lessee for a certain fee, for a certain period and under certain conditions for temporary possession and use with or without transfer to the lessee of ownership of the object leasing .

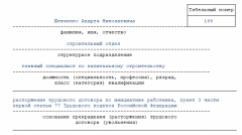

Lessee - an individual or legal entity that, in accordance with the leasing agreement, is obliged to accept the object of leasing for a certain fee, for a certain period and under certain conditions for temporary possession and use in accordance with the leasing agreement.

Salesman- an individual or legal entity that, in accordance with a purchase and sale agreement with a lessor, sells to the lessor within a specified period of time the property that is the subject leasing . The seller is obliged to transfer the object of leasing to the lessor or lessee in accordance with the terms of the purchase and sale agreement. The seller may simultaneously act as a lessee within the same leasing relationship. Any of the subjects of leasing can be a resident Russian Federation or a non-resident of the Russian Federation.

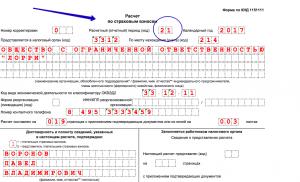

Leasing companies (firms) — commercial organizations(residents of the Russian Federation or non-residents of the Russian Federation) performing the functions of lessors in accordance with the legislation of the Russian Federation and with their constituent documents. Foundersleasing companies (firms) may be legal entities, individuals (residents of the Russian Federation or non-residents of the Russian Federation).

Types of leasing

According to the composition of the participants and the way they interact:

· Direct leasing - in which the owner of the property independently leases the object (bilateral transaction).

· Indirect (classic) leasing - The most common form of leasing transaction, when the transfer of property occurs through an intermediary (tripartite or multilateral transaction).

· Return lease- A special case of direct leasing is leaseback, the essence of which is that the leasing company acquires equipment from the owner and leases it to him.

· Subleasing - A type of sublease of a leased asset, in which the lessee, under a leasing agreement, transfers to third parties (lessees under a subleasing agreement) the property previously received from the lessor under a leasing agreement for possession and use.

· Leveraged Leasing - Leasing with the attraction of funds from several lessors. Occurs when leasing transactions due to their scale cannot be financed by one or even two lessors.

By type of property are distinguished:

- leasing of movable property;

- leasing of real estate;

- leasing of property that was in operation.

According to the degree of payback, there are:

- leasing with full payback, in which during the term of one contract there is a full payment of the value of the property;

- leasing with incomplete payback, when during the term of one contract only a part of the cost of the leased property is paid off.

According to the terms of depreciation, there are:

- leasing with full depreciation and, accordingly, with full payment of the cost of the leasing object;

- leasing with incomplete depreciation, i.e. with partial payment.

According to the degree of payback and depreciation conditions, there are:

- financial leasing, i.e. during the term of the lease agreement, the tenant pays the lessor the entire cost of the leased property (full depreciation). Financial leasing requires large capital investments and is carried out in cooperation with banks;

- operational leasing, i.e. the transfer of property is carried out for a period less than the period of its depreciation. The contract is concluded for a period of 2 to 5 years. The object of such leasing is usually equipment with a high rate of obsolescence.

The scope of service is:

- pure leasing, if the lessee undertakes all maintenance of the leased object;

- leasing with a full range of services - full maintenance of the object of the transaction is assigned to the lessor;

- leasing with a partial set of services - the lessor is entrusted with only certain functions for servicing the leased asset.

- General leasing (most represented abroad) - Allows, with the constant cooperation of the lessor with the lessee, to conclude a general agreement on the provision of a leasing line, according to which the lessee, if necessary, can take additional property without concluding a new contract each time.

Depending on the sector of the market where transactions take place, there are:

- domestic leasing - all market participants represent one country;

- international leasing - at least one of the parties or all parties belong different countries and also if one of the parties is a joint venture.

External leasing is divided into export and import leasing. With EXPORT leasing foreign country is the lessee, and in case of IMPORT leasing - the lessor.

In relation to tax and depreciation benefits, there are:

- fictitious leasing - the transaction is speculative in nature and is concluded in order to extract the greatest profit by obtaining unreasonable tax and depreciation benefits;

- Valid Lease – The landlord is entitled to tax benefits such as an investment allowance and accelerated depreciation, and the tenant can deduct rental payments from taxable income.

By the nature of leasing payments, there are:

- leasing with cash payment – all payments are made in cash;

- leasing with a compensation payment - payments are made by the supply of goods produced on this equipment, or in the form of a counter service;

- leasing with mixed payment.

Existing forms of leasing can be combined into two main types: operational and financial leasing.

OPERATIONAL LEASING is a lease relationship in which the lessor's expenses related to the acquisition and maintenance of leased items are not covered by rental payments during one lease contract.

Operational leasing is characterized by the following main features:

- the lessor does not expect to recover all its costs through the receipt of lease payments from one lessee;

- a leasing contract is concluded, as a rule, for 2-5 years, which is much shorter physical wear and tear equipment, and may be terminated by the lessee at any time;

- the risk of damage or loss of the object of the transaction lies mainly with the lessor. The leasing agreement may provide for a certain liability of the lessee for damage to the property transferred to him, but its amount is significantly less than the original price of the property;

- lease payment rates are usually higher than in financial leasing. This is due to the fact that the lessor, not having a full guarantee of cost recovery, is forced to take into account various commercial risks (the risk of not finding a tenant for the entire amount of equipment available, the risk of breakdown of the transaction object, the risk of early termination of the contract) by increasing the price of their services;

- the object of the transaction are mainly the most popular types of machinery and equipment.

With operational leasing, the leasing company purchases equipment in advance, without knowing the specific tenant. Therefore, operating leasing firms must have a good knowledge of the market for investment goods, both new and used. Leasing companies in this type of leasing themselves insure the leased property and provide it Maintenance and repair.

At the end of the lease agreement, the lessee has the following options for terminating it:

- Extend the term of the contract on more favorable terms;

- Return the equipment to the lessor;

- Buy equipment from the lessor if there is an agreement (option) to purchase at fair market value. Since at the conclusion of the contract it is impossible to determine in advance the residual market value of the object of the transaction at the end of the leasing contract, this provision requires leasing companies to have a good knowledge of the used equipment market.

With the help of operational leasing, the lessee seeks to avoid the risks associated with owning property, for example, obsolescence, a decrease in profitability due to changes in demand for manufactured products, equipment breakdowns, an increase in direct and indirect non-production costs caused by repairs and downtime of equipment, etc.

Therefore, the lessee prefers operational leasing in cases where:

- the expected income from the use of the leased equipment does not pay off its original price;

- equipment is required for a short period of time (seasonal work or one-time use);

- equipment requires special maintenance;

- the object of the transaction is new, untested equipment.

The listed features of operational leasing determined its distribution in such industries as Agriculture, transport, mining, construction, electronic information processing.

FINANCIAL LEASING- this is an agreement that provides for the payment of lease payments during the period of its validity, covering the full cost of depreciation of equipment or a large part of it, additional costs and profits of the lessor.

Financial leasing is characterized by the following main features:

- participation of a third party (manufacturer or supplier of the object of the transaction);

- the impossibility of terminating the contract during the so-called main lease term, i.e. the period necessary to reimburse the lessor's expenses. However, in practice this sometimes happens, which is stipulated in the leasing agreement, but in this case the cost of the operation increases significantly;

- a longer period of the leasing agreement (usually close to the service life of the transaction object);

- the objects of transactions in financial leasing, as a rule, are of high cost.

Just like with operational leasing, after the expiration of the contract, the lessee can:

- buy the object of the transaction, but at the residual value;

- to conclude new treaty for a shorter period and at a preferential rate;

- return the object of the transaction to the leasing company.

The lessee informs the lessor about his choice 6 months or in another period before the expiration of the contract. If the contract provides for an agreement (option) to purchase the subject of the transaction, then the parties determine the residual value of the object in advance. It usually ranges from 1 to 10% of the original cost, which gives the lessor the right to charge depreciation on the entire cost of the equipment.

Since financial leasing is similar in economic terms to long-term bank lending of capital investments, a special place in the financial leasing market is occupied by banks financial companies and specialized leasing companies closely associated with banks. In a number of countries, banks are only allowed to engage in financial leasing. The legislation of these countries establishes the requirements that lease relations must meet in order for them to be classified as financial leasing.

We have considered two main types of leasing. In practice, there are many forms of leasing transactions, but they cannot be considered as independent types of leasing operations.

The forms of leasing transactions are understood as well-established models of leasing contracts. The most widespread in international practice are the following forms of leasing operations:

LEASING "STANDARD". Under this form of leasing, the supplier sells the object of the transaction to a financing company, which, through its leasing companies, leases it to consumers.

At LEASE BACK the owner of the equipment sells it to a leasing company and at the same time leases this equipment from him. As a result of this transaction, the seller becomes a tenant. Leaseback is used in cases where the owner of the object of the transaction is in dire need of Money ah and with the help of this form of leasing improves their financial condition.

LEASING TO "SUPPLIER". In this case, the seller of the equipment also becomes a lessee, as in a leaseback, but the leased property is not used by him, but by other tenants, whom he is obliged to find and lease the object of the transaction to them. Sublease is prerequisite in contracts of this kind.

BACKUP LEASING. With this form of leasing, rental payments are made by suppliers of products manufactured on equipment that is the object of a leasing transaction.

RENEWABLE LEASING. The leasing agreement under this form provides for the periodic replacement of equipment at the request of the tenant with more advanced models.

FINANCIAL LEASING. This form of leasing provides for the lessor to receive a long-term loan from one or more creditors in the amount of up to 80% of the leased assets. Lenders in such transactions are large commercial and investment banks that have significant resources attracted on a long-term basis.

Financing of leasing transactions by banks is carried out mainly in two ways:

- loan. The bank lends to the lessor, providing him with a loan for one leasing operation or, more often, for a whole package of leasing agreements. The loan amount depends on the reputation and creditworthiness of the lessor;

- acquisition of liabilities. The bank buys from the lessor the obligations of its customers without the right to recourse (reverse claim), taking into account the reputation of the lessees and the effectiveness of the project. This method is used for large one-time transactions involving reliable borrowers. When organizing project financing with the participation of a leasing company, banking institutions also act as guarantors. The collateral for a bank loan when it is received by the lessor (without the right to reclaim the lessee) are the objects of the leasing transaction and lease payments.

Leasing with fundraising is also called investment-type or third-party leases. To reduce the risk of payment, the lessor's creditors include in leasing contracts special condition, which provides for an absolute and unconditional obligation to make payments on time and in cases of equipment failure due to the fault of the lessor. Payments are not suspended, and the lessee makes claims to the lessor.

When leasing large-scale facilities (aircraft, ships, drilling platforms, towers), group (shareholder) leasing is most often used. In such transactions, several companies act as the lessor.

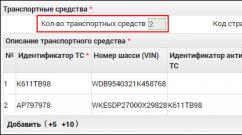

CONTRACT HIRE is a special form of leasing, in which the lessee is provided with complete fleets of machines, agricultural, road construction equipment, tractors, cars for rent. Vehicle.

GENERAL LEASING– the right of the lessee to supplement the list of leased equipment without entering into new contracts. In practice, there is a combination of various forms of contracts, which increases their number.

The rapid growth of leasing operations is explained by the presence of a number of advantages.

The advantages of the lessee are:

- financing of the deal at fixed rates;

- the possibility of expanding production and adjusting equipment without large costs and attracting borrowed funds;

- the cost of purchasing equipment is evenly distributed over the entire term of the contract. Funds are released for other purposes;

- protection against obsolescence (obsolescence) - leasing contributes to the rapid replacement of old equipment with more modern ones, reduces the risk of obsolescence;

- borrowed capital is not attracted; the balance sheet maintains an optimal ratio of equity and debt capital;

- lease payments are linked to the profitability of using equipment received under leasing;

- maintenance and repairs can be undertaken by the lessor;

- the ability to upgrade equipment without significant costs;

- tax incentives and investment incentives;

- purchase of equipment at the end of the contract;

- in case of operational leasing, the risk of equipment destruction lies with the lessor;

- high flexibility, leasing allows you to quickly respond to market changes;

- lease payments are not included in a country's external debt indicator.

The advantages of the lessor (bank) in a leasing transaction include:

- expansion of the sphere of application of banking capital;

- relatively less risk than providing bank loans;

- tax incentives;

- the possibility of establishing closer contacts with equipment manufacturers, which creates additional conditions for business cooperation.

For the supplier, the benefits of leasing come down to expanding sales opportunities and getting cash.

Renting

Renting is a short-term lease of property without the right of its subsequent acquisition by the tenant.

Leasing is a kind of investment activity. Moreover, the lessor buys the property (fixed assets), which is provided for by the contract, from the supplier and gives the lessee the opportunity to temporarily own and use it for entrepreneurial activity according to the legislation of the Russian Federation. The lessor, acquiring fixed assets for the lessee, begins to finance the future use of the property, then all costs are reimbursed through lease payments, and he receives income. It turns out that the leasing company, one might say, lends to the lessee. Thus, leasing is a type of investment activity that combines elements of lending and leasing. Today, this type of investment activity, being a form of financing, is still not fully used as a type of investment in fixed capital.

Types of leasing

There are 3 forms of leasing: financial, operational (or operational) and returnable.

financial leasing- the most used form of leasing in our country. There are 3 parties involved in the transaction: the lessee, the leasing company and the supplier. The leasing company acquires the property from the supplier and then transfers it to the use of the lessee. At the end of the contract, the fixed assets pass into the possession of the client.

Operational leasing(operational) lies in the fact that at the end of the contract the return of the leasing company is expected. Now in Russia this type of investment activity is practically not used. Operational leasing is a lease-related relationship in which the costs of the lessor are not covered by payments during the leasing contract. At the same time, the leasing company acquires fixed assets in advance, without having a specific tenant. Thus, operating leasing firms are well aware of the economic situation of the investment product market, both new and used. In addition, in this case, leasing companies themselves insure the leased property and provide its repair and maintenance.

Return lease is a type of leasing where the supplier and the lessee are the same person. We can say that this is a bilateral leasing deal. When concluding an agreement for this type of investment activity, the organization sells the property (fixed assets) of the leasing company and leases this property. In addition, those firms that at the time of purchasing the equipment for some reason could not or often did not know about the possibilities of leasing, use all its advantages after acquiring the equipment. This scheme is often used when obtaining tax benefits that are provided for a finance lease agreement. Another type of leasing should be mentioned - international, in which one of the parties to the agreement - the lessee and the lessor - is a non-resident of the Russian Federation. In international leasing transactions concluded in our country, the lessor is the non-resident.

Consider questions such as: What is leasing, leasing participants,types and forms of leasing transactions And lease payment methods.

Leasing is a form of long-term lease related to the transfer for use of equipment, vehicles and other movable property except for land plots and natural objects.

Participants in a leasing transaction (leasing)

The lessor is an individual or legal entity that, at the expense of its own or borrowed funds, acquires property from the seller and provides it under a leasing agreement to the lessee. Depending on the type of leasing and the leasing agreement, the term for which the property is transferred, the terms of use and the amount that the lessee will pay to the lessor for the use of the property will be determined.

The lessee is a natural or legal person who, in accordance with a leasing agreement, takes the object of leasing (property) for a certain fee, under certain conditions and for a certain period of time for temporary possession and use in accordance with the leasing agreement.

The seller is an individual or legal entity that, in accordance with the purchase and sale agreement with the lessor, delivers to the lessor or directly to the lessee, at the appointed time, the property acquired by him, which is the subject of leasing. The seller may not always be a participant in a leasing transaction.

Leasing example

In simple terms, the lessor is the one who gives his equipment for use to another person on certain conditions for a certain amount. And the lessee, respectively, is the one who takes this equipment under a leasing agreement.

Types of leasing

1. Financial leasing is a type of leasing in which the lessor fully returns the cost of the leased asset and provides income to the lessor. The amount of money paid by the lessee can be divided into: the amount for the cost of equipment and the income of the lessor. A feature of financial leasing is that at the expiration of the lease agreement, the lessee receives the subject of the agreement, i.e. it becomes his property.

2. The second type of leasing is operational leasing. Operational leasing is an agreement under which the transfer of property is carried out for a period less than the depreciation period. Main Feature is that the leased asset is returned to the lessor. This type is more often used for single use, for example: holding an action, bus tour or a one-time release of products for which the acquisition of equipment in the property is not practical. Of course, with operating leasing, increased lease payments are paid compared to financial leasing.

Forms of leasing

There are the following main forms of leasing, which can be of three types:

1) Direct leasing;

2) Return lease;

3) Mixed leasing.

Direct leasing- after the expiration of the term of the lease lease agreement, all ownership rights to the leased asset are transferred to the lessee (tenant).

Return lease- leasing, in which the lessee sells his property to the lessor and immediately takes it back for a long-term lease. After the end of the lease term, the property again becomes the property of the lessee, as in direct leasing. It is applied in the event that the tenant enterprise does not have enough working capital.

Mixed leasing- leasing, in which the property necessary for the tenant is acquired with common money, but in different shares. Most often, the costs of the lessee amount to no more than 20-25% of the value of the property. This form is used when purchasing expensive equipment (property). At the end of the contract, the property remains with the lessee.

What are lease payments? Leasing payments are the amount that the lessee pays the lessor for the use of the property.

There are the following methods of leasing payments:

method "with a fixed total amount". The total amount is divided by the number of years and paid in equal installments during the term of the contract;

advance method. This method involves the payment of an advance to the lessor in the amount specified in the lease agreement, and the remaining part is paid as in the method with a fixed total amount. Be careful when working on this method because when paying, the advance lessor may be lost;

minimum payment method. The most cunning method, which includes in the amount of payments the amount of depreciation for the entire period of the contract, as well as a fee for the use of borrowed funds by the lessor, a commission and additional payments provided for by the contract. For example, if the lessor used a bank loan to purchase property for the lessee, then the latter will pay not only the cost of the equipment and the interest that ensures the income of the lessor, but also interest on a bank loan!

As far as payments are concerned, frequency and timing of payments specified in the lease agreement. For example, yearly, quarterly, monthly, weekly, daily.

Leasing is a financial service, which is the rental of equipment, vehicles or real estate with the possibility of further redemption. This is a kind of lending that allows organizations to update fixed assets, and individuals- purchase expensive goods.

Basic concepts of leasing and its types

It is important to understand the essence and types of leasing. The main concepts include:

- - subject of leasing - movable and immovable property that is leased out (this does not include land plots, natural objects and property owned by the state or such for which there are restrictions on circulation) and belongs to the lessor;

- - the lessor - the owner of the object of leasing, transferring it to rent for a certain fee;

- - lessee - an individual or legal entity that takes the object of leasing for use on specific conditions with a mandatory monthly payment and the possibility of subsequent redemption.

There is such a classification of types of leasing:

- Financial. At the end of the contract, the lessee (tenant) has the right to redeem the object. Its residual value is quite low, since depreciation is taken into account over long term use. In some cases, an object even without additional payment becomes the property of the lessee;

- Operational. Often referred to as operating room. This type of leasing does not provide for the subsequent purchase of property, and the term of the contract is much shorter. At the end of the contract, the object can be re-leased. The rate is higher compared to financial leasing;

- Returnable. Occurs very rarely. The seller of the property is also its tenant. This is a special form of a loan secured by your own production assets. At the same time, the legal entity also receives an economic effect due to the simplification of taxation.

Allocate different types financial leasing, depending on the terms of the contract:

- With full payback. The object is fully paid off during the term of the contract;

- With incomplete payback. The object is only partially paid off during the term of the contract.

You can learn how to rent a car by reading the article:

You may be interested in the conditions for leasing trucks:

The benefits that the program for acquiring a car on lease provides to an entrepreneur are described

Basic forms of leasing.

There are also specific types of leasing agreement, called forms:

- Clean. All costs are covered by the lessor;

- Partial. The lessor bears only the costs of maintaining the property;

- Full. All expenses are covered by the lessee;

- Urgent. One-time rental of objects;

- Renewable. Possibility of renewing the lease term at the end of the first contract;

- General. Possibility to rent additional equipment without concluding a new contract;

- Straight. The owner of the object independently leases it;

- Indirect. The property is transferred through an intermediary;

- Separated. Leasing involves several manufacturing companies, lessors, banks and insurers;

- Interior. within the boundaries of one country. International or external. One of the participants is in another country.

Watch the video: Money. Leasing. Business Center – Conversation PRO

Leasing as a type of investment activity.

You can consider leasing, the types and advantages of which have been described above, as investment activity. After all, this is a kind of investment by the lessor of its own free funds in the development and economy of the lessee.

A leasing company can purchase equipment and lease it out under certain conditions. Such investments are always profitable because they pay off and protect the investor from the depreciation of the free currency.

Given the types of leasing, the scheme should be developed depending on the interests of the investor. To get more profit, you can lease equipment without further right to buy (operating lease).

If the goal is to sell the property and acquire a new one, then in such a situation it is better to choose financial leasing.

Infusions of the lessee into transport and equipment taken for use are also investments. An individual or legal entity invests free funds in objects that can be used for personal or industrial purposes.

This is how you manage to earn money, replenish your fleet and protect yourself from inflation. Such capital injections are always profitable.

Types of leasing relations are differentiated depending on:

Forms of organization of transactions, their duration;

The scope of the obligations of the parties;

Features of leasing objects and the conditions for their depreciation;

Types of lease payments;

Relationship to tax incentives;

Market sectors;

Internal leasing - when leasing this form, the lessor and the lessee must be residents of the Russian Federation;

International leasing - in this case, the lessor or lessee is not a resident of the Russian Federation;

financial leasing (finance leasing) - a leasing agreement (and not its separate type), under which the lessor undertakes to acquire ownership of the property specified by the lessee from a certain seller and transfer to the lessee as a leased asset for a certain fee, for a certain period and under certain conditions in temporary possession and use, however, with regard to those contained in the Law on Financial Leasing, they are subject to application only insofar as they comply with the provisions of the Civil Code of the Russian Federation, and we are talking both on the provisions on financial leasing (leasing) and on general provisions on lease, applied subsidiarily in the absence of special rules on a leasing agreement in the Civil Code of the Russian Federation (§ 6, Chapter 34).

IN this case the principle of legal regulation of civil law relations, enshrined in paragraph 2 of Art. 3 of the Civil Code of the Russian Federation: norms civil law contained in other federal laws must comply with the Civil Code of the Russian Federation. That's the only way to save legal regulation leasing agreements from legal chaos and confusion, which promises him a direct and immediate application of all the provisions of the Federal Law "On Leasing".

The main forms of leasing regulated by the Law include domestic and international leasing. The main feature of international leasing under the said Law is that the lessor or lessee is a non-resident of the Russian Federation. According to the Law, if the lessor is a resident of the Russian Federation, the international leasing agreement is governed by the Law "On Leasing" or other legislation of the Russian Federation. If the lessor is a non-resident of the Russian Federation, the international leasing agreement is still regulated by federal laws, but this time in the field of foreign economic activity.

The criterion for dividing leasing into main types is the duration of its validity. to adjustable federal law The main types of leasing are:

1) Long-term leasing-leasing, carried out for 3 or more years; 2) Medium-term leasing-leasing, carried out within 1.5 to 3 years;

3) Short-term leasing - leasing carried out for less than 1.5 years.

When the leasing contract ends, the lessee has 2 ways: either to purchase the equipment as a property, or to renew the contract on preferential terms (repair, maintenance, insurance is carried out by the lessee).

Operational leasing (operative leasing) - with it there is no indispensable mandatory feature of a leasing agreement - the obligation of the lessor to purchase leased property from a certain seller in accordance with the instructions of the lessee. Therefore, the type of “operational leasing” established by the Law, without having all necessary features leasing agreement, from the point of view of the Civil Code of the Russian Federation and the Ottawa Convention, cannot be recognized as a leasing agreement and regulated accordingly by the provisions of § 6 of Chapter 34 of the Civil Code of the Russian Federation and the norms of the Convention, and is ordinary contract rent.

When the leasing contract ends, the lessee returns the equipment to the leasing company and refuses further cooperation. Subsequently, the equipment goes into operation to another lessee (repair, maintenance and insurance are carried out by the lessor) and organizational conditions planned leasing deal.

Return lease - “a kind of financial leasing, in which the seller of the leased asset simultaneously acts as a lessee”, in this case, the lessee (who is also the seller) sells his property to a leasing company, and then takes it on lease. The transaction is made in the following sequence:

1) A leasing agreement is concluded between the landlord and the tenant;

2) The leasing company buys equipment from the tenant - the owner of the equipment;

3) The tenant regularly pays rent payments in accordance with the terms of the leasing contract.

The law "On Financial Lease (Leasing)" dated October 29, 1998 No. 164-FZ states that "the seller can simultaneously act as a lessee within the same leasing relationship."

Thanks to this law, enterprises have the opportunity, using all the advantages of leasing, to replenish working capital, as well as to optimize the cost structure. For the convenience of customers, many companies combine lending and leasing in one institution.

A leaseback is used by the original owner for the following purposes:

1) Expedient use of investments attracted from outside. Depending on the need, this may be an increase in fixed assets or an increase in working capital. At the same time, leasing to some extent limits the scope of their application to fixed capital;

2) Obtaining tax benefits. In this case, the enterprise uses its equipment previously leased, which allows to significantly reduce taxable profit. This happens due to the attribution of leasing payments to the cost of products;

3) Leveling the balance. This happens as a result of the sale of property (movable and immovable) not at book value, but at a usually outstripping market value;

4) Re-equipment of enterprises with new technological machines and equipment. By purchasing new equipment, the company returns the funds spent on leasing the company, while retaining the right to own and use this equipment.

Leverage - (credit, share, separate) leasing or leasing with additional attraction of funds is the most difficult, as it is associated with multi-channel financing and is used, as a rule, for the implementation of expensive projects.

A distinctive feature of this type of leasing is that the lessor, when buying equipment, pays out of his own funds not its entire amount, but only a part of it. The rest of the amount he borrows from one or more creditors. At the same time, the leasing company continues to enjoy all tax benefits, which are calculated from the full value of the property.

Another feature of this type of leasing is that the lessor takes out a loan on certain conditions, which are not very typical for domestic financial and credit relations. The loan is taken without the right to sue the lessor's assets. Therefore, as a rule, the lessor arranges for the benefit of creditors a pledge on property until the loan is repaid and cedes to them the right to receive part of the lease payments to repay the loan.

Thus, the main risk under the transaction is borne by creditors - banks, Insurance companies, investment funds or other financial institutions, and only lease payments and leased property serve as collateral for repayment of the loan. In the West, more than 85% of all major leasing transactions are built on the basis of leveraged leasing.

Leasing sales assistance represents the sale of property using leasing on the basis of a special agreement concluded between the supplier (seller) of the property and the leasing company. These agreements have various forms. In the simplest case, the name of the leasing company, its address, telephone number and basic terms of leasing are indicated in advertising materials supplier, and all issues related to the leasing of property with a potential user are directly decided by the leasing company. However, most often the agreement between the supplier and the leasing company provides for the possibility for the supplier to conclude a leasing agreement on behalf of the leasing company. At the same time, the agreement between the supplier and the leasing company stipulates that in the event of bankruptcy of the lessee, the supplier is obliged to buy the property from the leasing company.

Subleasing - it should be singled out as a separate category. This type of leasing is a type of sublease of the subject of leasing, in which the lessee, after the execution of the contract, transfers certain property to third parties for possession and use of certain property for a certain fee and on certain conditions. At the same time, this facility was previously received from the lessor under a leasing agreement and is the subject of leasing. The object of leasing can be both new property and property that was in use, that is, property belonging to the secondary market of means of production.

Subleasing implies that the lessee, by drawing up a subleasing agreement, acquires the right to require the seller to comply with certain requirements. In order to transfer the subject of leasing to subleasing, the consent of the lessor, drawn up in writing, is mandatory.

Wet and clean leasing. Leasing is subdivided into "clean" and "wet" leasing according to the volume of service of the transferred property.

Wet leasing (wet leasing) involves the mandatory maintenance of equipment, its repair, insurance and other operations for which the lessor is responsible. In addition to these services, at the request of the lessee, the lessor can take on the responsibility for training qualified personnel, marketing, supply of raw materials, etc. » (wet leasing). The subject of this type of leasing, as a rule, is complex specialized equipment. Wet leasing is usually used by either the manufacturers of this equipment or wholesale organizations; financial institutions and banks rarely turn to this type of leasing, since they do not have the necessary technical base at their disposal.

Due to the fact that the market of leasing services has not yet developed in Russia and there are practically no leasing companies that could provide high-quality maintenance of leasing objects, the most common type of leasing is pure. Net leasing (net leasing) is a relationship in which all maintenance of the property is undertaken by the lessee. Therefore, in this case, the cost of equipment maintenance is not included in the lease payments. Banks, insurance companies and other financial institutions engaged in the leasing business.

According to most experts, one of the largest and most developed segments of the financial lease market in Russia is railway leasing. The railway market is about 15-20% of the total market.